Insurance might be one of the great resilient industries, but that doesn’t mean that companies like Allstate (NYSE: ALL) are without risk. In fact, Allstate lost 10.3% in pre-market trading on Thursday and kept those losses going into today’s trading session. Allstate’s losses in the market parroted its own budget losses. ALL announced it would post a loss for the third quarter. This was thanks, in large part, to the huge catastrophe payouts required by Hurricane Ian, which ravaged large parts of Florida just weeks ago. Reports noted that Allstate now looked for a net loss of as much as $725 million, with Ian itself causing a $366 million net loss and inflation also impacting results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This is certainly bad news for Allstate and for its investors. However, given the nature of the bad news and the likelihood of it being repeated, I’m bullish overall on the company. Insurance is one of the last expenses to be cut, and that will likely provide Allstate with an extra note of resiliency.

Is Allstate a Good Stock to Buy, According to Analysts?

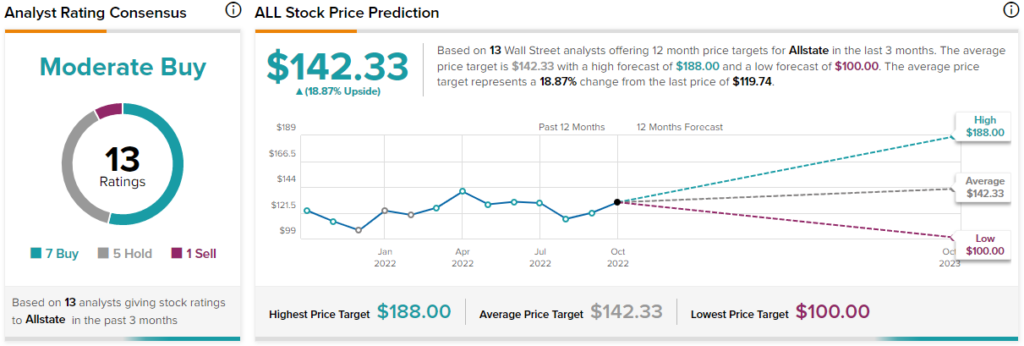

Turning to Wall Street, Allstate has a Moderate Buy consensus rating. That’s based on seven Buys, five Holds, and one Sell assigned in the past three months. The average Allstate price target of $142.33 implies 18.9% upside potential.

Analyst price targets range from a low of $100 per share to a high of $188 per share.

Investor Sentiment is Mildly Mixed

Most investor sentiment metrics will be somewhat mixed. Disagreements among various segments are often a part of matters. For Allstate, some parts look much better than others. For instance, Allstate has a ‘Perfect 10’ Smart Score on TipRanks.

That’s the highest level of “outperform,” which suggests a near-certainty that Allstate will do better than the broader market.

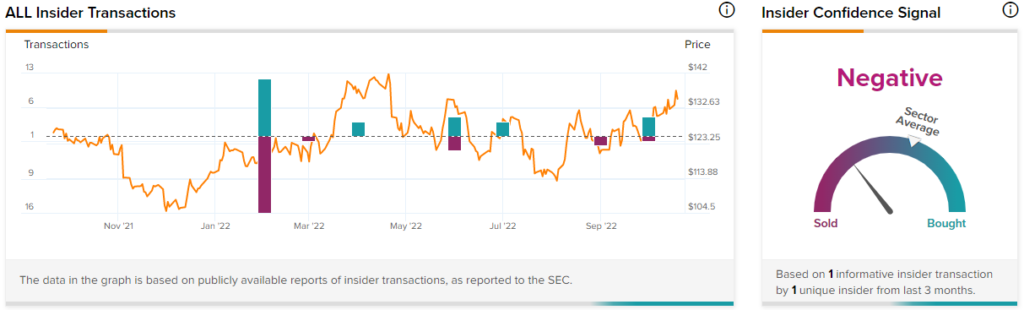

Despite this ringing endorsement, Allstate insiders don’t appear particularly interested in buying in. Insider trading at Allstate has been somewhat negative of late. One fairly substantial “Informative Sell” just landed last month, in fact. Mark Prindiville sold $694,000 worth of stock.

Looking at the aggregate, meanwhile, tells something of a different story. Insider trading turns positive when uninformative trades are considered. In the last three months, insiders sold stock three times but bought it four times.

Going back to the last 12 months, meanwhile, shows insiders buying stock 26 times but selling 23 times. There is a clear interest in buying among Allstate insiders. However, it’s undercut significantly by the selling interest.

Still a Necessary Part of Life…for Now

The part about Allstate that makes it so attractive is that, at the end of the day, many of its products are a legal requirement to own. Allstate offers car and motorcycle insurance. Drivers will need both, as insured vehicles are a legal requirement to drive. Allstate also offers insurance that isn’t specifically required by law but is necessary by circumstance.

Allstate’s homeowner’s insurance, for example, is often of the kind required by mortgage lenders in order to actually get the loan. Allstate’s business insurance protects against lawsuits that may or may not ever happen. Not a legal requirement, but perhaps more a practical one.

These points help ensure—no pun intended—a certain practical minimum for Allstate to operate. It also helps ensure that Allstate’s revenue won’t plunge to zero as long as the rule of law is still operating and people have cash enough to pay to drive to work.

Yet, there’s likely still a hit ahead. There will be those who scale back or cancel their insurance to save money that is needed for more immediate goals, like eating and putting enough gas in the car to get to work to earn the money required to buy insurance in the first place.

Thus, it’s good news that Allstate is making some modifications to its own business lines to ensure it stays ahead of the curve.

Allstate is changing the way that auto shops do business with it. The company will now process claims through CCC Intelligent Solutions using its “Open Shop” solution. Allstate noted that the Open Shop tool allows carriers to more readily set up repairs via shops that are part of CCC’s CCC ONE platform.

It’s unclear just where such a change will actually take place or if it would serve as a replacement for current tools, however.

The latest issues for Allstate have left some investors particularly concerned, however. The losses prompted by Hurricane Ian were just part of the picture. Allstate lost ground to other causes as well, with the reserve adjustment for personal auto insurance totaling $643 million.

That was mainly due to bodily injury issues and rising medical costs—not to mention vehicle replacement costs—which hit the company unusually hard. It also suggested a certain amount of trouble ahead in getting the company back to improve its margin rates.

This is a cause for concern, yes, but only on a limited scale. If inflation doesn’t improve eventually, investors will likely have a lot more to worry about than Allstate’s margin rates. However, Allstate is clearly working to shore up its operations in the short term, so that should help.

Conclusion: Hit by Inflation, but So is Almost Everybody

Basically, Allstate is looking reasonably good right now. Sure, it needs to shore up its costs. It needs to find a way to trim outgo while maintaining income. However, much of Allstate’s troubles with outgo are a consequence of higher inflation.

Most insurance firms will have the exact same problem. The cost of parts to repair a damaged car is up for everybody, not just Allstate. The cost of rebuilding a house is up for everybody as well.

Thus, Allstate gets a certain amount of coverage here from the rest of the field, which is suffering in a similar fashion. Investors really can’t throw over Allstate to back the competition because the competition is in the same boat.

A combination of factors contributes to my bullish attitude toward Allstate. Allstate is suffering under market conditions, but so is everybody else. Allstate is working to address its shortfall and will still have products required by law to own.

Just to top it off, Allstate is selling just a bit closer to its lowest price targets than its highs. That suggests that an opportunity is still afoot.