After consolidating for several months, shares of Micron Technology (NASDAQ:MU) are on the move, rising about 47% in three months.

For context, the impact of non-memory component shortages and the continued decline in DRAM prices limited the upside in Micron stock. However, management’s positive commentary around supply, lower-than-expected drop in DRAM (Dynamic Random Access Memory) prices, and solid demand led to an uptrend in Micron stock.

What’s Ahead?

During the Q1 conference call, management stated that in the PC (personal computer) industry, the non-memory component shortages impacted “suppliers’ ability to build DDR5 (PC memory) modules.” However, management expects “these shortages to moderate through 2022,” which positions it well to capitalize on demand.

Moreover, Micron stated that it entered into a supply agreement with UMC that will likely strengthen its NAND (a type of memory) solutions for the automotive market as demand improves in 2022.

While supply challenges are expected to ease in 2022, average selling prices for DRAM and NAND could benefit from higher demand in 2H22, noted Vijay Rakesh of Mizuho Securities.

Providing takeaways from his call with Micron’s CFO, David Zinsner, and VP Investor Relations, Farhan Ahmad, Rakesh noted that strength in the PC and data center segment is driving average selling price and, in turn, will support margins. Further, the analyst sees “lower memory inventories” as a tailwind in 2022.

Rakesh added that Micron’s 2H22 margins “could see upside versus CONSENSUS with significant cost-downs on both DRAM and NAND and accretive DDR5/NVMe SSD product ramps.”

However, Micron’s operating expenses could see a sequential increase due to its investments in new technologies and products, according to management.

Nevertheless, Rakesh is bullish about Micron’s prospects and finds its valuation attractive.

Wall Street’s Take

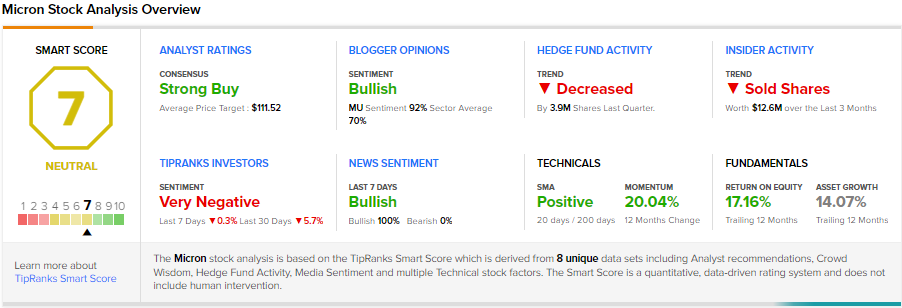

Along with Rakesh, most analysts have a positive outlook on Micron shares. It has received 19 Buy, 4 Hold, and 1 Sell recommendation for a Strong Buy consensus rating. Further, the average Micron price target of $111.52 shows a decent upside of 14.9% to current levels.

However, Micron stock scores 7 out of 10 on TipRanks’ Smart Score system, indicating that MU stock could perform in line with the benchmark index.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.