The collapse of Silicon Valley Bank and Signature Bank and the Credit Suisse (CS) crisis have impacted investors’ confidence in bank stocks. Although UBS (UBS) has agreed to acquire Credit Suisse, the recent banking turmoil might continue to impact investor sentiment for some time. Nonetheless, several Wall Street analysts feel that the pullback in some of the large bank stocks offers a good opportunity to buy them for the long term. We used TipRanks’ Stock Comparison Tool to place JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC) against each other to pick the bank stock that could offer the most attractive upside as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

JPMorgan Chase (NYSE:JPM)

JPMorgan Chase is the largest bank in the U.S., with assets worth $3.7 trillion as of December 31, 2022. The bank delivered better-than-anticipated fourth-quarter results, with earnings per share rising over 7% to $3.57. Higher net interest income (NII) due to rising interest rates helped in more than offsetting the steep decline in investment banking fees and a jump in credit provision.

JPMorgan has solid liquidity and is expected to benefit from the ongoing crisis. A recent Bloomberg report stated that big banks like Bank of America (BAC), JPMorgan, Citigroup, and Wells Fargo have raked in billions in new deposits due to the recent collapse of regional banks.

Is JPM a Good Stock to Buy?

Last week, Wells Fargo analyst Mike Mayo upgraded JPMorgan to Buy from Hold and increased the price target to $155 from $148, stating that “Goliath is Winning.” He further said, “JPM is battle-tested through downturns, aided by its fortress balance sheet.”

Mayo also pointed out that JPM has won “meaningful” market share in all its business lines and has previously impressed in difficult times like these when other financial firms had issues. The analyst feels that the bank’s performance has been supported by its “multi-channel, multi-product, and multi-geographic approach.” Mayo is “incrementally more positive” about JPM’s near-term deposit outlook, and therefore its NII growth this year.

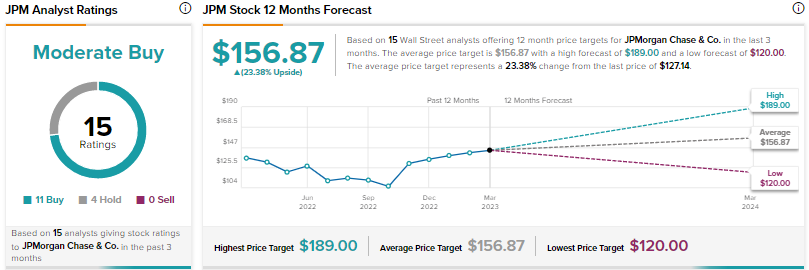

Overall, Wall Street’s Moderate Buy consensus rating for JPMorgan Chase is based on 11 Buys and four Holds. The average JPM stock price target of $156.87 suggests 23.4% upside potential. Shares have declined 5.2% since the start of this year.

Citigroup (NYSE:C)

Despite higher net interest income, Citigroup’s Q4 2022 earnings per share (excluding the impact of divestitures) declined to $1.10 from $1.99. The bank faced a sharp decline in investment banking revenue. Additionally, the company set aside a larger provision for credit losses due to deteriorating market conditions.

Nonetheless, Citigroup assured investors that it remains on track to achieve a return on average tangible common equity (ROTCE) of 11% to 12% in the medium term. The bank is taking measures to enhance its profitability by simplifying the organizational structure and reducing expenses.

Is Citigroup a Buy, Sell, or Hold?

As previously discussed, Wells Fargo’s Mike Mayo is bullish about JPMorgan. He is also positive about Citigroup. Mayo stated, “U.S. banks are stronger, have more capital, and should continue to gain share vs. European Banks – and they are likely prepared for any potential CS issues since this is not new news.” Mayo called JPM “the strongest” and believes that Citigroup “should benefit” from the ongoing situation.

With four Buys, five Holds, and one Sell, Citigroup scores the Street’s Moderate Buy consensus rating. At $57.40, the average Citigroup stock price target suggests 30.2% upside. Shares are down 2.5% year-to-date.

Wells Fargo (NYSE:WFC)

Wells Fargo has paid billions of dollars to regulators in fines in recent times, including $3.7 billion to the Consumer Financial Protection Bureau for mismanagement of auto loans, mortgages, and deposit accounts. The company’s fourth-quarter earnings per share declined by over 50% to $0.67 due to charges related to legal and regulatory matters and an increase in the allowance for credit losses.

Excluding the anticipated losses related to regulatory charges, the company reported higher net interest income, driven by rising interest rates. Wells Fargo expects its deposit balances and credit quality to continue to return toward pre-pandemic levels. Meanwhile, the bank continues to build an appropriate risk and control infrastructure to win back customers’ trust.

What is the Target Price for WFC?

Wall Street’s Moderate Buy consensus rating for Wells Fargo is based on 11 Buys and five Holds. The average WFC stock price target of $52.47 suggests 40% upside potential. Shares are down 9.2% year-to-date.

Conclusion

Wall Street is cautiously optimistic about JPMorgan, Citigroup, and Wells Fargo due to the ongoing fears related to the banking sector and macro pressures. That said, as of now, they see higher upside potential in Wells Fargo, given the pullback in the stock. The bank continues to improve its risk and control framework and is also attracting customers with new offerings. Investors who can look beyond the ongoing headwinds and have a longer-term investment horizon can pick banking stocks trading at attractive levels.