Shares of Meta Platforms (NASDAQ:META) jumped in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $4.39, which beat analysts’ consensus estimate of $3.64 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sales increased by 23.2% year-over-year, with revenue hitting $34.15 billion. This beat analysts’ expectations by $700 million. The company also revealed robust user growth, with 3.14 billion “daily active people” – a 7% increase from the previous year.

Meta’s top line benefitted from higher ad revenues. Meta’s CFO, Susan Li, highlighted that the company’s Family of Apps ad revenue was $33.6 billion, up 24% year-over-year, with the online commerce vertical being the largest contributor. Further, Meta CEO Mark Zuckerberg previously stated that 2023 would be a “year of efficiency.” The company’s focus on driving efficiency is paying off well, as Meta lowered its total expenses in Q3, which cushioned its bottom line.

Looking forward, management now expects revenue for Q4 2023 to be in the range of $36.5 billion to $40 billion. For Fiscal Year 2023, capital expenditures are expected to be in the $27-29 billion range

Is Meta a Buy, Sell, or Hold?

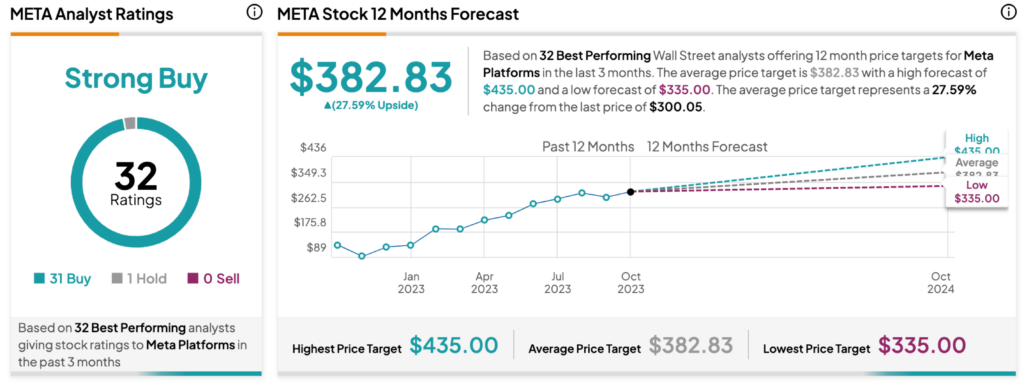

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 31 Buys, one Hold, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $382.83 per share implies a 27.59% upside potential.