Linde (NYSE:LIN), Coca-Cola (NYSE:KO), and McDonald’s (NYSE:MCD) are famous for their solid dividend payments and growth history (more than 25 consecutive years). While these Dividend Aristocrats (learn more about Dividend Aristocrats here) are perfect for earning a steady income and are loved by Wall Street analysts (they sport a Strong Buy consensus rating), TipRanks’ Insiders Trading Activity tool shows that corporate insiders are dumping these stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But before we move ahead, it is important to highlight here that corporate insiders selling stocks are not always a bad sign. However, tracking insiders’ activities helps investors make sound investment decisions, especially if trades are informative. TipRanks scans regulatory (SEC) filings to determine whether insider trades are Informative or Uninformative and then displays that data on its Insider Trading pages. Note that Informative Buy or Sell transactions indicate insiders’ sentiment and possess a higher predictive ability.

Interestingly, TipRanks offers daily insider transactions as well as a list of the top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

With this background, let’s delve deeper into these Dividend Aristocrat stocks.

Is Linde Stock a Buy?

With 12 Buy, one Hold, and one Sell recommendation, Linde stock has a Strong Buy consensus rating on TipRanks. These analysts’ average price target of $408.71 on the share of this industrial gases and engineering company indicates 5.28% upside potential.

LIN stock has increased its dividend for 30 consecutive years. Moreover, it offers a yield of 1.3%. Furthermore, its integrated asset base, solid pricing strategy, and productivity initiatives will likely support its earnings and cash flows and drive higher dividend payments in the future.

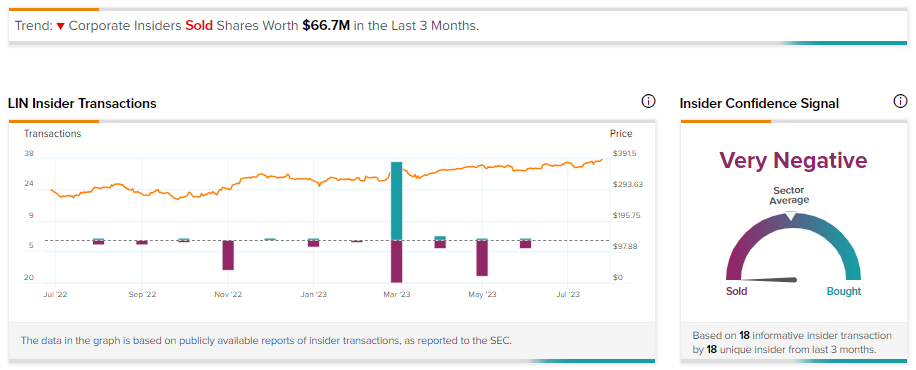

Coming to the Insider Trading Activity tool, the insider confidence signal is “Very Negative” for LIN stock. In the last six months, the stock witnessed 35 informative sell transactions from several insiders, including its Chairperson, Stephen F. Angel. Further, insiders sold LIN shares worth $66.7 million in the last three months.

Is Coca-Cola Stock a Buy Right Now?

Coca-Cola stock has seven unanimous Buy recommendations from Wall Street analysts and a Strong Buy consensus rating. Analysts’ average price target of $72 implies 14.20% upside potential.

The beverage giant increased its dividend for 61 consecutive years. Moreover, it offers a yield of 2.9%. Looking ahead, easing of the supply chain, pricing initiatives, and improvement in unit case volume will drive its earnings and dividend payouts.

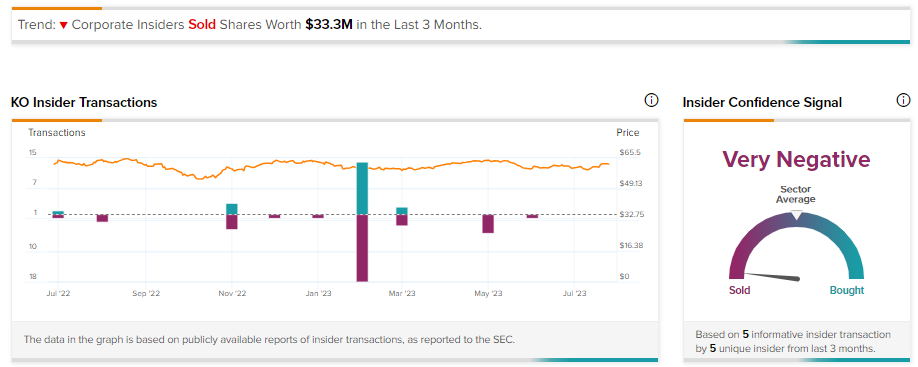

Insider Trading Activity tool, the insider confidence signal is “Very Negative” for KO stock. In the last six months, the stock witnessed seven informative sell transactions from several insiders, including its CEO, James Quincey. Further, insiders sold KO shares worth $33.3 million in the last three months.

Is MCD a Good Dividend Stock?

With a stellar history of growing its dividend for 46 consecutive years, MCD stock is a dependable income stock. It has received 17 Buy and four Hold recommendations for a Strong Buy consensus rating. Analysts’ average price target of $323.19 implies 10.78% upside potential. At the same time, it offers a dividend yield of 2%.

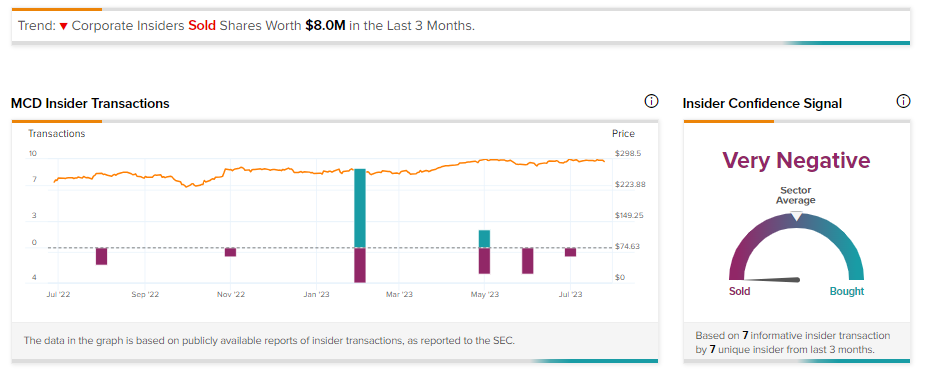

While analysts are bullish, our Insider Trading Activity tool reveals that the insider confidence signal is “Very Negative” for MCD stock. In the last six months, the stock witnessed nine informative sell transactions from several insiders, including McDonald’s USA president Joseph M. Erlinger. Further, insiders sold MCD shares worth $8 million in the last three months.

The Bottom Line

LIN, KO, and MCD stocks have received contrasting signals from analysts and insiders. There are no concrete reasons behind these informative sell transactions. Further, these stocks remain fundamentally strong. Thus, it could be perceived that insiders took advantage of the appreciation in stock prices and bullish market sentiments to book profits on their holdings.

However, investors with long-term investment horizons shouldn’t worry too much about these sells, and are best off focusing on analysts’ recommendations instead.