In this piece, I evaluated two software stocks, Microsoft (NASDAQ:MSFT) and Palantir Technologies (NASDAQ:PLTR), using TipRanks’ comparison tool to determine which is better. While euphoria has gripped both stocks, Microsoft could receive either a bullish or neutral view depending on how you approach it, although I am overall neutral on the stock. Meanwhile, the bear case for Palantir is clear.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Of course, Microsoft has long been a behemoth in the software industry, and its best-known offerings are the Windows operating system, the Microsoft 365 suite of productivity software, and the Edge web browser. On the other hand, newcomer Palantir Technologies specializes in big-data analytics, developing platforms that fuse machine-assisted and human-driven data analysis.

Including a three-month gain of 17%, shares of Microsoft are up 57% year-to-date. Meanwhile, Palantir stock has soared 210% year-to-date, following a gain of 35% over the last three months.

Palantir’s excessive year-to-date rally versus Microsoft’s gain looks like an oversized reaction to the artificial-intelligence-related euphoria that has sent numerous technology stocks through the roof this year, including both Palantir and Microsoft.

In fact, the market’s excess gains remain largely concentrated in the tech sector, as evidenced by the 48% year-to-date gain in the tech-heavy Nasdaq 100 (NDX) versus the S&P 500’s (SPX) much smaller 19% gain and the Dow Jones Industrial Average’s (DJIA) minuscule 6% bounce.

Unfortunately, the AI-related euphoria has caused so much speculation in tech stocks that the usual valuation multiples like the price-to-earnings (P/E) ratio have been rendered virtually useless. Thus, a closer look at the other factors is needed to determine which, if either, of these tech stocks is trading at an attractive price right now.

Microsoft (NASDAQ:MSFT)

Microsoft stock is currently trading at $373, near its record high of ~$379. As a result, it’s edging into overbought territory. Recent AI-related developments have made the software giant unstoppable of late. Microsoft’s long-term stock-price gains, combined with the AI-related euphoria in its shares, suggest a bullish-to-neutral view may be appropriate, depending on which side of the investment case an investor favors. Again, though, I personally favor the neutral side.

First, let’s discuss the neutral view. Microsoft’s Relative Strength Index (RSI) currently sits at around 66, and anything over 70 is generally considered overbought territory, so it’s getting close. If MSFT becomes overbought, it may be ripe for a correction. The fact that it’s trading around a record high also suggests a pullback may develop, offering a better entry price for patient investors.

The latest developments regarding ChatGPT developer OpenAI and Microsoft’s responses to the situation may be driving an excess in its shares. In a surprise move, OpenAI ousted co-founder Sam Altman as CEO. Microsoft has a vested interest in OpenAI because of its more than $13 billion investment in the company, which gave it a 49% stake, and Microsoft management quickly offered support for the company after it ousted Altman.

The software giant also promptly snapped up Altman after his ouster at OpenAI, making him the head of a new advanced AI research team. Altman is largely credited with the development of ChatGPT, the first generative AI chatbot that worked so well that it triggered a sudden surge in all stocks having anything to do with AI.

Clearly, hiring Altman will be a boon for Microsoft, so it’s no surprise that investors snapped up as many shares as they could following the news. However, this related euphoria could fade, resulting in a pullback that would provide a better entry price.

On the bullish side, Microsoft shares are up 84% over the last three years, 286% over the last five years, and 1,091% over the last decade, making it look like an attractive buy-and-hold position for the long term. In fact, investors who wait to buy the stock may risk missing out on significant gains if there is no pullback anytime soon.

Ultimately, it seems like a nearly 50/50 bet that could go either way — buy shares now to benefit from Microsoft’s long-term stock-price gains and risk a pullback in the near future, or wait for a better entry point now and risk the possibility of no pullback occurring anytime soon because of the AI hype.

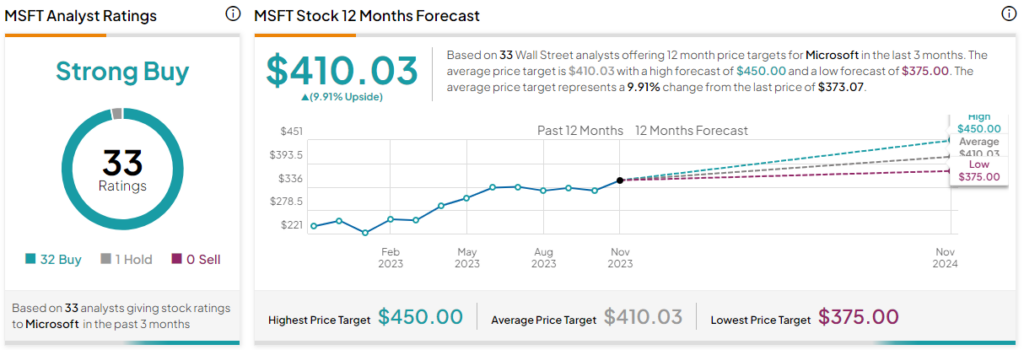

What is the Price Target for MSFT Stock?

