Killam Apartment REIT (TSE: KMP.UN) has been a solid long-term performer but has fallen this year. KMP.UN is a real estate investment trust, which acquires, manages, and develops multi-residential apartment buildings and manufactured home communities. It has been rewarding investors through monthly dividends since 2007. Its current dividend yield comes in at around 4%, and analysts are highly bullish on the stock despite its downtrend, making it worth considering.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a look at why that may be the case.

Killam Apartment REIT Creates Value for Shareholders

When it comes to REITs, there’s another important thing to consider besides dividends – book value per share. Looking at KMP’s historical book value per share trend can help investors determine if the company is creating value for shareholders or not. Luckily for investors, its book value per share has been slowly trending higher over the past decade, going from C$10.70 in Fiscal 2012 to C$19.91 on a trailing-12-months basis. It’s worth noting that the growth really started in 2016 and was flat before then.

Is KMP.UN Stock’s Dividend Yield Worth It?

As mentioned earlier, Killam Apartment REIT has a ~4% dividend yield that is paid monthly. This would be impressive if KMP.UN was a dividend-growth stock, but it’s not. In fact, its dividend per share has only been growing at a 1.9% compound annual growth rate (CAGR) for the past 10 years. Essentially, if it keeps up this growth rate for the next 10 years, its dividend yield will only reach just above 4.80%. Therefore, it’s probably not suitable for investors to purchase the stock just for its dividend.

Nonetheless, its dividend is relatively safe, as its adjusted funds from operations (AFFO) payout ratio is 75% on a rolling-12-months basis.

What investors should consider instead is KMP.UN’s dividend combined with its book value per share growth. This will likely fuel shareholder returns going forward and makes the stock worth considering.

For example, if you add its dividend yield and its 10-year book value per share CAGR of 6.5% (assuming it can keep up this growth rate), you can potentially expect double-digit annual returns from the stock at current levels. This also assumes no valuation multiple expansion, which would be a conservative assumption, as discussed in the section below.

Killam Apartment REIT is Potentially Undervalued

Killam Apartment REIT’s valuation presents an interesting opportunity. This is because, in the past five years, the stock has historically traded at a 30% premium to its book value. Now, it trades at ~0.86x its book value, meaning that the stock can rally another ~16% before reaching its equity value. This, of course, adds to its bull case. If another bull market comes eventually, the stock can reach 1.3x book value again, giving it an even higher upside potential.

Nonetheless, we can conservatively assume that a 1.0x multiple is fair. One thing to keep in mind is that its book value may potentially drop in the short term because rising interest rates are causing property values to fall, which somewhat justifies the discount. However, there is that margin of safety, and a drop is likely to be temporary in nature, in our opinion.

Is KMP.UN Stock a Good Buy? Analysts Say Yes.

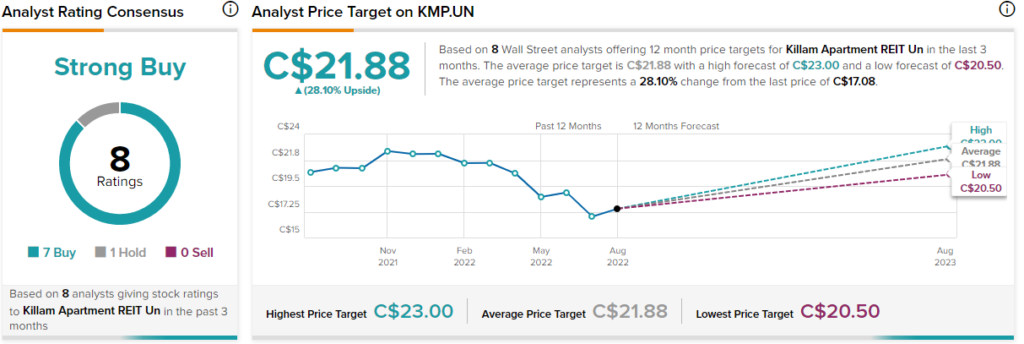

According to analysts, Killam Apartment REIT stock earns a Strong Buy consensus rating based on seven Buys and one Hold rating assigned in the past three months. The average KMP.UN stock price prediction of C$21.88 implies 28.1% upside potential. Analyst price targets range from a high of C$23 to a low of C$20.50.

Conclusion: Killam Apartment REIT Presents a Solid Opportunity

Killam Apartment REIT has several positives on its side. Notably, analysts are almost unanimously bullish on the stock, assigning it solid upside potential. Also, it is trading at a discount to its net worth, which has historically grown at a modest rate. Combined with its respectable 4% dividend, and the stock can potentially generate double-digit annual returns, going forward.