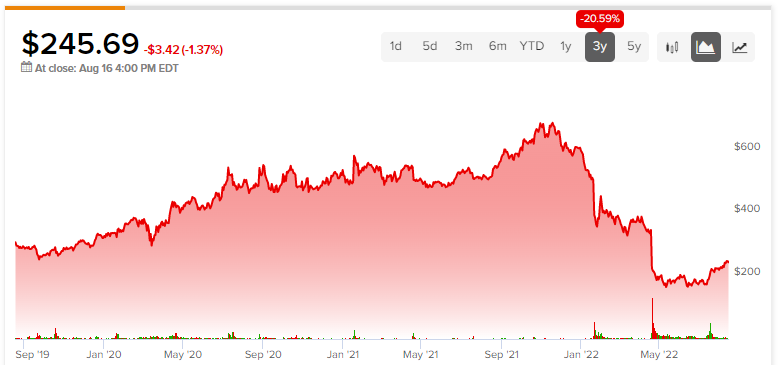

Shares of video-streaming pioneer Netflix (NFLX) have effectively been knocked out of the FAANG basket following their horrific implosion of around 75% from peak to trough. The correction in the name has to do with a streaming market that’s not nearly as bountiful as it used to be, with new rivals swooping in and firms willing to blow considerable sums of cash to gain subscribers.

Though some may think the “streaming wars” are ending, given the diminishing economic profits to be had with every new entrant, I think it’s still just beginning, as entertainment bundles (think video, music, and games) become more commonplace.

The former tech-savvy firm now seems to be valued like just another media company. Though CEO Reed Hastings is a man with innovation in his veins, it could prove difficult to regain prior multiples. Indeed, the crash in Netflix stock isn’t just about macro factors that have weighed on the rest of the market.

Despite market uncertainties and stronger rivals, I remain neutral on Netflix stock, as it desperately seeks a way to regain ground in streaming while putting a dent into new markets like video gaming. I’m not so sure gaming is the way to make Netflix sticky again. Regardless, I think it’s unwise to bet against Hastings, as he looks ahead to new frontiers in interactive entertainment.

What’s Wrong with Netflix Stock?

Competition is heating up, as many old-fashioned media firms are eager to jump from linear television to streaming. Following its widely-followed merger, Warner Bros. Discovery (WBD) is now on track to take streaming to another level with the merging of its HBO Max and Discovery+ services. Competition is creating a churn problem for Netflix. With every media firm announcing strategic streaming-focused long-term spending plans, the outlook for Netflix becomes a tad grimmer.

In simple terms, Netflix seems stuck on that content-spending mouse wheel while margins look to be challenged by competitors. Undoubtedly, Warner Bros. Discovery still derives a lot of business from linear television. Programming from Discovery is still largely cable-centric.

In any case, Warner Bros. Discovery is a firm with intriguing brands (think DC Comics and reality shows from Discovery) that could have the means to close the gap with its much larger rivals in streaming.

For now, Warner Bros. Discovery is weighed down by more than $55 billion worth of debt. This could crimp its streaming ambitions and lead to cuts in original content creation over the nearer term. Over the next 10 years and beyond, Warner Bros. Discovery could evolve to become another streaming contender.

Despite growing competitive pressures, Netflix still has deep pockets, algorithms, and beloved brands by its side. As debt-burdened rivals like Warner Bros. Discovery cut shows (like Batgirl), Netflix will be able to entice viewers with its heavy budget and pipeline of releases. Sandman is one of the bigger-budget series that could cause many former Netflix users to return.

Once such users return, Netflix needs to lock them in because the next content drought is inevitable. Unfortunately, Netflix’s gaming push has not had much of an effect, with only ~1% of users bothering to try some of Netflix’s newly-launched mobile game offerings.

Netflix’s Gaming Push Fails to Yield Fruit

Netflix seems to be going for quantity over quality when it comes to gaming. As Netflix looks to pivot, it may wish to funnel more of its gaming budget toward a select few titles with what it takes to draw crowds.

The mobile game scene may be fast-growing, but Netflix doesn’t yet have a game library to match that of the Apple (AAPL) Arcade service. Despite the rough (and conservative) start in the video-gaming scene, I don’t expect games to be axed like a failed series.

There’s not much to lose by betting big on mobile gaming. If Netflix leverages its original brands (think Stranger Things or Sandman), it may have more luck enticing users to try its mobile-game offerings.

Unfortunately, the inability to play Netflix games via the Netflix app appears to be hurting its gaming push. As per Apple’s policies, Netflix requires users to download its games individually from the App Store.

For now, Netflix’s gaming business seems like a giant question mark, and I’m not so sure if it will help the firm retain subscribers, moving forward. Mobile gaming seems to be a market dominated by just a handful of “whales,” and unless Netflix is willing to take a big chance on a big-budget title, its gaming business may fail to launch.

There’s just way too much competition in mobile games.

Netflix Tries to Hit the “SPOT” with Podcast Listeners

Netflix’s partnership late last year with music streamer Spotify (SPOT) was intriguing. Spotify’s inclusion of a “Netflix Hub” gives Netflix a glimpse of what it’d be like to be in the audio realm.

Spotify’s podcast push was a move to help differentiate itself from increased competition in music streaming. Thus far, the move has paid off. Still, Spotify faces many of the same issues as Netflix amid rising competition in entertainment services.

Arguably, a Netflix-Spotify merger makes a lot of sense. The media market has seen a lot of consolidation. Every merger could take away a bit of power from Netflix over the long run.

With Warner Bros. Discovery being one of the latest media titans to keep tabs on, I think Netflix would be wise to expand into new realms to put an end to the churn.

Is Netflix Stock a Buy, Sell, or Hold?

Turning to Wall Street, NFLX stock comes in as a Hold. Out of 32 analyst ratings, there are seven Buys, 19 Holds, and six Sells.

The average Netflix price target is $229.30, implying downside potential of 6.7%. Analyst price targets range from a low of $157.00 per share to a high of $365.00 per share.

Conclusion: Netflix is in a Challenging Spot

Netflix remains in a challenging spot as media rivals look to gain further ground. As bundling becomes the new normal for entertainment subscriptions, look for Netflix to open its wallet to evolve. For now, the 21.4x trailing earnings multiple seems a tad rich.