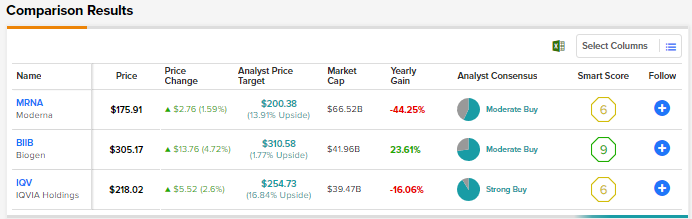

The COVID-19 pandemic has made governments across the world realize the importance of healthcare and the need to develop treatments for unmet medical needs. Many biotechnology companies are working on drugs that could generate billions of dollars once approved. Moderna (NASDAQ:MRNA) is a great example of the growth prospects that a biotech stock can offer. That said, biotech stocks are often high-risk, high-reward propositions. Using TipRanks’ Stock Comparison Tool, we will compare Moderna, Biogen (NASDAQ:BIIB), and IQVIA (NYSE:IQV) to pick the most promising biotech stock as per Wall Street pros.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Moderna (MRNA) Stock

Moderna shot to fame when its mRNA-1273 COVID-19 vaccine (Spikevax) became the second COVID-19 vaccine to win the U.S. Food and Drug Administration’s (FDA) emergency use authorization and full approval subsequently.

However, MRNA stock has declined significantly from the all-time high seen in August 2021 over concerns about the declining demand for COVID-19 vaccines following a rapid vaccination drive worldwide. Moderna’s Q3 revenue declined 32% to $3.4 billion. Furthermore, expenses related to increased headcount and growth investments impacted profitability. Q3 EPS declined 67% to $2.53.

Moreover, the company lowered its full-year guidance for the COVID-19 vaccine revenue to the range of $18 billion to $19 billion, down from its previous outlook of $21 billion, citing supply chain constraints that pushed some vaccine deliveries into 2023.

As of September 30, 2022, Moderna’s Spikevax COVID-19 vaccine and Omicron-targeting bivalent boosters (mRNA-1273.214 and mRNA-1273.222) were its only commercial products authorized for use. The company’s pipeline consists of 48 programs focused on developing therapeutics and vaccines for infectious diseases, immuno-oncology, rare diseases, autoimmune diseases, and cardiovascular diseases.

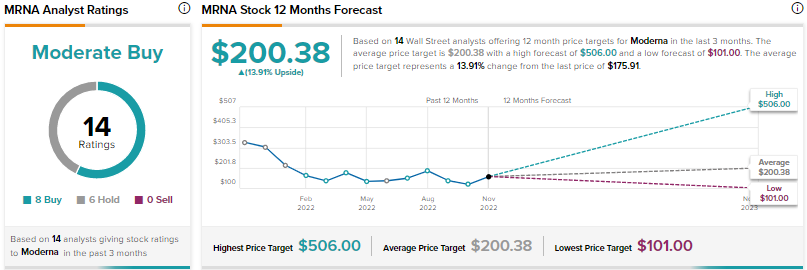

What is the Prediction for Moderna Stock?

Wall Street’s Moderate Buy consensus rating for Moderna stock is based on eight Buys and six Holds. The average MRNA stock target price of $200.38 implies nearly 14% upside potential. Shares have declined nearly 31% year-to-date.

Biogen (BIIB) Stock

Biogen is focused on developing therapies for neurological diseases and related therapeutic adjacencies. After facing setbacks related to its Alzheimer’s drug, Aduhelm, the company has been in the news due to the developments related to its other Alzheimer’s drug, Lecanemab. Biogen is jointly developing Lecanemab with Japanese firm Eisai Co., Ltd. (ESALY).

Biogen stock rose 4.7% on November 30 after Eisai presented full findings from the trial related to Lecanemab at the Clinical Trials on Alzheimer’s Disease (CTAD) Conference held in San Francisco. The Phase 3 clinical trial (Clarity AD) assessing Lecanemab as a treatment for people with early forms of Alzheimer’s disease showed that the drug reduced the rate of cognitive decline by 27% compared to a placebo. Nevertheless, there are concerns about the side effects of Lecanemab, including brain swelling and bleeding.

The approval of Lecanemab is crucial for Biogen, especially as sales from its key drugs, like Tecfidera and Spinraza, are declining.

What is the Target Price for Biogen Stock?

Stifel analyst Paul Matteis reiterated a Buy rating on Biogen stock following the full Lecanemab CTAD presentation, which he believes reaffirms the positive top-line result. Matteis noted, “Overall, there was nothing odd/unexpected that would undermine CLARITY-AD as a clearly positive trial, while on the safety side there were no surprises.”

On TipRanks, Biogen scores the Street’s Moderate Buy consensus rating based on 19 Buys and seven Holds. At $310.58, the average BIIB stock price target of $310.58 suggests a modest upside potential of 1.8% from current levels. Biogen stock has rallied over 27% so far this year.

IQVIA Holdings (IQV) Stock

IQVIA offers advanced analytics, technology solutions, and clinical research services to the life sciences industry. The company helps to expedite the drug discovery and development process by leveraging artificial intelligence and machine learning.

During the Q3 conference, the company reassured investors that it is not seeing any indications of a slowdown in demand despite macro challenges. IQVIA has an extensive presence in over 100 countries and works with more than 10,000 customers, including top 25 large pharma companies.

IQVIA delivered market-beating Q3 results, with revenue rising 5% to $3.6 billion and adjusted EPS increasing 14.3% to $2.48. While demand remains strong, IQVIA has been facing operational challenges due to increased wages, high levels of attrition, disruptions caused by the Russia-Ukraine war, and lockdowns in China. It expects minor delays in the timing of deliveries due to macro challenges and staff shortages at certain sites. Overall, IQVIA projects full-year revenue growth in the range of 3.2% to 4.0%.

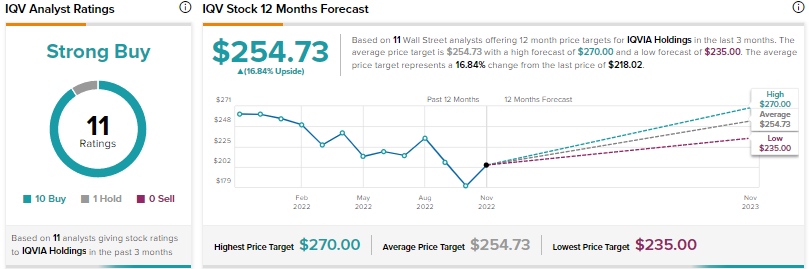

Is IQVIA Stock a Buy?

Barclays analyst Luke Sergott increased the price target for IQVIA stock to $235 from $215 following the Q3 results. Sergott noted that while the Q3 performance was “solid,” guidance was “mixed.” The analyst feels that IQVIA’s earnings could be under pressure next year due to higher interest expenses. Nonetheless, Sergott expects the company to bring down its debt to address higher interest expenses.

Overall, IQVIA scores a Strong Buy consensus rating backed by 10 Buys and one Hold. The average IQV stock price target of $254.73 implies nearly 17% upside potential. Shares have fallen 22.7% year-to-date.

Conclusion

Wall Street is more optimistic about IQVIA Holdings than Moderna and Biogen. They see higher upside potential in IQV stock compared to the other two biotech stocks. It’s worth noting that as of September-end, IQVIA had a strong backlog of $25.8 billion, reflecting growth of 5.4% year-over-year and an increase of 9.4%, excluding the impact of currency headwinds.