The rise of GLP-1 weight-loss drugs has arguably been the second-hottest trend in the stock market right now — second to generative artificial intelligence (AI). Undoubtedly, the “GLP-1 run” has brought a great deal of enthusiasm to the biotechnology and healthcare scenes. However, I don’t expect it’ll be the last ground-breaking innovation from the health space over the coming years.

As AI and biotech join forces, there’s no telling where the healthcare scene could be headed next. In any case, the healthcare scene may stand to be one of the biggest beneficiaries of the rise of AI.

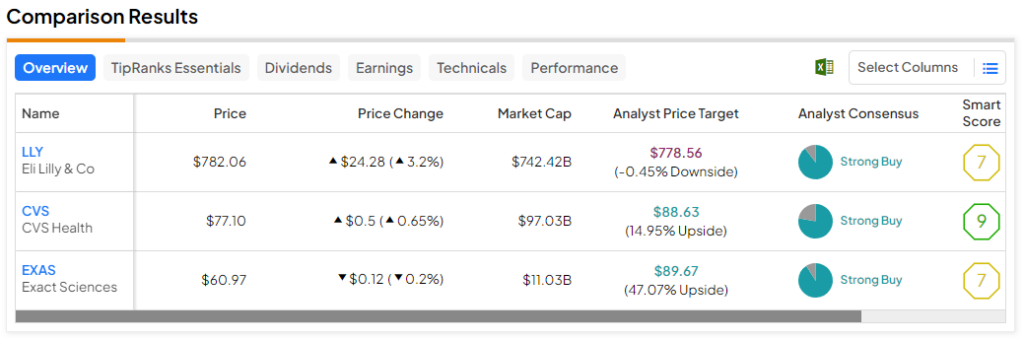

Therefore, let’s use TipRanks’ Comparison Tool to look at three Strong Buy-rated names that may be worth a second look going into March.

Eli Lilly (NASDAQ:LLY)

Eli Lilly stock has been boiling of late, recently spiking to new all-time highs of around $794 and change per share. Undoubtedly, the GLP-1 run was a shot in the arm for the $742.4 billion company that may have its sights set on the $1 trillion market cap mark.

Though there are a growing number of options within the red-hot obesity drug market, Mad Money host Jim Cramer recently stated Eli Lilly’s offering could be the best-selling drug of all time. That’s a profound statement from the Wall Street veteran and not one to be taken lightly. As Lilly continues crushing the broader markets, I can’t help but stay bullish as it looks to lead the health pack to greater heights.

Indeed, Zepbound and Mounjaro (Lilly’s injectable weight-loss offerings) are taking on a potentially massive market — one that could be larger than expected. Though weight-loss drugs were meant for the obese, we may witness a growing number of non-obese people use the drug in the future as they look to slim down ahead of beach season, weddings, or just to get better selfies for their social media pages. In any case, Eli Lilly seems to be a frontrunner that could give Ozempic and Wegovy (two top rivals in the weight-loss scene) a good run for their money.

Besides weight-loss drugs, Eli Lilly also has skin in the AI drug discovery game, with a strategic partnership with AI innovator Isomorphic Labs. All things considered, LLY stock seems to have enough growth drivers to keep its run going. Only time will tell if it can break the $1 trillion milestone this year. Either way, I wouldn’t bet against the name after its latest parabolic move.

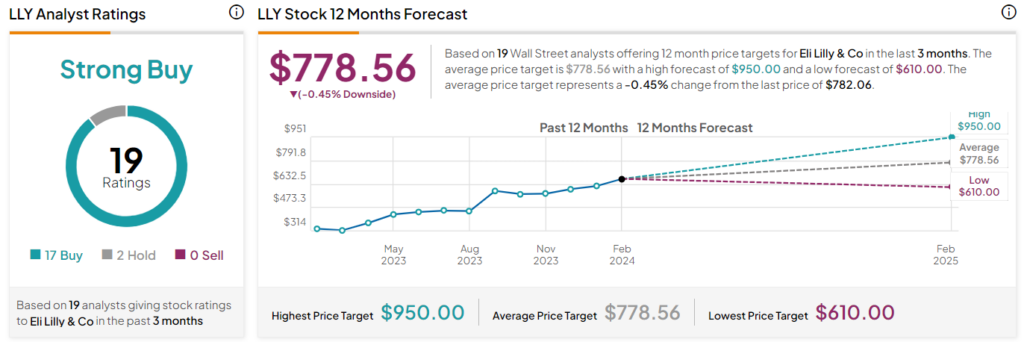

What Is the Price Target of LLY Stock?

