Alibaba (NYSE:BABA), JD.com (NASDAQ:JD), and TJX Companies (NYSE:TJX) will announce their quarterly results this week. While macro challenges and their impact on consumption remain a concern, TipRanks’ Website Traffic screener shows sequential growth in web visit trends for all three, implying that these companies could produce improved financials.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Website Screener: Leading Indicator of Future Stock Behavior

It’s important to monitor a company’s website domains’ performance, as it helps investors analyze how the changes in consumer behavior might affect the upcoming earnings report and the company’s stock price.

Take the example of Netflix (NASDAQ:NFLX). Our Website Traffic screener showed ahead of its earnings that NFLX’s web visits were rising. This translated into higher user engagement and better-than-expected paid subscriber additions. Thanks to the improvement, NFLX stock closed higher post the Q3 earnings report.

Let’s take a look at how BABA, JD, and TJX are faring in their website traffic, ahead of earnings.

Alibaba

Our screener shows that things are improving for Alibaba, which has struggled amid a slowdown in consumption and heightened competition. TipRanks’ Website Traffic screener shows that the number of visits to alibaba.com and its two other websites (aliexpress.com and taobao.com) increased 36.4% (sequentially) for the September ending (Q2) quarter.

The impact of improving traffic is also reflected in Alibaba’s strong performance during the 11.11 Global Shopping Festival. The company announced that its GMV (Gross Merchandise Volume) performance was in line with the prior year despite macro concerns.

Alibaba is scheduled to announce its Q2 financials on November 17. Alibaba has exceeded analysts’ earnings estimates in the last three consecutive quarters. As for Q2, analysts expect Alibaba to post earnings of $1.67 a share.

Is BABA a Buy or Hold?

On TipRanks, BABA stock is a Strong Buy. It has nine unanimous Buy recommendations. Moreover, given the slump in BABA stock over the past year, analysts’ price target of $137.78 implies 94.7% upside potential.

However, with hedge funds selling a whopping 12.7M BABA stock last quarter, it has an Underperform Smart Score of two out of 10.

JD.com

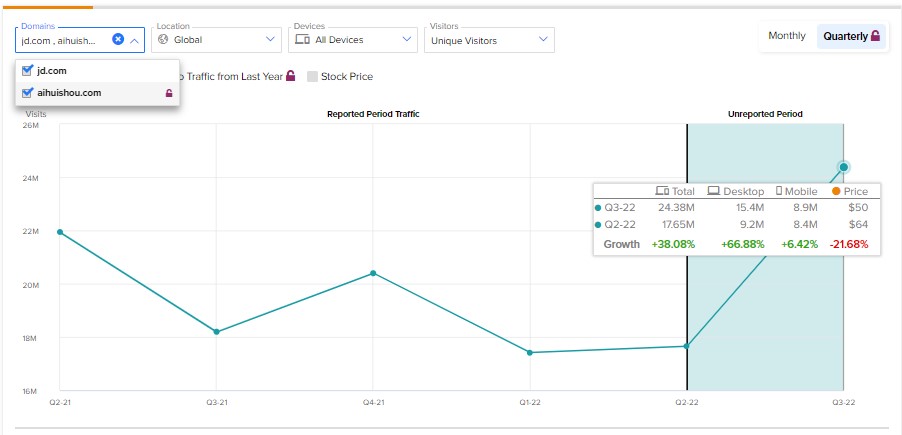

Like Alibaba, traffic trends have shown solid improvement for JD.com. Per the TipRanks’ Website Traffic tool, the number of visits to jd.com and its other website (aihuishou.com) increased by 38.8% in Q3 over the previous quarter.

The improvement in traffic led to a strong performance during the recently concluded 2022 Singles’ Day Grand Promotion event. JD.com highlighted that the growth rate exceeded the industry average during the period (from October 31 to November 11).

JD.com is set to report its Q3 financial results on November 18. The company has surpassed analysts’ earnings estimate in the last four consecutive quarters. As for Q3, analysts expect JD.com to post earnings of $0.68 a share, reflecting an increase from the prior year and the previous quarter.

Is JD.com a Good Stock to Buy?

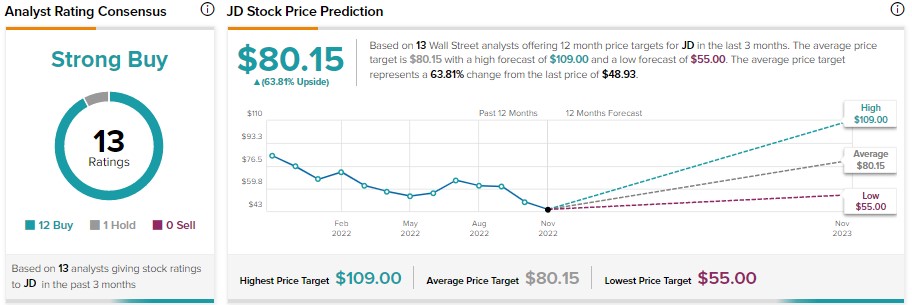

On TipRanks, JD.com stock has a Strong Buy consensus rating based on 12 Buy and one Hold recommendations. Meanwhile, analysts’ average price target of $80.15 implies 63.8% upside potential.

While analysts are bullish, hedge funds sold 18.7M JD stock last quarter. Overall, JD stock has a Neutral Smart Score of seven on 10.

TJX Companies

This off-price home fashion and apparel retailer has benefited from its value proposition. The company has delivered strong financials so far despite the challenging retail environment. Our website traffic tool shows that the momentum in its business has sustained in Q3. However, tough year-over-year comparisons could hurt TJX’s sales growth.

Per the tool, the visits to tjmaxx.com and its two other websites (marshalls.com and sierra.com) grew 19.2% quarter-over-quarter in Q3.

TJX will announce its Q3 financials on November 16. Analysts expect TJX to post earnings of $0.80 a share in Q3, reflecting an increase over the previous quarter. However, EPS could decline year-over-year due to the tough year-over-year comparisons.

Is TJX a Buy, Sell, or Hold?

TJX stock is a Strong Buy on TipRanks based on 12 Buy and two Hold recommendations. Further, analysts’ average price target of $78.07 implies 5.6% upside potential.

While insiders have sold TJX stock worth $11.9M in the last three months, it carries an Outperform Smart Score of nine on 10.

Bottom Line

Website traffic trends are pointing to a recovery in the financials of these companies. As BABA and JD stocks have corrected quite a lot, any improvement in their financials could significantly lift their stock prices. Meanwhile, TJX has outperformed the benchmark index over the past six months and faces tough comparisons. Nevertheless, TJX is expected to gain from its attractive pricing, which could support the uptrend in its stock.