Top U.S. banks, including JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), and Bank of America (NYSE:BAC), will release their fourth-quarter financial results on Friday, January 12, 2024. While the high-interest rate environment will likely support NII (net interest income) growth, the slowdown in loan growth and an increase in provisions for credit losses could exert downward pressure on earnings in Q4.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Speaking at Goldman Sachs’ U.S. Financial Services Conference, top executives from these financial services companies hinted about a continued decrease in investment banking (IB) fees and a rise in loan loss provision.

Wedbush analyst David Chiaverini expects a stable Q4 for banks. However, the analyst expects loan growth to remain muted due to the high interest rates. With this backdrop, let’s understand what the Wall Street analysts recommend about JPM, C, WFC, and BAC stocks ahead of their Q4 earnings.

Is JPM Stock a Good Buy?

JPM reiterated its full-year NII outlook of $88.5 billion in 2023. The bank will likely see a positive impact on its net interest margin from higher loan balances in Q4. JPM could witness a year-over-year and sequential increase in its IB revenue. However, its trading revenues could stay flat. Further, higher loan balances will likely increase JPM’s reserves to cover potential losses arising from credit risk, which, in turn, will hurt its earnings.

Analysts expect JPM to post earnings of $3.38 per share in Q4 compared to an EPS of $3.57 in the prior-year quarter. The year-over-year decline reflects pressure on its bottom line from higher provisions.

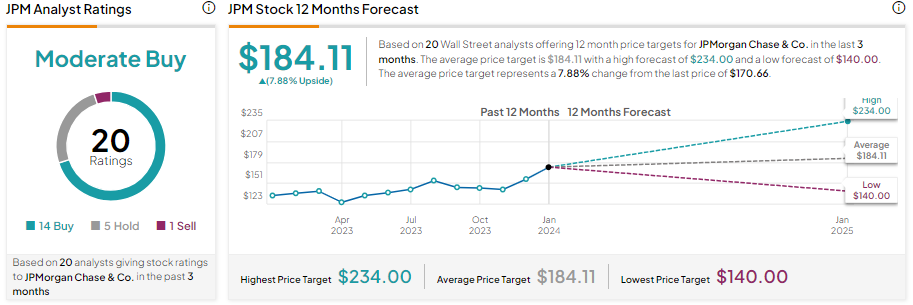

JPMorgan Chase stock has increased by about 27% over the past year and has a Moderate Buy consensus rating ahead of the Q4 print. It has received 14 Buy and five Hold recommendations. Moreover, analysts’ average price target of $184.11 implies 7.88% upside potential from current levels.

Is Citigroup a Buy or Sell?

Citigroup’s Q4 earnings could take a hit due to softness in NII and higher provisions. The financial services giant expects its trading revenues to decline sequentially by 15-20% due to lower client activity. While IB revenues could improve, Citi expects its provisions for credit losses to be about $2.2-$2.3 billion.

Wall Street analysts expect Citigroup to post earnings of $0.11 per share in Q4, down significantly from $1.16 in the prior-year quarter. Moreover, it reflects a steep sequential decline.

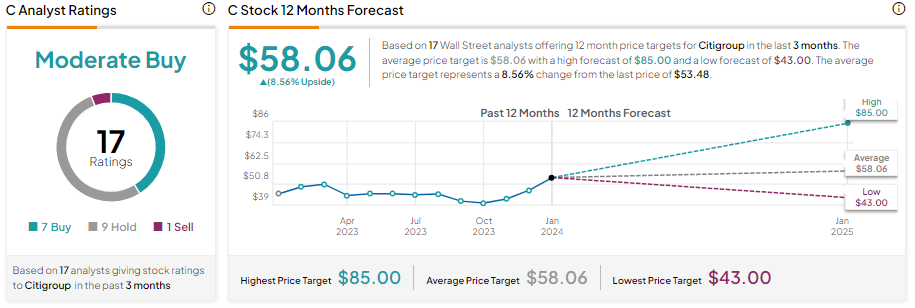

Citigroup stock has a Moderate Buy consensus rating, reflecting seven Buy, 11 Hold, and one Sell recommendations. Its stock has gained about 16% in one year. Moreover, analysts’ average price target of $50.32 implies 21.17% upside potential from current levels.

What is the Future of Wells Fargo?

Analysts are cautiously optimistic about Wells Fargo’s prospects ahead of fourth-quarter earnings. The moderation in loan growth, led by a decline in home lending, could restrict its top line. Further, an increase in provisions will likely pressure its earnings. Nonetheless, WFC’s focus on improving efficiency will likely cushion its bottom line.

Wall Street expects Wells Fargo to deliver earnings of $0.87 per share, up from $0.67 in the prior-year quarter. However, its EPS will likely show a sequential decline.

Wells Fargo stock has a Moderate Buy consensus rating based on 11 Buy and nine Hold recommendations. WFC stock gained about 20% in value over the past year. Meanwhile, analysts’ average price target of $54 implies an upside potential of 9.56% over the next 12 months.

Is BAC a Buy or Sell?

Bank of America reaffirmed its Q4 NII outlook of $14 billion at Goldman Sachs’ U.S. Financial Services Conference. However, its investment banking fee is trending lower, and management expects the segment to report a low single-digit decline in Q4. Nonetheless, the bank’s markets and trading revenue are estimated to improve in Q4. Further, BAC will likely witness an increase in reserves, which will likely hurt its bottom line.

Analysts expect Bank of America to post earnings of $0.55 per share, compared to $0.85 in the previous year’s quarter.

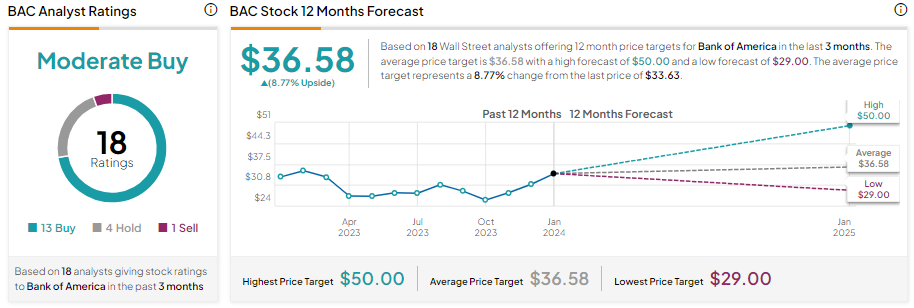

BAC stock has 13 Buy, four Hold, and one Sell recommendations for a Moderate Buy consensus rating. Its stock has underperformed its peers and has increased by only about 1.6% in one year. Looking ahead, analysts’ average price target of $36.58 on BAC stock implies 8.77% upside potential.

Bottom Line

These large banks could witness pressure on their bottom line due to the moderation in loan growth and higher provisions for credit losses. Further, analysts are cautiously optimistic about their prospects ahead of Q4 earnings. While these banks have a strong balance sheet, analysts’ average price target suggests limited upside potential over the next 12 months.