Executives from top financial services giants such as JPMorgan Chase (NYSE:JPM), Goldman Sachs (NYSE:GS), and Bank of America (NYSE:BAC) shared insights at Goldman Sachs’ U.S. Financial Services Conference. While presenting their Q4 outlook, these banks, excluding JPMorgan Chase, anticipate a decrease in investment banking (IB) fees. Additionally, a rise in provisions may negatively impact their earnings.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Against this backdrop, let’s delve into the guidance provided by these financial institutions and examine what the Street recommends for their stocks.

JPM Reiterates NII Forecast

JPM’s Co-CEO, Consumer & Community Banking, Marianne Lake, reiterated the full-year net interest income (NII) guidance. Lake said JPMorgan Chase will deliver an NII of $88.5 billion in 2023. Further, she maintained the full-year expense outlook of $84 billion.

As for Q4, Lake expects the bank’s investment banking revenue to increase year-over-year and sequentially. However, trading revenues are projected to stay flat. While credit cards are expected to drive its loans, higher loan balances will likely increase JPM’s reserves to cover potential losses arising from credit risk.

What is the Outlook for JPM?

Street is cautiously optimistic about JPM stock. With 12 Buy and six Hold recommendations, JPM stock has a Moderate Buy consensus rating. Further, the average JPM stock price target of $173.28 indicates that it has the potential to go up by 9.69% from current levels.

Goldman Sachs: IB Revenues to Trend Lower in Q4

Goldman Sachs’ CFO Denis Coleman said that investment banking is “sort of trending below trend at the moment” in Q4. However, he pointed out that the bank’s market share has remained very strong, and it has maintained its leadership in the segment.

Moving on to trading, Coleman said trading revenue is trending nearly flat year-over-year in Q4. Meanwhile, within trading, the equities business is doing well.

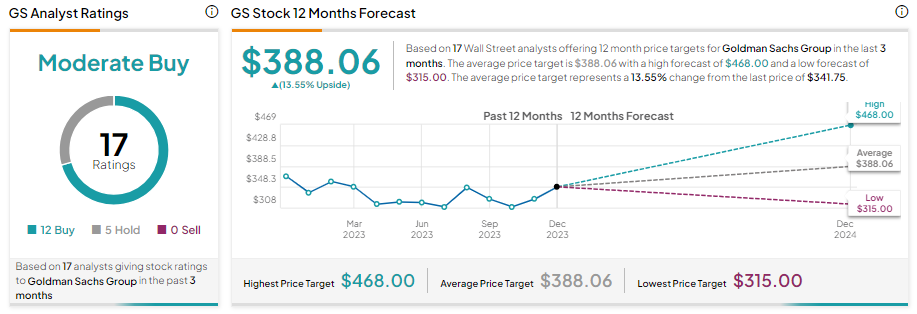

Is Goldman Sachs a Good Stock to Buy Now?

With 12 Buy and five Hold recommendations, Goldman Sachs stock has a Moderate Buy consensus rating. Further, the average GS stock price target of $388.06 indicates that it has the potential to go up by 13.55% from current levels.

BAC Retains Q4 NII Outlook

Bank of America’s CEO Brian Moynihan retained the Q4 NII guidance and expense target. Moynihan added that the investment banking fee is trending 10-15% lower so far in Q4. He said that BAC will deliver about $1 billion in IB fees in Q4, reflecting a low single-digit decline.

While IB fees will remain low, its markets and trading revenue are estimated to increase by low single digits year-over-year in Q4. Further, BAC has built some reserves despite solid credit performance.

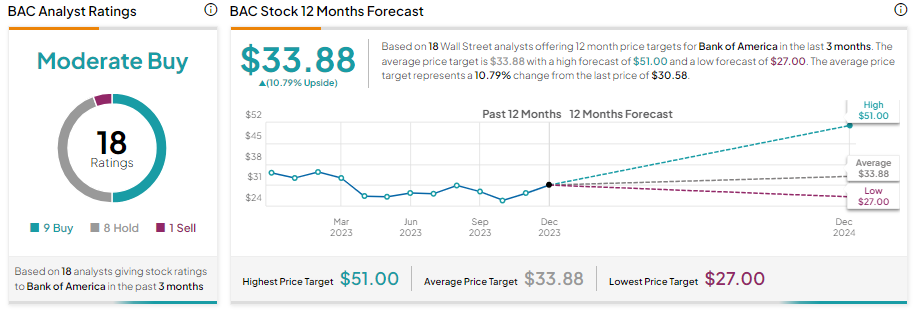

What is the Future of BAC Stock?

Like its peers, BAC stock sports a Moderate Buy consensus rating, reflecting nine Buy, eight Hold, and one Sell recommendations. Further, the average BAC stock price target of $33.88 indicates 10.79% upside potential from current levels.