Michael Burry made a name for himself by shorting the market to the point where they made a movie about him called “The Big Short.” But is he preparing for a time when lightning will strike twice? Recent moves in his portfolio suggest as much and in a very big way. The news began, as news seems to these days, on Twitter. Michael Burry Stock Tracker noted a major move in Michael Burry’s Scion Asset Management portfolio, as he bought a massive quantity of put options in two major market-tracking funds: the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust (QQQ).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

How massive? He bought $890 million worth of puts in SPY and another $740 million in QQQ. Together, this represents 93% of his overall portfolio value, and that has more than a few market watchers on edge. A gigantic put option buy like this suggests that Burry is expecting the market to plunge. Such a plunge might not be out of line; after all, Charles Schwab’s lead analyst Liz Ann Sonders noted several potential bumps in the road ahead for stocks.

Unusually high valuations, Federal Reserve interest rate moves, and a macroeconomic picture that’s still hazy all add up to create volatile ground. Granted, Burry has been wrong before. He’s made a call for a market crash before without success. His calls for a recession have gone similarly unanswered, depending on who you talk to. But the recent shipping slumps seen at Maersk suggest that something may be going on, and Burry did call that effectively.

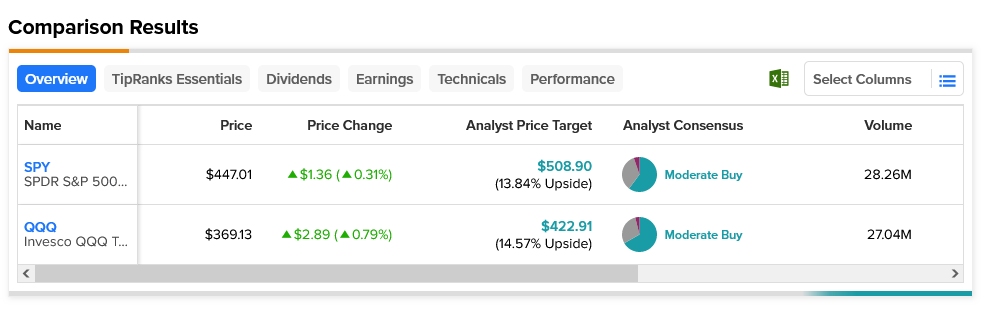

Burry’s put options come at an odd time. Both SPY and QQQ are considered Moderate Buys by analyst reckoning. Further, both have similar upside potentials. SPY’s average price target of $508.90 gives it a 13.84% upside potential, while QQQ boasts a 14.57% upside potential on its average price target of $422.91.