EV giant Tesla (NASDAQ:TSLA) has shed over 60% of its value over the past 12 months, creating what looks like a highly-attractive buying opportunity. At its current valuation, investors who believe in Tesla’s long-term potential can now bet big on its fundamentals, which could pay many dividends down the road. Therefore, we are bullish on TSLA stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The global electric vehicle market is booming, as it was worth $165 billion at the end of 2021 and is expected to expand to $434.4 billion by 2028. Pioneers such as Tesla stand to benefit immensely from the massive upside.

Tesla generated an impressive $57.1 billion in sales in the first three quarters of last year and is likely to close out Fiscal 2022 with record-breaking revenue of over $81.7 billion, according to estimates. Though the competition in the sector continues to grow each year, Tesla has effectively maintained its position as the leader in the EV sector. Also, with its stock price trading more attractively than ever before, TSLA stock could be one of the best EV stocks for 2023.

Tesla is Trading at Multi-Year Lows

It can be tempting to view Tesla’s current slump as a company-specific challenge, but it has plenty to do with broader market conditions. When interest rates rise, companies with overblown valuations become more vulnerable than others. Now, TSLA stock trades at just 5.1 times forward sales estimates, roughly 37% lower than its five-year average. Moreover, it trades at roughly 26 times trailing-12-month cash flows, 61% lower than its five-year average. Hence, it’s trading at multi-year lows and presents itself as an attractive investment option.

Nonetheless, the automotive industry is known to be cyclical, and that may turn off some investors. Tesla’s CEO, Elon Musk, noted that the current Chinese recession has weakened consumer purchasing power, which could potentially weigh down the company’s results in the near term. However, Tesla is confident that these difficult economic times are only temporary and will not impede progress toward reaching its long-term goals.

The Long-Term Case is Firmly in Place

Tesla continues to be a leader in the electric vehicle industry. In the third quarter of 2022, its revenue rose 56% year-over-year, and EBITDA soared 68%. This growth was largely due to Tesla’s focus on innovation and the optimization of its manufacturing and scalability initiatives. With such a clear vision and commitment to excellence, Tesla is in a robust position for long-term future success.

Additionally, EV sales are projected to reach 25% of global sales by 2025, and Tesla will benefit, of course. Tesla’s total addressable market represents an exciting growth opportunity, as the company is all-electric and thus does not have to worry about cannibalizing its sales. Additionally, its commitment to solely producing EVs allows it to hone its brand recognition and create durable infrastructure buildouts, such as charging networks, further establishing and solidifying its place in the industry.

Is TSLA Stock a Buy, According to Analysts?

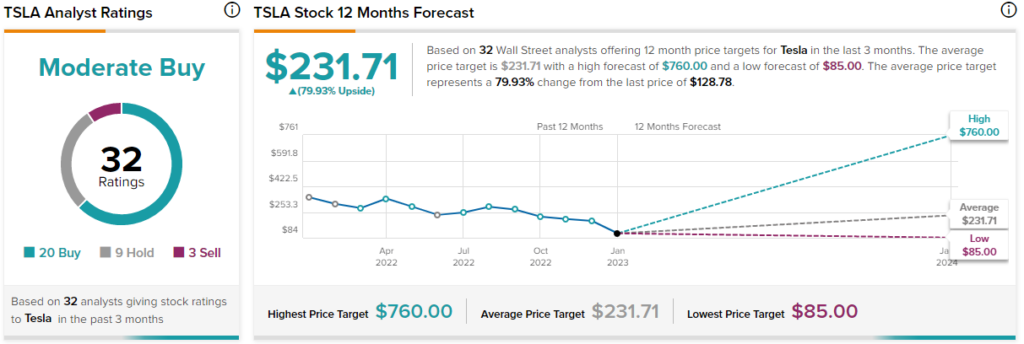

Turning to Wall Street, TSLA stock maintains a Moderate Buy consensus rating. Out of 32 total analyst ratings, 20 Buys, nine Holds, and three Sell ratings were assigned over the past three months. The average TSLA stock price target is $231.71, implying a 79.9% upside potential. Analyst price targets range from a low of $85 per share to a high of $760 per share.

The Takeaway

The past few years have been exciting for Tesla investors as the company broke new ground and was able to redefine expectations among industry players. The steep drop in the stock price provides a unique opportunity for those who believe that EVs will dominate the automotive sector. Perhaps the biggest issue with investing in TSLA stock was its lofty valuation, which now seems to be less of an issue.

According to Morgan Stanley analyst Adam Jonas, execution will be key for automotive companies, and Tesla remains the top pick in this regard. Therefore, it looks like an ideal time for investors to consider wagering on Tesla for the long haul.