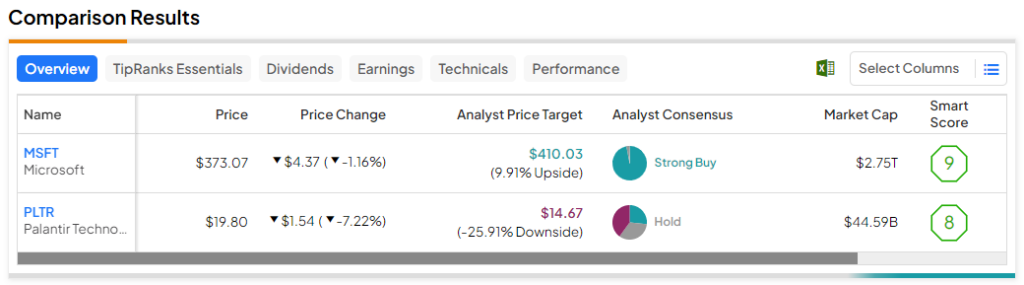

Microsoft has a Strong Buy consensus rating based on 32 Buys, one Hold, and zero Sell ratings assigned over the last three months. At $410.03, the average Microsoft stock price target implies upside potential of 9.9%.

Palantir Technologies (NASDAQ:PLTR)

Meanwhile, the investment case for Palantir Technologies is much clearer. At a P/E of 283, Palantir Technologies is trading at an astonishingly high valuation, especially considering that it’s barely profitable. Thus, a bearish view seems appropriate for now.

The stock is near its 52-week high, and it looks like a correction may be starting, with the stock closing 7.2% lower in the most recent trading session. Plus, a large number of Auto Sell transactions by insiders provides further evidence that Palantir could be overdue for a correction. Additionally, an insider unloaded $5.1 million worth of Palantir shares via an Informative Sell transaction three months ago.

Typically, insiders establish preset trading plans that include prices at which to automatically sell shares of their company. Thus, the large number of Auto Sell transactions over the last three months suggests insiders don’t believe there will be any more upside for Palantir shares in the near term.

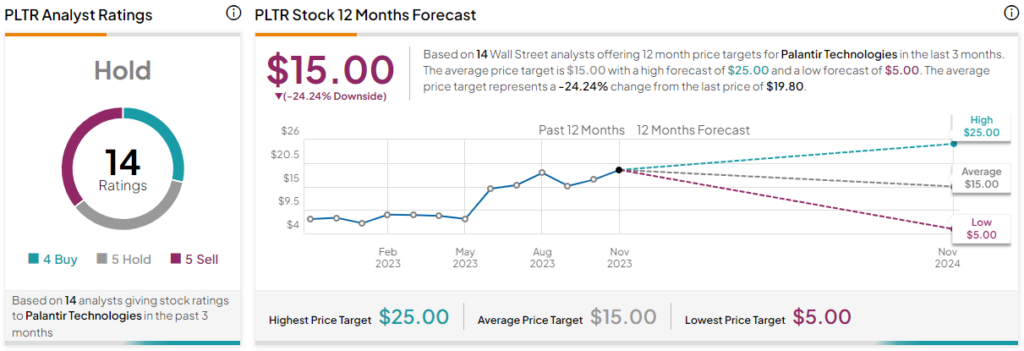

What is the Price Target for PLTR Stock?

Palantir Technologies has a Hold consensus rating based on four Buys, five Holds, and five Sell ratings assigned over the last three months. At $15, the average Palantir Technologies stock price target implies downside potential of 24.2%.

Conclusion: Neutral to Bullish on MSFT, Bearish on PLTR

Considering all of the above factors for Microsoft, I am neutral on the stock, but either a neutral or bull case could be made, depending on one’s point of view. On the one hand, buying now looks riskier than waiting, especially given the “fear of missing out” or FOMO mindset. On the other hand, it’s hard to imagine that buying and holding Microsoft for many years will lead to losses, even at current levels.

At the same time, the bear case for Palantir Technologies is clear. At some point, a more constructive view may become appropriate, but not in the near term.