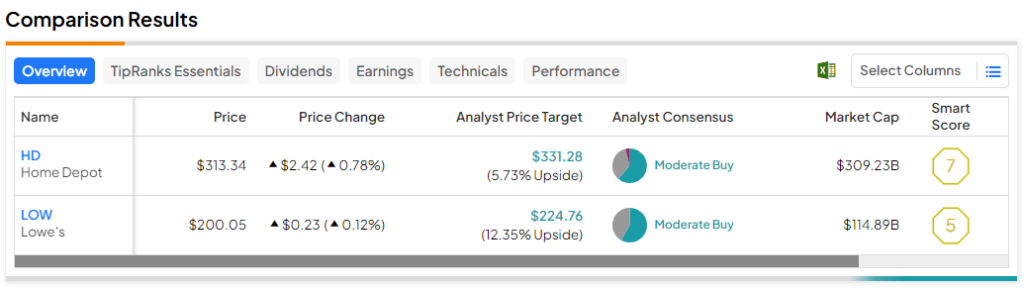

In this piece, I evaluated two hardware retail stocks, Home Depot (NYSE:HD) and Lowe’s (NYSE:LOW), using TipRanks’ comparison tool to determine which is better. A deeper analysis suggests both companies may be solid dividend stocks, suggesting a bullish view for both, although a closer look is needed to determine the winner of this pairing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Home Depot is the largest home improvement retailer in the U.S. The multinational retailer sells tools, construction materials, appliances, and services. Lowe’s is another American retailer that specializes in home improvement.

Shares of Home Depot are roughly flat year-to-date after slipping 5% over the last three months. Meanwhile, Lowe’s stock is up 2% year-to-date despite plummeting 11% over the last three months.

That dramatic sell-off over the last three months has dropped the valuation of Lowe’s below Home Depot’s valuation. We’ll look at their price-to-earnings (P/E) ratios to gauge their valuations against each other. For comparison, the home improvement industry is trading at a P/E of about 21.6.

However, there’s more to the story here than just valuation, so a closer look is in order.

Home Depot (NYSE:HD)

At a P/E of 19.9, Home Depot is trading slightly below its industry’s P/E and its mean P/E of 21.7 since February 2019. Recession fears that led to weak guidance have restrained the stock recently, but this company isn’t going anywhere. Thus, at current price levels, and especially due to its attractive dividend growth, a bullish view seems appropriate for Home Depot.

The retailer’s current dividend yield stands at around 2.6%, making it an attractive dividend stock, especially considering the other dividend-related factors. Home Depot has boosted its dividend annually for the last 13 straight years and raised its dividend at an average of about 18% each year over the last decade, demonstrating the long-term viability of its dividend.

Unfortunately, fears of a recession have restrained Home Depot stock over the last year or two, and the recent earnings report contained some concerning guidance. The retailer did manage to beat both earnings and revenue expectations, though, coming in at $3.81 per share on $37.7 billion in revenue (versus the consensus of $3.75 per share on $37.6 billion in sales). However, it also revealed year-over-year declines on both the top and bottom lines.

Still, such declines are currently occurring with consumer discretionary stocks in general, meaning they’re only temporary. Despite these temporary concerns, I believe Home Depot is a solid long-term gainer worth holding as a dividend stock.

While the stock is up only 20% over the last three years, it has gained 94% over the last five and 390% over the last 10, demonstrating long-term gains alongside the growing dividend payments.

What is the Price Target for HD Stock?

Home Depot has a Moderate Buy consensus rating based on 16 Buys, nine Holds, and one Sell rating assigned over the last three months. At $331.28, the average Home Depot stock price target implies upside potential of 5.7%.

Lowe’s (NYSE:LOW)

At a P/E of 15.3, Lowe’s is trading at a sizable discount to its industry and its mean P/E of 23.3 since December 2018. However, while a bullish view does look appropriate for Lowe’s at this time, it’s not due to its valuation. It’s because it looks like an attractive dividend growth stock.

The retailer’s current dividend yield is about 2.2%, and it has raised its dividend annually for the past 60 years, classifying it as a Dividend King. In fact, Lowe’s has boosted its dividend by nearly 23% annually on average over the last three years and raised it by 19% per year over the last five.

Nevertheless, while Lowe’s has raised its dividend more per year and for a longer period than Home Depot, its stock and financials display a higher level of volatility during these uncertain economic times. In fact, Lowe’s has received price-target cuts from multiple analysts over the last week or so.

Like Home Depot, Lowe’s also cut its sales and earnings outlook, although it actually missed the consensus revenue number in its latest earnings report, coming in at $20.5 billion versus the $20.9 billion that had been expected. Additionally, Lowe’s reported a steep 7.4% year-over-year decline in comparable-store sales versus Home Depot’s much smaller drop of 3.1%.

Finally, Lowe’s is less profitable than Home Depot, with its net income margin ranging from 8.5% over the last 12 months to 6% in 2020 and down to 4% in 2019. Meanwhile, Home Depot has maintained a steady net income margin in the neighborhood of 10% for several years.

Thus, while Lowe’s does look like an attractive dividend stock, its financials just aren’t as strong as Home Depot’s, giving its much larger competitor the win in this pairing.

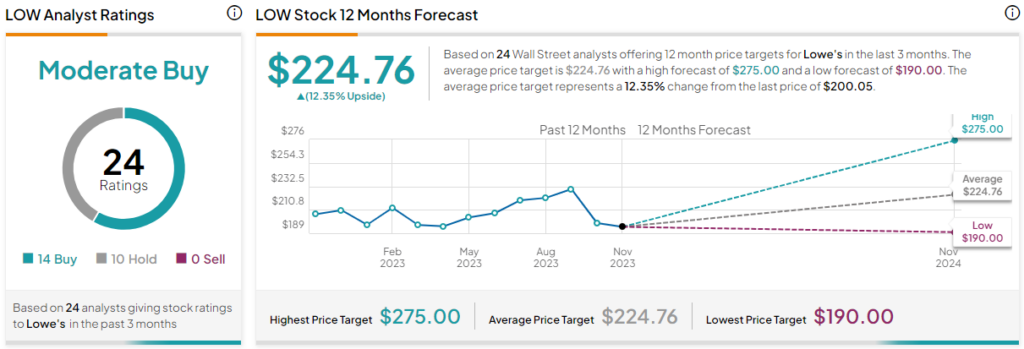

What is the Price Target for LOW Stock?

Lowe’s has a Moderate Buy consensus rating based on 14 Buys, 10 Holds, and zero Sell ratings assigned over the last three months. At $224.76, the average Lowe’s stock price target implies upside potential of 12.35%.

Conclusion: Bullish on HD and LOW

While both stocks receive a bullish rating due to their status as attractive dividend stocks, picking a winner of this pairing may depend on your point of view. On the one hand, Lowe’s is the more reliable dividend payer with a much longer track record of increases and larger annual increases in recent years.

However, in my view, Home Depot would be the winner of this pairing based on its higher profitability and lower volatility in its sales and earnings results. Ultimately, it might not make sense to hold both stocks since they are both retailers addressing the same market. So, while I would pick Home Depot over Lowe’s, others might disagree due to Lowe’s superior dividend statistics.