Offering a market-geared alternative to the wild cryptocurrency sector, blockchain mining specialist Marathon Digital (NASDAQ:MARA) certainly earned respect as a viable opportunity for speculation. However, with the underlying sector facing a very rough patch, it’s time to read the writing on the wall. You don’t have to be pessimistic indefinitely. However, I am bearish on MARA stock right now because it’s too tethered to an unpredictable market.

MARA Stock Faces Excessive Dependency on Cryptos

Fundamentally, the main concern for MARA stock and its ilk is that the underlying business almost runs as a motorcycle sidecar to the underlying crypto market. Essentially, as cryptos move, so do Marathon and other blockchain-related ventures.

Investors can simply look at the financial performance of Marathon to verify the above claim. When the calendar closed on the year 2020, Marathon posted only $4.36 million in revenue. However, in the following year, the top line skyrocketed as sales hit $150.46 million. That wasn’t surprising, as the crypto market soared to record heights.

Of course, the dramatic rise in consumer inflation forced the Federal Reserve to temper accelerating prices. Through a combination of hawkish monetary policy – along with broader stability concerns – virtual currencies suffered a deflationary wave. Subsequently, Marathon posted revenue of $117.75 million in 2022, down nearly 22% compared to the prior year.

Also, MARA stock more or less mimicked the ebb and flow of blockchain-derived assets, spiking in late 2021 and collapsing from there. While shares are up around 225% since the beginning of this year, the disappointing trend in cryptos recently reflects on the blockchain miner.

In the trailing one-month period, MARA stock slipped by approximately 35%. While many contrarians undoubtedly view the latest fallout as a buying opportunity, investors should consider the bigger picture.

Broader Headwinds Conspire Against Marathon Digital

To be clear, this assessment of MARA stock has nothing to do with personally disliking the underlying business. Rather, Marathon and its sector rivals feature highly-cyclical operations. Unfortunately, broader headwinds on the horizon indicate that the market faces a negative cyclical pivot. Thus, agree or disagree, MARA stakeholders should at least consider emergency responses.

First, the Fed unsurprisingly indicated in its latest meeting minutes that inflation remains a pressing concern. While debate exists about tactical and strategic solutions, the reality is that the economy is far from reaching the end of the tunnel. If reading the tea leaves correctly, more interest rate hikes could be on the way. Of course, higher borrowing costs would be problematic for risk-on investments like MARA stock.

Second, the consumer base is demonstrating significant signs of pain, which subsequently may limit Marathon’s total addressable market. In particular, consumption data shows that many households are putting off expensive purchases. That being the case, individual households gambling on cryptos or crypto miners seems unnecessarily risky.

Plus, you must also consider that the consumer base is already struggling as is. Following the surge in credit card usage – which has led to plastic debt exceeding a record $1 trillion, by the way – many people are turning to unsecured personal loans to make ends meet.

Simply, such a consumer base does not provide a favorable backdrop for MARA stock.

Options Rumblings Raise Eyebrows

As stated earlier, contrarians have piled into MARA stock. According to its options chain for contracts with an expiration date of August 25, 2023, the change in open interest for out-of-money MARA calls came out to 4,165. In addition, said open interest outweighed the open interest of out-of-money puts by a factor of nearly 1.56.

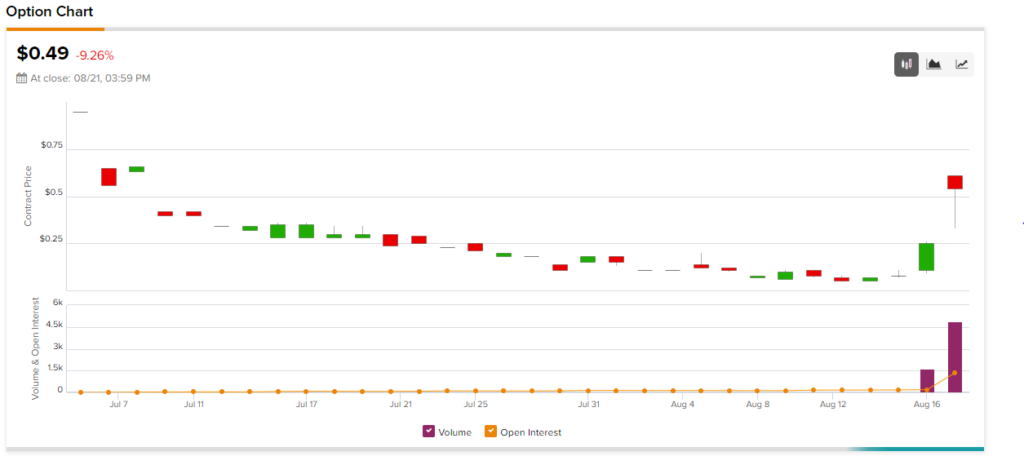

Here’s the thing, though. At a minimum, out-of-money puts increased significantly in price (see the $11 strike put image for the August 25 expiration below). Yet, traders were willing to pay the premium to open new put transactions. Further, institutional options flow indicates that smart money has begun to be skeptical about MARA stock.

To be sure, institutional players make mistakes. However, with arguably most of the evidence pointing to a negative pivot, you should be careful with Marathon Digital.

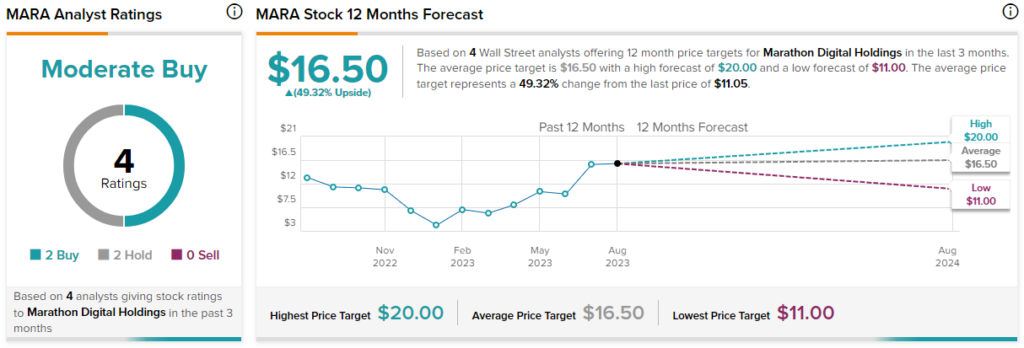

Is MARA Stock a Buy, According to Analysts?

Turning to Wall Street, MARA stock has a Moderate Buy consensus rating based on two Buys, two Holds, and zero Sell ratings. The average MARA stock price target is $16.50, implying 49.3% upside potential.

The Takeaway: MARA Stock is Facing a Reality Check

While few investments can rival the stratospheric potential of Marathon Digital when the stars align, right now, the opposite framework has materialized. In this case, MARA stock faces significant volatility, and the downside could worsen. Therefore, stakeholders need to be realistic about the cyclical nature of crypto-related businesses and make the smart move.