Shares of home improvement retailer, Home Depot (NYSE:HD) gained in pre-market trading after the company reported earnings for its third quarter of Fiscal Year 2023. The retailer’s earnings per diluted share came in at $3.81 compared to earnings of $4.24 per diluted share in the same period last year, which beat analysts’ consensus estimate of $3.75 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moreover, the retailer’s sales declined by 3% year-over-year to $37.7 billion. This beat analysts’ expectations of $37.6 billion. In the third quarter, Home Depot’s overall comparable sales declined by 3.1% while in the U.S., they decreased by 3.5%.

Ted Decker, Home Depot’s Chair, President, and CEO commented, “Our quarterly performance was in line with our expectations. Similar to the second quarter, we saw continued customer engagement with smaller projects, and experienced pressure in certain big-ticket, discretionary categories.”

However, the company’s management narrowed its guidance in FY23 and expects its sales and comparable sales to fall between 3% and 4% year-over-year. Meanwhile, diluted earnings are projected to decline from 9% to 11% year-over-year in FY23.

Is HD a Good Stock to Buy?

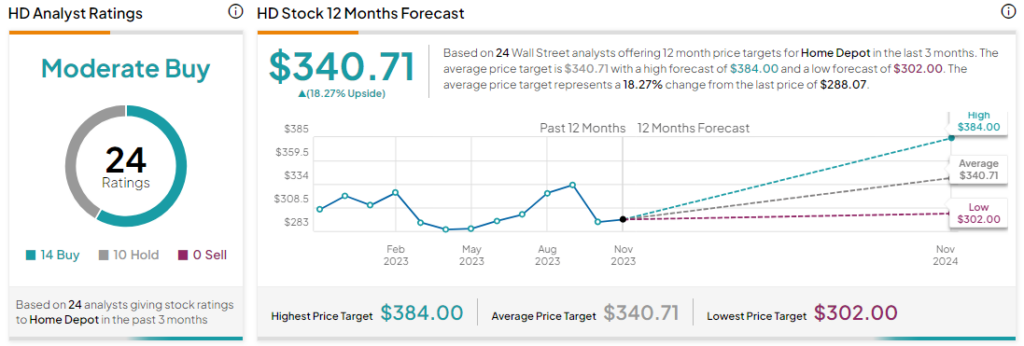

Turning to Wall Street, analysts are cautiously optimistic about HD stock with a Moderate Buy consensus rating based on 14 Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. The average HD price target of $340.71 implies an 18.3% upside potential at current levels.