Walmart (NYSE:WMT) shares are down nearly 8% in the early session today after the retail giant delivered better-than-expected third-quarter results but its financial outlook failed to impress investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue rose by 5.2% year-over-year to $160.8 billion, outpacing estimates by $1.15 billion. EPS of $1.53 also came in ahead of expectations by $0.01. During the quarter, Walmart’s gross margin rate was positively impacted by gains at Walmart U.S. and the shift of Flipkart’s The Big Billion Days Event (BBD) to Q4 this year from Q3 last year.

Further, the company’s comparable sales in the U.S. rose by 4.9% and e-commerce sales jumped by 24% on the back of strength in pickup and delivery.

Looking ahead to Fiscal year 2024, Walmart expects net sales to grow by 5% to 5.5%. EPS for the year is expected to land between $6.40 and $6.48. Further, consolidated operating income during the year is anticipated to increase by 7% to 7.5%.

What is the Prediction for Walmart Stock?

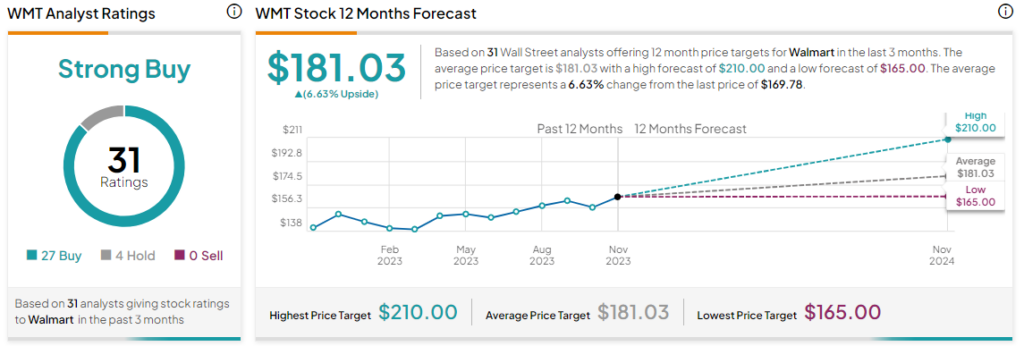

Overall, the Street has a Strong Buy consensus rating on Walmart and the average WMT price target of $181.03 implies a modest 6.6% potential upside in the stock. That’s after a nearly 12% rise in Walmart shares over the past six months.

Read full Disclosure