Microsoft (MSFT) recently cut some jobs in various departments as it begins its fiscal 2023. However, the company stated that the layoff has nothing to do with the worrying economic situation, which has led many businesses to rethink their hiring strategies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to a CNBC report, Microsoft explained that the recent layoff was part of a strategic realignment. Meanwhile, according to a Bloomberg report, the job cuts are also not a response to the growing concerns that the economy could slip into a recession.

Microsoft shares fell more than 4% on July 12. The stock has declined about 23% year-to-date amid volatility that has hit stock and crypto markets across the board.

Apart from its popular Windows and Office software products, Microsoft is also among the top cloud computing providers. The company has a tradition of evaluating its business regularly.

As the Fed attempts to combat historic inflation levels with aggressive interest rate hikes, many fear a recession may be around the corner. Meta Platforms (META), Amazon (AMZN), Tesla (TSLA), and Coinbase (COIN) are among the companies that have either cut jobs or slowed hiring as the economic outlook becomes uncertain.

Microsoft’s Headcount to Grow in the Year Ahead

The latest job cuts at Microsoft affected less than 1% of the company’s headcount. Microsoft has an 180,000-person global workforce. In the fiscal year ahead, the company plans to continue to invest and grow its headcount.

Wall Street Bullish About MSFT

On July 12, Morgan Stanley analyst Keith Weiss reiterated a Buy rating on Microsoft. However, the analyst lowered the price target on Microsoft stock from $372 to $354, which suggests nearly 40% upside potential.

Consensus among analysts is a Strong Buy, based on 27 Buys and one Hold. The average Microsoft price forecast of $349.47 implies upside potential of 38% to current levels.

Bloggers Lean Towards Microsoft

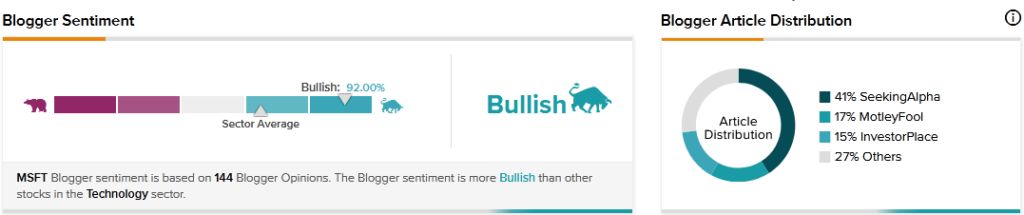

TipRanks data shows that financial blogger opinions are 92% Bullish on MSFT, compared to a sector average of 65%.

Key Takeaway for Investors

While Microsoft is not immune to adverse economic conditions that many fear may be coming, the reason for the latest layoff at the company does not seem to be a cause for alarm. However, the steepest decline in PC shipment in almost a decade in Q2 is something Microsoft investors would want to keep in mind while gauging the economic outlook and the stock’s prospects.

Read full Disclosure