Eli Lily stock is a Strong Buy, according to analysts, with 17 Buys and two Holds assigned in the past three months. The average LLY stock price target of $778.56 implies 0.5% downside potential.

CVS Health (NYSE:CVS)

If you’re not interested in chasing what’s the hottest of the hot in the healthcare space right now, perhaps CVS is more your cup of tea. It’s a value play, maybe a deep-value play, as it attempts to stage a comeback from a relatively uneventful year that saw the firm come up short in a wide range of metrics due to higher-than-expected medical costs.

With a lower bar (CVS slashed its 2024 guidance recently) set ahead of it and a modest valuation (11.9 times trailing price-to-earnings, well below the healthcare plans and pharmaceutical retail industry averages of 19.4 times and 33.6 times, respectively), I continue to be a raging bull on the stock.

Though low expectations and a depressed valuation aren’t share-price drivers in themselves, I do think they may be setting the stage for a potentially prominent comeback over the next year. As CVS battles through what remains of pharmacy and health plan industry headwinds, the firm seems to be looking to jolt efficiencies by closing a few of its pharmacies that aren’t exactly firing on all cylinders.

Combined with investments in data analytics and AI (CVS recently teamed up with Microsoft (NASDAQ:MSFT) to work on digital health and cloud computing), it’s only a matter of time before CVS is running more effectively, perhaps enough to give margins a nice long-term boost.

With the confidence of Wall Street and one of the cheapest multiples around, the stock looks like an intriguing name to watch.

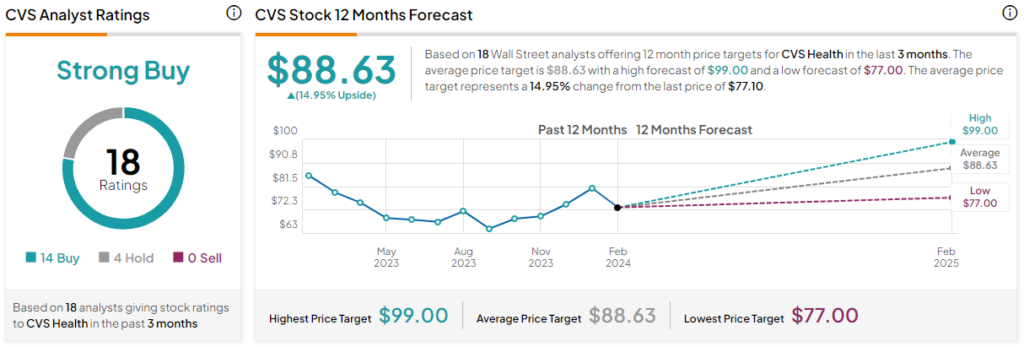

What Is the Price Target of CVS Stock?

CVS stock is a Strong Buy, according to analysts, with 14 Buys and four Holds assigned in the past three months. The average CVS stock price target of $88.63 implies 14.95% downside potential.

Exact Sciences (NASDAQ:EXAS)

Finally, we have Exact Sciences, the innovative firm behind colon cancer screening products like Cologuard. The stock has been in a rut for a few years, but don’t pin it on Cologuard. The product has continued to be the star of the show over at Exact Sciences. With earnings on tap for this Wednesday, it will be interesting to see how the firm’s top product fares. I think it’ll benefit from continued momentum as more folks look to get themselves screened from the comfort of their own homes.

Most intriguingly, Exact Sciences has a lot of big fans on Wall Street. Benchmark recently named the firm one of its “best ideas” for 2024, thanks in part to its “continued progress on the new product pipeline.”

Perhaps the biggest catalyst Benchmark outlined is the potential for an FDA green light for Cologuard 2.0. Though version two of Cologuard will likely launch next year, the benefits to Exact’s share price could be in the books well ahead of time. As Cologuard looks to drive EXAS stock out of its funk, I find it difficult not to be bullish.

What Is the Price Target of EXAS Stock?

Exact Sciences stock is a Strong Buy, according to analysts, with 10 Buys and one Hold assigned in the past three months. The average EXAS stock price target of $89.67 implies 47.1% downside potential.

The Bottom Line

There’s a lot of innovation going on in the healthcare scene right now — perhaps enough to justify stashing one of the following high-rated health plays on your watchlist. Of the trio, analysts expect the most gains from EXAS stock (47.1% upside potential) for the year ahead.