The rising popularity of weight loss drugs like Novo Nordisk’s (NVO) Ozempic and Wegovy and Eli Lilly’s (LLY) Mounjaro and Zepbound have resulted in such consumers spending less on food. According to a survey conducted by analysts from Morgan Stanley among 92,000 people, it showed that 12.3% of households indicated that they had a member taking weight loss drugs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analyst Pamela Kaufman and her team found that GLP-1 (glucagon-like peptide 1) or weight loss drug users slashed their spending on snacks, pastries, and ice cream but increased their spending on yogurt, fish, and vegetables. This finding aligned with prior surveys showing users making healthier choices with GLP-1 drugs.

The analyst pointed out that households using weight loss drugs initially spend more on groceries than non-GLP-1 households, but spending decreases after the use of these drugs. Before starting this treatment, GLP-1 households spend over $150 per month more on groceries, partly due to factors like larger household size and higher income. After adjusting for these differences, GLP-1 households’ grocery spending fell by 6% to 9% more than the change in spending of non-GLP-1 households.

The drop in grocery spending and the growing popularity of weight loss drugs could heavily impact retail giants like Walmart (WMT) and Target (TGT).

Is Walmart a Good Stock to Buy Now?

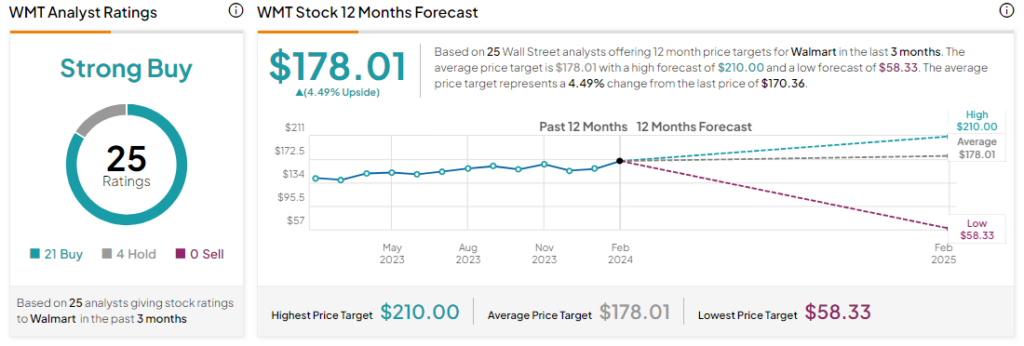

Analysts remain bullish about WMT stock with a Strong Buy consensus rating based on 21 Buys and four Holds. Over the past year, WMT stock has gone up by more than 15%, and the average WMT price target of $178.01 implies an upside potential of 4.5% at current levels. Walmart is expected to announce its calendar fourth-quarter results on February 20.