Last Reviewed and Updated by Gabe Ross on November 2, 2023

A Dividend Aristocrat is a company from the S&P 500 index (SPX) that has paid dividends and increased them consecutively for at least 25 years. These companies are usually large, well-capitalized companies. By their very nature, the companies’ stock prices generally have relatively less potential for appreciation than growth stocks. Therefore, they offer regular dividend payments to reward their shareholders. While the first two conditions (SPX inclusion and increasing dividends) are prerequisites, there may be some additional conditions on a case-to-case basis for becoming a dividend aristocrat.

Pros and Cons of Investing in Dividend Aristocrats

Investing in dividend aristocrats is indeed tried and true way of increasing wealth. These companies habitually carry high dividend yields and relatively high payout ratios. A prudent investor would be wise to consider having a portion of his/her portfolio allocated toward dividend-paying stocks to ensure consistent income.

Dividends are paid out of the quarterly profits earned by companies. To maintain these high dividend payouts, companies forego a part of their profits that could be reinvested in the business. On the other hand, it is believed that since dividend aristocrats are companies from well-established lines of business, they have little scope to expand their offerings and, thus, paying steady dividends is a means to attract investors.

In contrast to dividend aristocrats, start-ups and companies from the tech sector almost always prefer reinvesting profits into their businesses. Many of them will also be unprofitable as they grapple with the initial challenges of improving their financial performance. Having said that, these companies have robust growth potential, and their shareholders hope to be rewarded by way of significant stock price appreciation over the long run. With this background in mind, let’s look at the pros and cons associated with dividend aristocrats.

Pros of Dividend Aristocrats

- Provide regular, growing, and healthy dividend income to investors

- Financially sound and robust companies with positive top and bottom-line growth (generally)

- Ensure stability during macroeconomic uncertainty relative to growth stocks

- Great for building wealth over the long term

Cons of Dividend Aristocrats

- Dividend payments hamper the ability to reinvest in business growth

- Lower stock price appreciation

- Dividend income is taxable

- Low-risk, low-reward stocks in terms of business growth

How to Analyze Dividend Aristocrats on TipRanks

Interested in investing in dividend aristocrats after what you read about them? Well, TipRanks has a special page dedicated to them! To navigate to the page, on the main menu, go to Dividends –> Dividend Aristocrats.

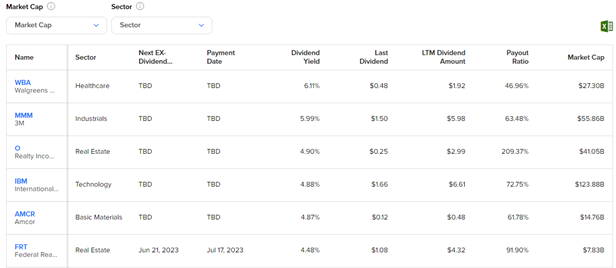

On the page, you will find a list of all the dividend aristocrats in a tabular format. The table includes the company name and ticker, sector to which the company belongs, next ex-dividend date, Upcoming payment date, current dividend yield, last dividend paid (per share), LTM dividend amount (last twelve months), current payout ratio, and the company’s market cap.

What’s more, you have the option to filter the list based on market capitalization (Micro/Small/Medium/Large/Mega) and sector (Financial/Healthcare/Consumer Defensive/Consumer Cyclical/Utilities/Basic Materials/Technology, etc.) Plus, you can download the entire list on an Excel worksheet.

Moreover, you can research exchange-traded funds (ETFs) that offer exposure to dividend aristocrats right here on TipRanks. Some of the most popular ETFs are:

- Vanguard Dividend Appreciation ETF (NYSEARCA:VIG)

- iShares Select Dividend ETF (NASDAQ:DVY)

- Schwab U.S. Dividend Equity ETF (NYSEARCA:SCHD)

- ProShares S&P 500 Dividend Aristocrats ETF (BATS:NOBL)

- WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ:DGRW)

Ending Thoughts

Dividend aristocrats have long been used in conservative investment strategies. Investors have taken a keen interest in researching these stocks and adding them to portfolios to build a regular, growing income stream. If you are considering adding dividend aristocrats to your portfolio, be sure to use TipRanks’ unique platform to find a comprehensive review of the most promising dividend-paying stocks.

Learn money management, and use data-driven stock insights with TipRanks.