Investing in blue-chip dividend stocks can help you generate a recurring stream of passive income at a low cost. Here, you need to identify quality large-cap companies that thrive across market cycles and generate steady cash flows. Generally, blue-chip companies allocate a portion of these cash flows to shareholders in the form of dividends. Further, these companies increase dividends annually each year, enhancing the effective yield over time.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

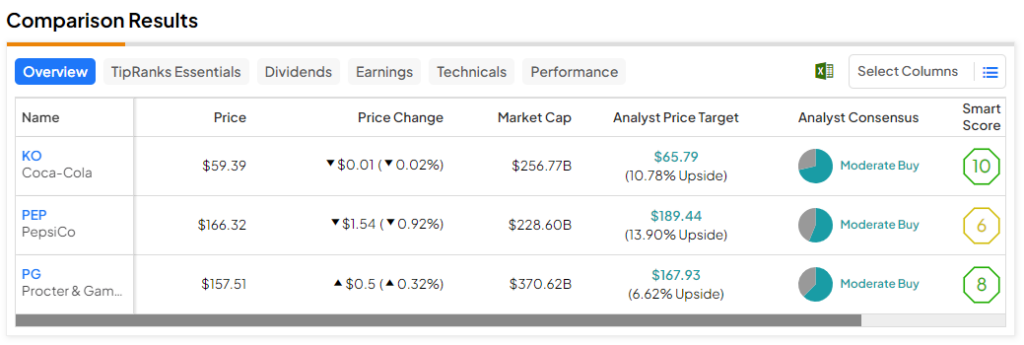

Three such companies that can help you generate passive income include Coca-Cola (NYSE:KO), Pepsi (NASDAQ:PEP), and Procter & Gamble (NYSE:PG). I am bullish on each of these stocks due to their strong brands, predictable earnings, and steady, growing dividends.

Coca-Cola (NYSE:KO)

Valued at $256 billion by market cap, Coca-Cola is among the most recognizable brands in the world. It is engaged in the manufacturing and marketing of non-alcoholic beverages. In the last 20 years, Coca-Cola’s stock has returned 133% to shareholders. But after adjusting for dividends, total returns are closer to 323%. In comparison, the S&P 500 Index (SPX) has returned 538% after adjusting for dividends.

While Coca-Cola has underperformed the broader market, it has still outpaced inflation over the long term. Moreover, the stock is much less volatile than the S&P 500 Index, with a beta of less than 0.6. A beta of less than 1.0 suggests low relative volatility for a particular stock.

Despite its massive size, Coca-Cola increased its sales from $33 billion in 2020 to $43 billion in 2022. In 2023, its sales increased to $45.75 billion. Comparatively, operating income has risen from $9 billion in 2020 to nearly $11 billion in 2022 and $11.3 billion in 2023.

Coca-Cola pays shareholders an annualized dividend of $1.94 per share, indicating a forward yield of 3.3%. In the last 20 years, Coca-Cola has increased its dividends at an annual rate of 7.3%.

Coca-Cola continues to gain market share in the beverage segment and ended 2023 with free cash flow of $9.7 billion. Its payout ratio has ranged around 75%, providing it with enough room to strengthen the balance sheet, reinvest in capital expenditures, and increase its dividends.

What Is the Target Price for Coca-Cola Stock?

Out of the 14 analysts tracking Coca-Cola, 10 recommend Buying, and four recommend Holding. There are no Sell recommendations for KO stock. The average KO stock price target is $65.79, indicating upside potential of 10.8% from current levels.

Pepsi (NASDAQ:PEP)

Valued at $229 billion by market cap, Pepsi is a direct competitor to Coca-Cola. Its portfolio of brands other than Pepsi includes Cheetos, Gatorade, Lay’s, and Mountain Dew, among others. Pepsi currently pays shareholders an annualized dividend of $5.06 per share, indicating a yield of 3%.

Moreover, the company has raised the payouts for 52 consecutive years, which is remarkable. In the last 20 years, Pepsi has grown its dividends by more than 10% annually.

In recent years, Pepsi has increased product prices to offset inflation, showcasing its pricing power. However, due to a sluggish macro environment, Pepsi expects sales to grow by just 4% year-over-year in 2024, lower than consensus estimates of 5.2%.

What Is the Target Price for Pepsi Stock?

Out of the 16 analysts covering PEP stock, nine recommend a Buy, seven recommend a Hold, and none recommend a Sell, giving it a Moderate Buy consensus rating. The average Pepsi stock price target is $189.44, 13.9% above the current price.

Procter & Gamble Stock (NYSE:PG)

The final dividend stock on my list is Procter & Gamble, valued at $370 billion. Operating in the branded consumer packaged goods segment, Procter & Gamble is a household name and operates in multiple verticals, such as beauty, healthcare, and family care, among others.

Similar to other companies, P&G is struggling with tepid consumer spending amid higher interest rates and inflation. Despite these headwinds, P&G saw its earnings grow by 16% in the October-to-December quarter due to cost savings and price hikes.

The company expects organic sales to grow between 4% and 5% in 2024, compared to a 7% increase in 2023. P&G’s focus on cost optimization should drive earnings and dividends higher from here.

P&G pays shareholders an annualized dividend of $3.76 per share, indicating a forward yield of 2.4%. These payouts have increased by 7.6% annually in the last 20 years.

What Is the Target Price for PG Stock?

Out of the 16 analysts covering PG stock, 10 recommend a Buy, six recommend a Hold, and none recommend a Sell, giving it a Moderate Buy consensus rating. The average PG stock price target is $167.93, 6.6% above the current price.

The Takeaway

Passive income investors can consider investing in large-cap dividend stocks. In addition to the dividend yield, investors are also positioned to benefit from long-term capital gains.

Given the average yield of 2.8% for these three stocks, an investment of $5,000 in each of these dividend giants will help you earn $420 in annual dividends. In case the payouts increase by 7% each year, your dividends will double in the next 10 years.