Expectations were incredibly high this earnings season for the so-called “Magnificent Seven.” Meta Platforms (NASDAQ:META) delivered an impressive round of results that may help it help it run further going into year-end. For the third quarter, there was pronounced strength right across the board. The firm isn’t just growing its user base again; it’s keeping them engaged. And with impressive new artificial intelligence (AI) tools, it’s not hard to imagine growth and engagement continuing to heat up.

Despite all the positives, shareholders were more than ready to throw in the towel on the stock, selling the stock after its October 25 earnings report. Chalk it up as a late-October temper tantrum from Mr. Market.

Meta stock has since recovered the ground lost from its quarterly stumble and could be ready to make new 52-week highs as it moves forward with its “year of efficiency” into what I view as a year of AI-driven growth.

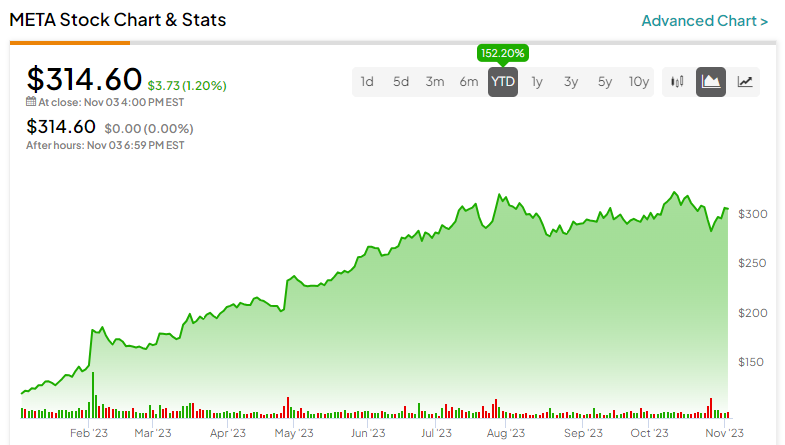

Indeed, it’s hard to justify buying Meta stock after an incredible 152% year-to-date surge, especially if you consider yourself a value investor. That said, many Wall Street analysts continue to see more upside potential in the name. I’m inclined to agree that Meta stock is a winner poised to continue winning, and I’m staying bullish.

There May be More Outperformance to Come

For the latest quarter, Meta’s revenue shot up 23%, as the ad business recovered swiftly. Daily active users (DAUs), a great gauge for social media companies, came in at 2.09 billion, ahead of the 2.07 billion estimate. Average revenue per user (APRU) was also a beat at $11.23, slightly ahead of the $11.05 consensus.

Fundamentally, Meta stock looks to be one of the better plays of the Magnificent Seven. Technically speaking, Meta also looks pretty good, at least according to Rich Ross, a technician over at Evercore, who views Meta Platforms as “best on the board absolutely and relatively.”

Not only is Meta’s social business picking up traction amid intense macro headwinds, but the firm has plenty of growth drivers (or catalysts) that could help extend its run going into the new year. Generative and conversational AI could help drive even more engagement across Meta’s social media Family of Apps.

If AI could help Meta give its ad business a jolt, with the likes of ad automation tools like Advantage+, it could certainly help keep many of its Facebook, Instagram, and WhatsApp users more glued to their screens.

As Meta rolls out its impressive chatbots into its Family of Apps, it will be interesting to see the effect on daily active users (DAUs). Of course, a ChatGPT-like spike in engagement may very well be out of the question. But at current valuations, I’m not so sure the potential of conversational AI is priced into the stock quite yet. Meta’s Llama 2 model (the company’s response to chatGPT) holds plenty of potential.

Meta Stock: What About Its Valuation?

At writing, shares of Meta trade at just 27.8 times trailing price-to-earnings (P/E), or 18.5 times next year’s expected P/E, both of which are roughly in line with the internet content & information industry averages of 26.1 and 19.4 times, respectively. Its current P/E represents the slightest premium for what I believe is one of the most impressive “AI monetization” plays of the entire Magnificent Seven cohort.

William Blair analyst Ralph Schackart, who has a Buy rating on the stock, sees “AI advancement driving engagement across the organization.”

Undoubtedly, Meta seems like more of an AI company than a virtual reality (VR) firm these days. However, it will be interesting to see how Meta’s Quest line stacks up against Apple’s (NASDAQ:AAPL) Vision Pro in 2024.

Is Meta Platforms Stock a Buy, According to Analysts?

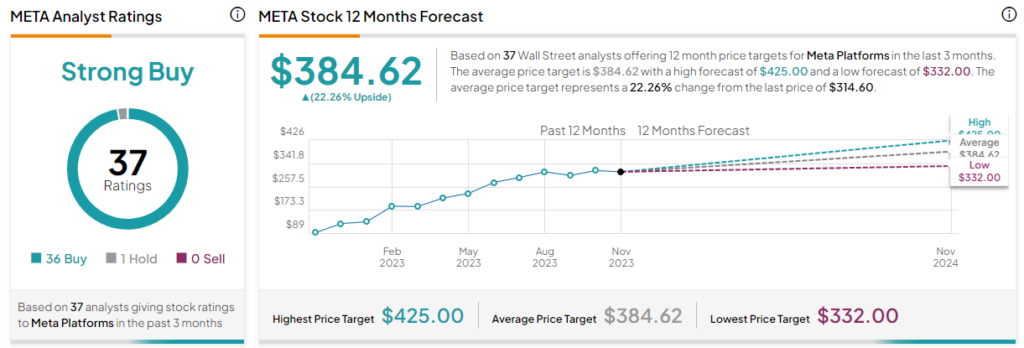

Turning to Wall Street, META stock comes in as a Strong Buy. Out of 37 analyst ratings, there are 36 Buys and one Hold recommendation. The average Meta stock price target is $384.62, implying upside potential of 22.3%. Analyst price targets range from a low of $332.00 per share to a high of $425.00 per share.

The Bottom Line on Shares of Meta

Even great earnings were met with punishment this earnings season. That has just been the mood lately. However, as sentiment shifts, look for investors to start rewarding AI monetization and sound business models built on top of AI once again.