Shares of video-streaming giant Netflix (NASDAQ: NFLX) are attempting to stage a comeback after crumbling under pressure this year. Netflix stock, which shed around 75% from peak to trough, is now up more than 55% from its bottom of around $163 per share. Though Netflix’s lower-cost, ad-based tier is sure to be a game-changer for the firm as the streaming world enters new waters, I do think concerns regarding the cannibalization of the highest-price tier are overblown.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In any case, analysts and investors are eager to get a first glimpse of how such a tier will impact financial results going into a potential recession year.

Netflix’s Move into Ads Could Help It Weather a Storm

With a bit of subscriber bleed suffered this year, I think Netflix’s decision to embrace ads could help stage a substantial recovery, even as macro storm clouds get uglier and move closer. At the end of the day, Netflix still has a robust content lineup and pipeline.

Though competition has picked up in recent years, the streaming pioneer still has many hit television shows that are sure to be discussed around the water cooler. Whether it be The Watcher or the latest season of Love is Blind, there’s always something on Netflix to binge. While a lack of competitiveness versus an increasingly-crowded streaming market may be partly to blame for Netflix’s subscriber weakness, I think a financially-strapped consumer is more to blame.

The ad-based tier could easily solve affordability issues for consumers who scrapped Netflix because they could no longer afford it due to economic circumstances or anticipation of more challenging times.

Understandably, many premium subscribers may be enticed to downgrade their subscriptions. However, I think most of those who can afford the ad-free tier will stay put. Why? A few bucks a month to spare yourself from ads is a great value proposition. Though Netflix may limit ads relative to television channels, it really does get in the way of the immersion factor. As such, I do think concerns about cannibalization are greatly overblown.

Netflix may be reluctant to get into ads, but it chose the perfect time, as inflation and recession cause a one-two combo of affordability issues and subscription cuts.

I remain bullish on shares of Netflix, even as we enter a recession.

Netflix Stock’s New Valuation is Compelling

After such a substantial valuation reset, shares of Netflix now trade at a comfortable 23.6x trailing earnings multiple. With an ad-based tier likely to mitigate recession headwinds, I think Netflix stock is a standout bargain of all names in the FAANG cohort.

If anything, Netflix could see subscriber momentum pick up where it left off a few quarters ago. Additionally, a cheaper tier of the service could open doors to a new wave of cost-conscious consumers that may be enticed to upgrade their subscriptions once their financial circumstances improve alongside the economic cycle.

The latest (third quarter) round of earnings results was encouraging. Subscriber gains marked the end of two straight quarterly losses. As management looks to test new “waters,” I do think Netflix stock is more than capable of experiencing further multiple expansion from these levels.

Now, Netflix may never trade at over 40x earnings again. However, I think a richer multiple could be in the cards if the firm can reignite top-line growth without hurting margins.

Further, Netflix is serious about getting into the gaming business. Recently, the company bought Spry Fox, the developer behind Cozy Games. As Netflix continues to improve its mobile-game development capabilities, the company could draw in fans while enhancing the stickiness of its platform with minimal incremental expenditures.

Indeed, relative to blockbuster hits, mobile games could help move the bottom line without excessive amounts of spend. For now, the gaming business has yet to pick up steam. With every studio deal, though, I think Netflix is closer to becoming a gaming powerhouse that could make Netflix the ultimate entertainment “bundle.”

Is NFLX Stock a Buy or Sell, According to Analysts?

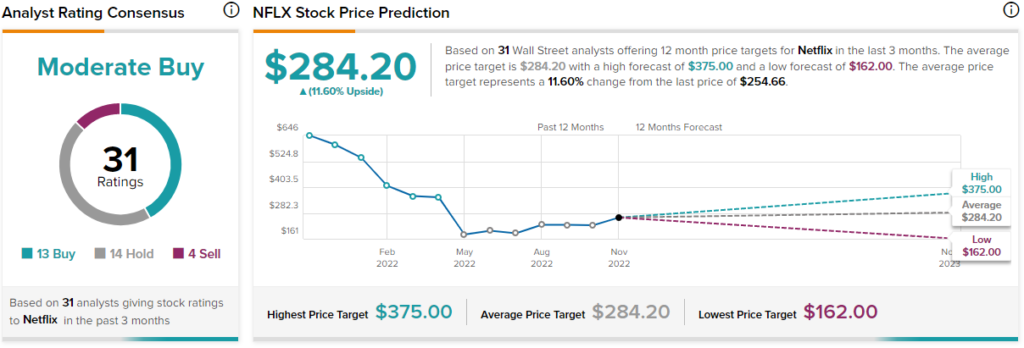

Turning to Wall Street, NFLX stock comes in as a Moderate Buy. Out of 31 analyst ratings, there are 13 Buys, 14 Holds, and four Sell recommendations.

The average Netflix price target is $284.20, implying 11.6% upside potential. Analyst price targets range from a low of $162.00 per share to a high of $375.00 per share.

Takeaway: NFLX Looks Attractive at Current Levels

After the crash, Netflix stock has a fresh slate and an intriguing new strategic plan. Ad-based tiers and gaming are low-risk endeavors that could propel Netflix to much higher multiples, even in a recession.

With a five-year beta of 1.28, Netflix stock has consistently been more volatile than the market. At these depths, I think Netflix stock could be less volatile, given lowered expectations and the recession resilience from its ad-based tier.