Power Corporation of Canada (TSE: POW) is a relatively large Canadian financial holding company that has performed well over the years when including its dividends. However, it has underperformed the S&P 500 (SPX) and the TSX indexes over the past five years. POW stock has fallen along with the rest of the market this year, and investors may be wondering if there is a buying opportunity here. Despite its 5.6% dividend yield, analysts are only slightly bullish on the stock, and we are neutral.

POW holds controlling interests in insurance company Great-West Lifeco (TSE: GWO), asset-management company IGM Financial (TSE: IGM), and Pargesa, a holding company with interests in European companies, making Power Corporation diversified.

Power Corporation’s Dividend is Good, but It’s Nothing Special

There are several things to consider when looking at a dividend stock, such as its dividend yield, payout ratio, and dividend-growth prospects. POW’s figures reveal that it’s a decent dividend stock but probably isn’t the best.

On a trailing-12-months (TTM) basis, POW’s dividend yield is 5.45%. However, because it raised its dividend from C$0.45 to C$0.49 in Q1 2022, its forward dividend yield is 5.6%, which is pretty good.

Also, its payout ratio sits at about 50.5%, meaning the company has the capacity to raise its dividend more – as long as its earnings remain steady.

Power Corporation’s dividend raises have also been relatively steady over the past eight years, and its five-year dividend compound annual growth rate (CAGR) comes in at 8.1%. If it can keep up this dividend growth rate for the next five years, its dividend yield will reach 8.3%.

This is respectable; however, there are other solid companies out there with higher dividend yields after this year’s sell-off. Also, there are concerns regarding the company’s value-creation capabilities, which we discuss below.

Power Corporation Isn’t a Value Creator

An easy way to figure out if a company is a value creator is to see if its returns on capital are greater than the cost of that same capital. For financial companies, it makes sense to use return on equity for this calculation. On a TTM basis, Power Corp’s return on equity is 10.6%. While this may seem like a respectable number, its cost of equity is currently 11.6%, meaning the company has theoretically destroyed some shareholder value in the past year.

Indeed, over the past five years, Power Corp’s return on equity averaged 10.3%, which isn’t the greatest compared to its high cost of equity. Even its diluted earnings per share (EPS) have been relatively flat over the past 10 years, with the exception of 2021, bringing a spike in EPS that has since returned near its mean.

Its EPS figure of C$3.59 on a TTM basis is still lower than the C$3.91 recorded in Fiscal 2015 and not much higher than the five-year average EPS of C$3.21.

Is Power Corporation Stock Expected to Rise?

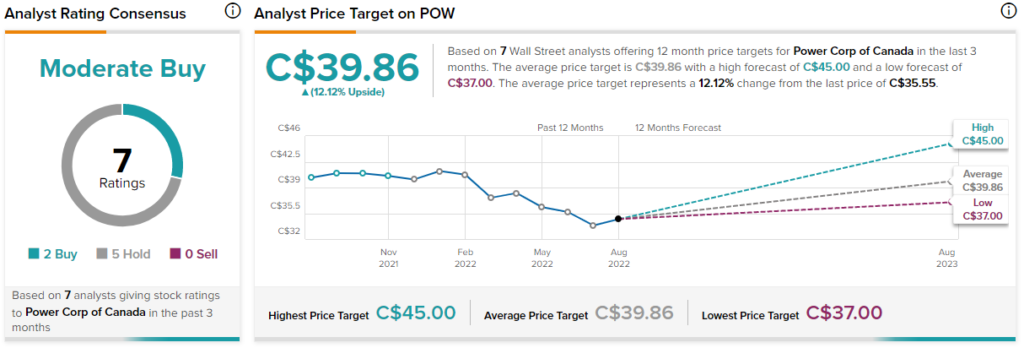

Turning to Wall Street, POW stock earns a Moderate Buy consensus rating based on two Buys and five Holds assigned in the past three months. The average POW stock price target of C$39.86 implies 12.1% upside potential from current levels.

Interestingly, five-star BMO (TSE: BMO) Capital analyst Tom Mackinnon reiterated a Hold rating on the stock 11 days ago, and his price target is C$37, implying just 4% upside potential.

Conclusion: We Believe POW Stock is a Hold

While Power Corporation provides a nice dividend yield that should grow modestly over time, there doesn’t seem to be a very lucrative market-beating opportunity here. This is especially true when considering the company’s low earnings growth rate and low return on equity compared to its cost of equity. We agree with five-star analyst Tom Mackinnon’s Hold rating that implies little upside potential, but analysts, in general, don’t expect much upside from the company regardless.