Recently, Mitchell Goldhar, CEO of SmartCentres Real Estate Investment Trust (TSE:SRU.UN) and a top-rated corporate insider, has been purchasing the stock. Divisional Executive Vice-President Rudy Gobin is another top-rated insider that bought stock recently. This could signal that the company is undervalued and has upside potential ahead. SmartCentres REITs’ valuation suggests that the stock can climb, and analysts agree as well, with both analysts that cover it giving it a Buy rating. Additionally, the stock has a high 7.1% dividend yield as an added bonus. Therefore, SRU.UN stock seems like it could be a decent investment.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

We also wrote about three other insider-buying scenarios that are similar to this one. The first article is about Slate Office REIT (TSE: SOT.UN), the second one is about Plaza Retail REIT (TSE: PLZ.UN), and the third one is about Granite REIT (TSE: GRT.UN)

A Retail REIT with Relatively-Low Risk

SmartCentres REIT develops, owns, and manages retail real estate in Canada. The company also has mixed-use real estate, which includes residential and office buildings. While some investors may view retail real estate as risky due to the rise in online shopping and work-from-home trends, SmartCentres generates over 60% of its rent from well-known, resilient tenants. These tenants include companies like Walmart (NYSE: WMT), which generates over 25% of SmartCentres’ revenue, McDonald’s (NYSE: MCD), Home Depot (NYSE: HD), and more.

Therefore, SRU.UN enjoys resilient cash flows from top companies that will still be around many years from now. For the first six months of this year, SmartCentres collected 98% of the rent that it was owed, with this figure expected to improve further by the end of the year.

Insiders are Buying SRU.UN Stock — Why It Matters

Mitchell Goldhar’s recent buys are important to note for a few key reasons. First, he is a top-rated insider, ranked #8,439 out of 96,113 corporate insiders on TipRanks, with an average return of 4.2% per transaction (not including dividends). Therefore, his transactions have been worth following, as they would have likely led to a market-beating performance.

Also, his transactions are classified as “Informative Buys,” which hold more weight than “Uninformative Buys.” Being the CEO, he knows whether the company is performing well or not, another reason why his Buys are worth following. He’s made several purchases recently, starting six months ago, with the most recent one taking place 15 days ago.

In the past 19 days alone, he has bought over C$1.1 million worth of SRU.UN stock, meaning he is bullish on the stock. The recent buys ranged from prices of C$25.00 to C$29.51 per share, with the stock currently trading at C$26.41. Insider Rudy Gobin bought C$128,150 worth of shares 18 days ago at an average price of C$25.63, further displaying management’s confidence.

Is SmartCentres REIT Stock Undervalued?

SRU.UN stock may be undervalued, which would justify the insider buying. An important and easy valuation metric to use for Canadian REITs is the price-to-book ratio. Note that this metric isn’t as useful for American REITs due to accounting differences. SmartCentre REIT’s price-to-book ratio is around 0.87x, meaning that it’s trading at a 13% discount to its net worth. This metric alone gives it about 15% upside potential before it reaches its net asset value.

In fact, SRU.UN has traded at an average price/book ratio of 1.2x over the past five years. The valuation premium was likely due to SmartCentre’s REIT’s book value per share uptrend over the past decade (excluding 2020). Its book value per share CAGR for the past decade is 5.2%.

Still, there’s something to consider. Here’s what we mentioned in a recent article about a different REIT in a similar situation: “One thing to keep in mind is that its book value may potentially drop in the short term because rising interest rates are causing property values to fall, which somewhat justifies the discount. However, there is that margin of safety, and a drop is likely to be temporary in nature, in our opinion.”

We think that as the economy eventually normalizes, SRU.UN stock’s price/book ratio can rise to about 1.0x or higher, and its book value per share should eventually continue its uptrend.

Is SmartCentres’ Dividend Worth It?

As mentioned earlier, SmartCentres REIT has a ~7.1% dividend, and it is paid monthly. The dividend by itself may be enough to entice some income investors but maybe not dividend-growth investors, especially since its dividend has only grown at a seven-year CAGR of 2.1%. However, when combined with the company’s price/book discount and its uptrending book value per share over the long term, the dividend is an extra bonus that will boost shareholder returns.

Also, its dividend is covered, as the company’s adjusted cash flow from operations (ACFO) payout ratio was 95.4% for the last 12 months. However, this doesn’t leave much room for error or dividend growth.

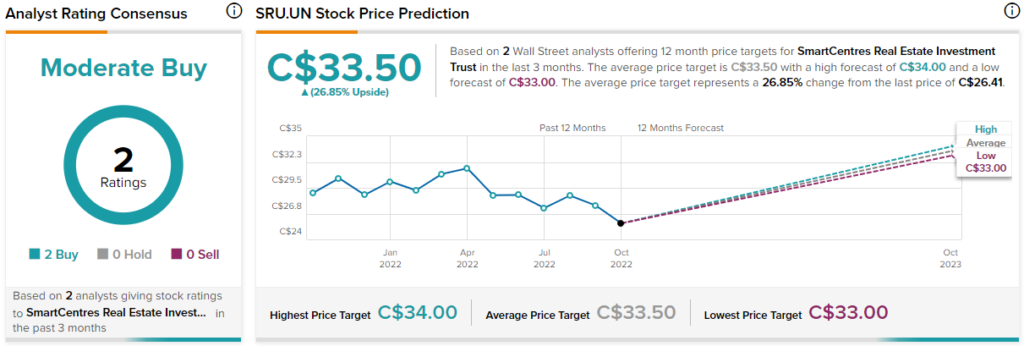

Analysts Believe SRU.UN Stock is a Buy

According to analysts, SmartCentres REIT stock earns a Moderate Buy consensus rating based on two Buy ratings assigned in the past three months. The average SRU.UN stock price forecast of C$33.50 implies 26.85% upside potential. Analyst price targets range from a high of C$34 to a low of C$33.

Conclusion: SmartCentres REIT Looks Solid

SmartCentres REIT looks like an attractive investment for a few reasons. First, it has high-quality tenants that can be relied upon in harsh times. Next, two highly-rated insiders have been buying up shares near the current price. Also, SRU.UN is trading at a 13% discount to its net worth, with an uptrending book value per share, implying solid long-term upside potential. Meanwhile, investors can receive a 7.1% dividend. Finally, analysts are bullish, seeing 26.85% upside potential.