Walmart (NYSE:WMT) stock fell over 8% yesterday after the company disclosed its expectations of weak consumer spending for the upcoming holiday season and provided a lower-than-expected Fiscal 2024 EPS forecast. The retail giant expects a moderation in Q4 sales growth compared to previous quarters due to a decrease in prices for certain food products and general merchandise.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Further, the company said it experienced a slowdown in October due to factors such as tightened credit and student loan repayments curbing spending power.

Alongside its third-quarter earnings report, WMT increased its sales growth expectations to 5% to 5.5% for Fiscal Year 2024 from the earlier guided 4% to 4.5%. Also, it anticipates adjusted EPS of $6.40 to $6.48 compared with a prior outlook of $6.36 to $6.46. However, the EPS expectations remained below the consensus estimate of $6.50.

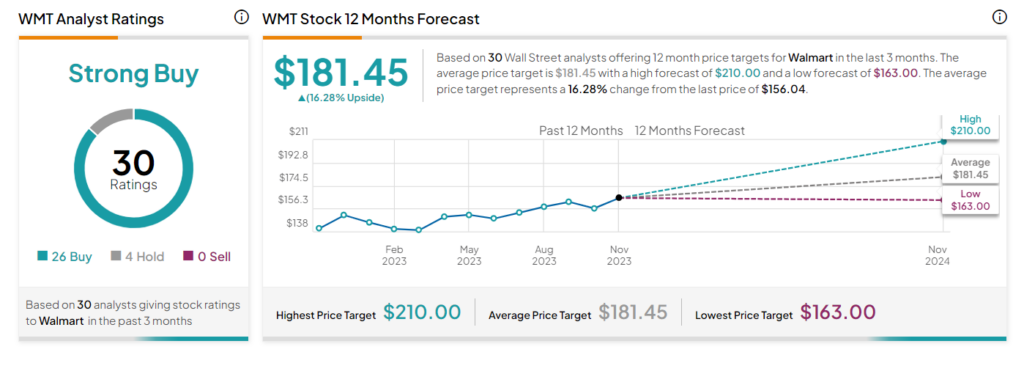

It is worth mentioning that following the Q3 earnings release, 13 analysts rated WMT stock a Buy, while two assigned a Hold.

Is it Good to Buy Walmart Stock?

Overall, analysts are upbeat about Walmart stock. It has 26 Buy and four Hold recommendations for a Strong Buy consensus rating. Further, analysts’ average price target of $181.45 implies 16.3% upside potential from current levels. The stock has gained about 10% so far in 2023.