Chinese e-commerce platform JD.com (NASDAQ:JD) is slated to release its third quarter Fiscal 2022 results on November 18, before the market opens. JD.com’s technology-driven platform offers electronics products and general merchandise products, including audio, video, and books. Year-to-date, JD stock has lost 18.3%.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Street expects JD.com to report adjusted diluted earnings of $0.69 per ADS in Q3, higher than the prior-year quarter figure of $0.49 per ADS. Meanwhile, total net revenue is pegged at $34.11 billion, mostly in line with the Q3FY21 figure of $33.94 billion.

Chinese technology companies have been struggling from macroeconomic headwinds, including regulatory scrutiny, delisting threats, slowing economic growth, and lockdowns related to the resurgence of the COVID-19 pandemic.

Here’s Why Analyst James Lee is Bullish About JD.com

Analyst James Lee of Mizuho Securities is highly optimistic about JD.com’s stock trajectory. JD is one of the top Chinese picks for Lee, who has a Buy rating on the stock. However, Lee reduced his price target on JD stock to $82 (50.5% upside potential) from $90 owing to macro headwinds and compression of overall group multiples.

Lee believes that JD is well positioned to gain higher market share once the challenges subside. Also, JD has the capability to improve margins despite the macro challenges, he added. Lee expects JD’s consolidated revenue to grow 11% year-over-year in Q3 and net margins to increase by 60bps year-over-year.

Looking forward, Lee expects internet companies to witness a steady uptick in consumer demand in Q4. “We like the setup into 2H22 with gradual recovery, resilient performance, and margin expansion. At the same time, any incremental fiscal support and loosened COVID policy should boost consumer sentiment and unlock demand,” Lee concluded.

What is the Forecast for JD Stock?

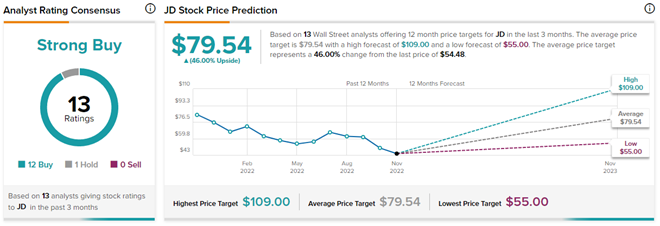

On TipRanks, the average JD.com price forecast of $79.54 implies 46% upside potential from current levels. Also, analysts have a Strong Buy consensus rating on JD.com stock. This is based on 12 Buys versus one Hold rating during the past three months.

Furthermore, JD.com currently trades at a very cheap Price/Sales ratio of 0.75x, supporting Lee’s belief that the stock is well positioned for a high upside swing once the headwinds are cleared.

Ending Thoughts

JD.com has taken a setback owing to the several macro challenges that are impacting the majority of Chinese stocks. Having said that, analysts have a strong conviction in JD’s performance improvement as the headwinds pass. Moreover, an improvement in the global website traffic visits at JD.com indicates strong performance in the upcoming quarter. Finally, investors and analysts must look at the long-term prospects of JD.com and continue to invest in the long run.