“The Big Short” fame investor Michael Burry’s Scion Asset Management revealed long positions in bulk shipping stocks, energy companies, prison stocks, banking companies, and media shares. Burry also increased his existing holdings in RealReal (NASDAQ:REAL), Geo Group (NYSE:GEO), and Cigna Group (NYSE:CI).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the other hand, he remains short on the currently buzzing tech sector. His fund currently holds 33 stocks or exchange-traded funds (ETFs) valued at roughly $1.74 billion. This represents a big jump from his first-quarter holdings, which were valued at approximately $106.94 million at the time. Notably, Scion bought a massive quantity of put options in two major market-tracking funds: the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust (QQQ).

Which Stocks Did Michael Burry Buy in Q2?

As per the latest 13F regulatory filing, Scion Asset Management bought stocks of these companies, among others:

- Star Bulk Carriers (SBLK)

- Safe Bulkers (SB)

- Expedia Group (EXPE)

- Charter Communications (CHTR)

- CVS Health (CVS)

- MGM Resorts (MGM)

- Stellantis (STLA)

- Warner Bros. Discovery (WBD)

- NexTier Oilfield Solutions (NEX)

- Crescent Energy (CRGY)

With this backdrop, let’s check what the future holds for these stocks.

Is RealReal Stock a Buy?

RealReal is an online luxury consignment site that engages in the delivery of luxury goods across multiple categories, including women’s, men’s, kids’, jewelry and watches, and home and art.

In its second quarter Fiscal 2023 results, RealReal posted a narrower-than-anticipated loss of $0.30 per share. Meanwhile, revenues of $130.86 million fell short of analysts’ expectations but exceeded the company’s own midpoint guidance.

Following the mixed Q2 print and the expectation of a solid Q3 performance, some analysts raised the price target on REAL stock. Despite that, on TipRanks, RealReal stock has a Hold consensus rating. This is based on one Buy versus three Hold ratings. The average RealReal price target of $2.40 implies a disappointing 2.2% downside potential from current levels.

Is GEO Stock a Good Buy?

The GEO Group is a real estate investment trust (REIT) that specializes in the ownership, lease, and management of correctional, detention, and re-entry facilities. In its Q2FY23 results, Geo’s adjusted earnings of $0.24 per share surpassed analysts’ expectations.

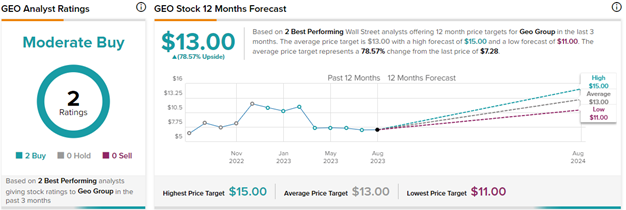

Based on the views of the two top analysts who recently rated Geo, the stock has a Moderate Buy consensus rating. Top Wall Street analysts are those awarded higher stars by the TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings).

The average Geo Group price forecast of $13 implies an impressive 78.6% upside potential from current levels. GEO stock has lost 32.1% so far this year.

Is Cigna a Good Stock to Buy?

Cigna is a global health services company that provides insurance and related products and services. The insurer also outpaced earnings expectations in its second-quarter print. Plus, the company gave a better-than-expected earnings forecast for Fiscal 2023. As a result, some analysts raised their price targets on Cigna stock.

With six Buys and three Hold ratings, Cigna stock has a Moderate Buy consensus rating. On TipRanks, the average Cigna stock prediction of $339.22 implies 17.3% upside potential from current levels. Year-to-date, CI stock has lost 9.2%.

Moreover, investors looking for the most accurate and most profitable analyst for CI could follow analyst Scott Fidel of Stephens. Copying his trades on this stock and holding each position for one year could result in 83% of your transactions generating a profit, with an average return of 21.6% per trade.

Ending Thoughts

Michael Burry is known to take risky bets that oddly go against general market sentiment. This time around, while experts are projecting a soft landing for the U.S. economy, Burry has taken a large bet against the market’s momentum. Plus, he is bullish on sectors such as banks, which have currently drawn scrutiny from credit rating agencies. Only time will tell if Burry’s stock predictions are accurate this time.