It’s tax time again. If you are receiving a tax return, it’s the perfect opportunity to consider buying a monthly dividend ETF to jumpstart your investment portfolio. Rather than splurging on an expensive toy or trinket that you’ll likely forget about in a year, it’s a wise idea to consider putting the money to work for you by buying a dividend ETF like the JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Making an investment like this is the gift that keeps on giving. Not only does it feature a significant 7.5% dividend yield, but it pays its holders a dividend on a monthly basis, setting them up for a stream of recurring passive income.

I’m bullish on this 7.5%-yielding ETF from JPMorgan (NYSE:JPM) based on its above-average yield, monthly payout schedule, solid group of blue-chip holdings, and reasonable expense ratio. Let’s take a closer look at this popular dividend ETF below.

What Is the JEPI ETF, Anyway?

JEPI debuted in May 2020, and with its high dividend yield and monthly payout schedule, it has quickly become the largest and most popular actively-managed ETF in the market today. The fund is managed by seasoned portfolio managers Hamilton Reiner and Raffaele Zingone, who have 37 and 33 years of investment industry experience, respectively.

JEPI’s goal is “to deliver consistent monthly income and the potential for capital appreciation, aiming to capture a majority of the returns associated with the S&P 500 (SPX) with less volatility.”

Investors should be aware that JEPI derives income from both dividend stocks and options premiums to generate this high yield and stream of monthly payments. According to the fund’s prospectus, JEPI seeks to achieve its objective by investing in stocks within the S&P 500 and “through equity-linked notes (ELNs), selling call options with exposure to the S&P 500 Index.”

JEPI can invest up to 20% of its assets in these ELNs. The ELNs that JEPI invests in are “derivative instruments that are specially designed to combine the economic characteristics of the S&P 500 Index and written call options in a single note form and are not traded on an exchange.”

Essentially, JEPI uses these ELNs to generate a consistent stream of income, but it’s important to note that the one potential downside is that selling these call options essentially caps the upside of the fund’s holdings.

As JPMorgan explains in the prospectus, “When the Fund sells call options within an ELN, it receives a premium but limits its opportunity to profit from an increase in the market value of either the underlying benchmark or ETF to the exercise price (plus the premium received). The maximum potential gain on an underlying instrument will be equal to the difference between the exercise price and the purchase price of the underlying benchmark or ETF at the time the option is written, plus the premium received.”

There’s nothing wrong with this strategy, but investors should always be aware of what they are buying, and as long as investors are comfortable with this potential tradeoff, then JEPI is a great way to generate income from dividends, as we’ll discuss further below.

An Above-Average Monthly Dividend

JEPI’s 7.5% yield is substantial. Not only is it significantly higher than the average yield for the S&P 500 (currently just 1.4%), but it’s also much higher than the risk-free yield offered by investing in 10-year treasuries (currently 4.2%).

The monthly payout is also an attractive feature. While most dividend stocks and ETFs pay out on a quarterly basis, JEPI pays a dividend each month like clockwork.

The amount of the dividend isn’t set in stone and can vary slightly, but right now, these payments average out to a 7.5% yield over the past 12 months, meaning that an investor putting $10,000 into the fund would receive about $750 in dividend payments over the course of the year (if the yield were to remain at 7.5%).

This is a nice way to use your tax return to make your money work for you and generate a stream of passive monthly income. You can also reinvest the dividends directly into JEPI (either by yourself or by using your brokerage’s dividend reinvestment setting, if applicable) so that each month, it buys a bit more JEPI, and you create a snowball effect as this investment compounds over time.

Top Holdings

JEPI gives its investors ample diversification. It owns 118 stocks, and its top 10 holdings account for just 27.2% of the fund. Below, you’ll find a table of JEPI’s top 10 holdings from TipRanks’ holdings tool.

As you can see, JEPI invests in a strong group of well-known blue-chip stocks. Aside from its 12.5% position in the equity-linked notes (ELNs), as discussed above, six of JEPI’s top nine holdings feature Outperform-equivalent Smart Scores of 8 or above.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Top 10 holdings Amazon (NASDAQ:AMZN), Progressive (NYSE:PGR), and AbbVie (NYSE:ABBV) all feature ‘Perfect 10’ Smart Scores.

What Is JEPI’s Expense Ratio?

JEPI is reasonably priced with an expense ratio of 0.35%. This means that for every $10,000 an investor puts into the ETF, they will pay $35 in fees each year. If the fund maintains this current expense ratio and gains 5% per year going forward, an investor allocating $10,000 into JEPI will pay $443 in fees over the course of a decade.

Is JEPI Stock a Buy, According to Analysts?

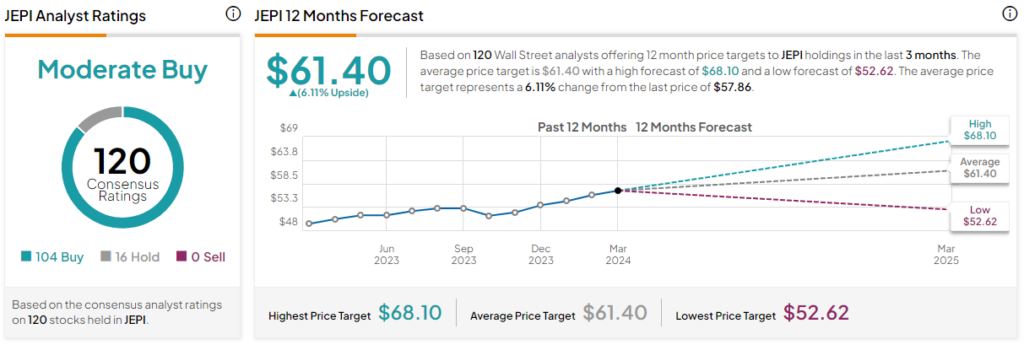

Turning to Wall Street, JEPI earns a Moderate Buy consensus rating based on 104 Buys, 16 Holds, and zero Sell ratings assigned in the past three months. The average JEPI stock price target of $61.40 implies 6.1% upside potential.

The Takeaway

Before you spend your tax return, think about putting it into a dividend ETF like JEPI, which will pay you a dividend each month for the foreseeable future, setting you up on your journey to becoming a dividend investor. You can also reinvest these dividends to accumulate JEPI and buy more shares periodically when you have excess cash, creating a snowball effect as your position compounds and pays even more as it grows.

To be clear, no investment is without risk, and investors are typically best served by creating a balanced, well-rounded portfolio, but JEPI can certainly be an important piece of one. I’m bullish on this popular ETF based on its attractive 7.5% dividend yield, monthly payout structure, diversified mix of blue-chip U.S. holdings, and reasonable expense ratio.