Shares of newly-merged media firm and streaming contender Warner Bros. Discovery (WBD) were under a considerable amount of selling pressure this past week following the release of some bleak second-quarter numbers. The quarter was dreadful, but with ambitious plans to cut costs and combine HBO Max and Discovery+, I do think there’s a lot to gain by giving Zaslav the benefit of the doubt at these depressed valuations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

WBD stock finds itself down almost 46% year-to-date and down over 50% over the past 12 months.

In the world of streaming, content is king. Though innovative and intuitive streaming user interfaces are nice to have, it’s clear that there really is no substitute for incredible content. As Netflix (NFLX) looks to defend its turf from media-firms-turned-video streamers like Warner Bros. Discovery, I do think the table seems to be subtly tilted in favor of Netflix’s rivals.

Undoubtedly, Warner Bros. Discovery has a lot of irons to wrinkle out before it can even be considered a contender for that number-one spot in streaming. Though investors are no fan of Warner Bros. Discovery’s cost-cutting mindset, I do think it’s a necessary move before the firm can re-focus on content that sticks.

Transitioning from cable to streaming is never a pain-free process. It’s an expensive endeavor requiring a bit of patience from investors. Fortunately, Warner Bros. won’t be in cut mode forever. Once Zaslav is finished reaching for the lowest hanging fruit, the firm could easily get aggressive and begin taking share away from streaming incumbents.

Warner Bros. Discovery may not have the financial flexibility to make a massive splash in streaming over the near to medium-term, given its heavy debt load. However, the firm has the brands that could help Warner Bros. Discovery produce a competent Netflix competitor.

At writing, the stock trades at a mere 0.6 times book value and 1.7 times sales, both well below industry averages. With such a wide discount to book value, I’d argue that Warner Bros. Discovery’s merged streaming platform does not have to be in the top two for WBD stock to rally much higher from current levels. With such a low bar set by investors, I am incredibly bullish on Warner Bros. Discovery stock at $14 and change per share.

These depressed valuations simply do not do the firm justice.

WBD Stock’s Awful Numbers and Uncertain Growth Plan Rattle Investors

WBD stock is down over 20% in just a few trading sessions. That’s a steep drop and likely an overreaction to a harsh Q2 result. Sure, the quarter marks a weak start for the media juggernaut, but there are catalysts farther out as the firm makes it through what’s shaping up to be a choppy rest of the year.

For the merged firm’s very first quarter, revenue contracted 1% year-over-year, while management shed light on its long-term streaming plans. Investors and analysts were unenthused. Following the tough quarter, Wells Fargo (WFC) slashed its recommendation (to Hold from Buy) and price target to $19 from $42 — one of the biggest cuts I’ve seen.

Warner Bros. Discovery’s Plans to Launch a Combined Platform

Indeed, a combined streaming platform makes a lot of sense. Though HBO Max and Discovery+ cater to completely different audiences, there’s no shame in bringing them together in one convenient place for its diverse range of viewers.

If Disney (DIS) can bring together cartoons and National Geographic documentaries on the same streaming platform, Warner Bros. Discovery can mix DC superheroes with the latest hit reality TV shows.

In prior pieces, I stated that the streaming platform with the greatest quality and quantity of content would be a force to be reckoned with in the streaming market. At the end of the day, more content gives customers a greater value. In such a wildly-competitive market, Warner Bros. Discovery needs to amp up its value proposition if it’s to take share away from some pretty deep-pocketed rivals.

With north of $55 billion in debt as of the end of last quarter, Warner Bros. Discovery seems to lack the content-spending capacity of its bigger brothers in the space.

To thrive, the firm needs to trim away its debt load while being very selective when it comes to content creation. It has a relatively limited budget to make something stick. As a part of the company’s recent cuts, two HBO max productions, Scoob! Holiday Hunt and Batgirl were axed.

At this juncture, it seems like the company is looking to focus on the quantity of older content (from the deep libraries of Warner Bros. and Discovery), at least in the initial stages. As debt levels come down, count me as unsurprised if Warner Bros. Discovery starts ramping up the production of original content again.

What Will be the Price of WBD Stock?

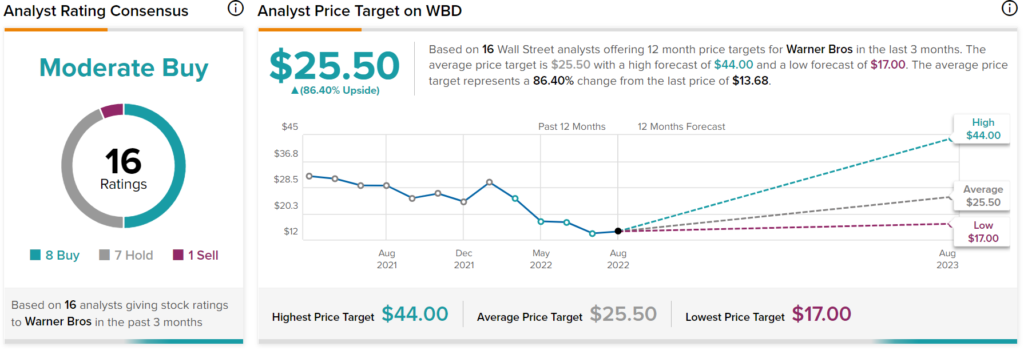

Turning to Wall Street, WBD has a Moderate Buy consensus rating based on eight Buys, seven Holds, and one Sell assigned in the past three months. The average WBD price target of $25.50 implies 86.4% upside potential.

Takeaway – WBD Stock Has Ambitious Goals

Streaming is a market where you’ve got to spend money to make money. That said, it will be interesting to see how WBD’s combined streaming platform fares, even if the pipeline of new releases isn’t nearly as full as the likes of Netflix. Looking way ahead, the company sees global streaming EBITDA at $1 billion, with 130 million subscribers by 2025. That’s an ambitious target that may be subject to upgrades if its quantity-focused strategy pays off.