Technology behemoth Microsoft Corporation (MSFT) is facing the pressure of a possible mass worker exit after the company announced unsatisfactory wage hikes and bonuses last week. A large number of employees are speculated to leave the company after September 15, the day when Microsoft will pay the revised salary and bonuses to employees.

While employees seem dissatisfied, Wall Street analysts remain bullish about the tech giant’s growth potential, and they think it’s a Buy.

Microsoft Employees Seem Unhappy with their Salaries

As per a BusinessInsider report, the salary raises are between 5% and 10%, and a few Microsoft employees are complaining that the hike does not even meet the inflation figures. Unmotivated employees are ready to leave the company once they receive their first paycheck with revised figures. This poses a problem for a technology company that thrives on the existence of a talented worker pool.

Interestingly, some employees even quoted, “Microsoft has an unspoken rule that if you want to get what you deserve, you have to jump ship and come back, this unspoken rule has exacerbated the turnover rate of Microsoft employees.” This could also mean that employees will return to Microsoft, taking advantage of a higher paycheck.

Last month Microsoft announced the layoff of less than 1% of the company’s headcount. Though the company did mention that it had nothing to do with macroeconomic concerns, and was only related to strategic realignment.

Post that, Microsoft reported its Fiscal fourth-quarter results that fell short of analysts’ expectations on both revenue and earnings front. Nonetheless, a double-digit growth forecast for Fiscal 2023 provided a breather to investors. Importantly, slower demand for personal computers (PC) is also taking a toll on the software giant’s performance.

Recently, Microsoft CFO Amy Hood also notified employees to cut down on business expenses like travel, outside training, and company gatherings. Moreover, the company has reportedly frozen hiring in some of its units.

Most of these steps taken by Microsoft point towards precautionary measures undertaken to skirt the current inflationary environment and the looming fears of a recession. Whether employees will leave the company for better pay packages or will continue to be loyal during challenging times remains to be seen.

Is Microsoft a Buy or a Sell?

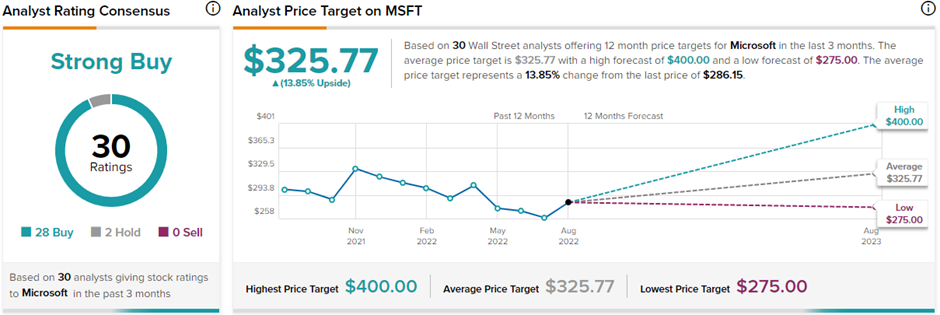

Despite all the uncertainty, Wall Street analysts remain highly optimistic about MSFT stock with a Strong Buy consensus rating. This is based on 28 Buys and two Holds. The average Microsoft price target of $325.77 implies 13.9% upside potential to current levels. Meanwhile, the stock has lost nearly 14% so far this year.

Similarly, TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Microsoft is currently Very Positive, as 147 hedge funds increased their cumulative holdings of MSFT stock by 10.4 million shares in the last quarter.

Parting Thoughts

A weak quarter, unfavorable macro backdrop, slowing demand for PCs, and worker dissatisfaction are all piling up on Microsoft’s performance. Despite this, analysts and top-notch fund managers remain highly bullish about the stock’s trajectory. Moreover, the company’s management fully believes in its turnaround once the headwinds fade away.

Undoubtedly, Microsoft boasts of a wide moat, one that is difficult to replicate and sustain for other newer players. Microsoft’s large market share gains and competitive advantage will ensure continued growth in the long run.