It’s no secret that the world is going to depend heavily on technology as years go by. The pandemic accelerated the adoption of technology into our daily lives and work places.

Phrases like AI (artificial intelligence), 5G, and IoT (Internet of Things) will become increasingly common in time. It makes sense to look at stocks in the tech space which have tremendous room for growth. Micron (MU) is one such stock which has the potential to deliver solid returns.

Micron has a global manufacturing and R&D network that spans 13 countries. It has over 47,000 patents in its over four-decade history. I am bullish on the stock. (See Analysts’ Top Stocks on TipRanks)

A Great Run and Then the Fall

The company is one of the three largest memory manufacturers in the world. It is a major producer of DRAM (dynamic random-access memory) which is a kind of random-access semiconductor memory. This context is important because the world is facing a massive shortage of semiconductor chips. The other two major memory players are based out of South Korea.

The stock had an incredible run during the pandemic as the world was hungry for semiconductor chips. It was trading at $45 levels in August 2020 and hit $77 levels at the end of the year.

On the face of it, year-to-date, Micron’s stock price is almost at the same level. However, its stock has been on a 2021 roller-coaster ride. It opened 2021 at $77.42, and hit $95.3 in the first week of April. Since then, the stock steadily fell until it hit $67-levels in October. It spent time consolidating in October before starting to rise again.

The reason for the fall is that Micron’s business is very cyclical. The stock moves up and down based on the demand and supply for memory. When the world needed semiconductors, the stock moved up. Now, as the world is slowly opening up, there was a fall in its stock price. However, Micron stock seems to have bottomed out.

Steady Earner

Fiscal Years 2019 and 2020 were slow ones for the company. For 2019, it reported revenues of $23.41 billion and earnings of $6.31 billion. For 2020, the corresponding numbers were $21.43 billion and $2.69 billion. However, 2021 saw the company’s revenues surge to $27.71 billion and earnings come in at $5.86 billion. It ended Fiscal Year 2021 with a cash position of $3.69 billion.

More importantly, the company has beaten earnings expectations in each of the last four quarters which shows that despite two slow years in the last three, the company has delivered profits and hasn’t disappointed investors.

Micron Technology president and CEO Sanjay Mehrotra said that demand outlook for 2022 was strong, and Micron would continue to deliver innovative solutions. For the first quarter of fiscal 2022, the company’s guidance is $7.65 billion in revenue, with a gross margin of 46%.

Future Planning

A report by Global Market Insights, released this June, said that the semiconductor memory market revenue will cross $180 billion by 2027. It said, “The growing uptake of Dynamic Random-access Memory (DRAM) in gaming consoles, PC hardware, and high-performance computing devices will support the industry growth.”

Micron said that memory and storage are a growing portion of the global semiconductor industry, and represent approximately 30% of the semiconductor market. On October 20, Micron announced that it would invest over $150 billion in the next decade “in leading-edge memory manufacturing and research and development (R&D), including potential U.S. fab expansion.”

However, the company also said that government support would be critical to its expansion plans. Memory manufacturing in the U.S. costs around 35%-45% more than those in lower-cost markets. Funding to support new semiconductor manufacturing capacity is a must, said EVP of Global Operations Manish Bhatia. He added, “Sustained government support is essential for Micron to ensure a resilient supply chain and reinforce technology leadership for the long term.”

The top three companies in the sector invest billions of dollars every year to manufacture chips. These chips are increasingly getting more complicated and expensive with every passing generation. It is very unlikely that price wars will break out over market share. The game will be played on quality.

One fact that Micron investors will have to accept is that the company’s stock price is going to be volatile. They can take solace in the fact that the lows and highs for the stock will generally move up. The company has realized this and has purchased 15.6 million shares of its common stock for $1.2 billion during the fiscal year of 2021.

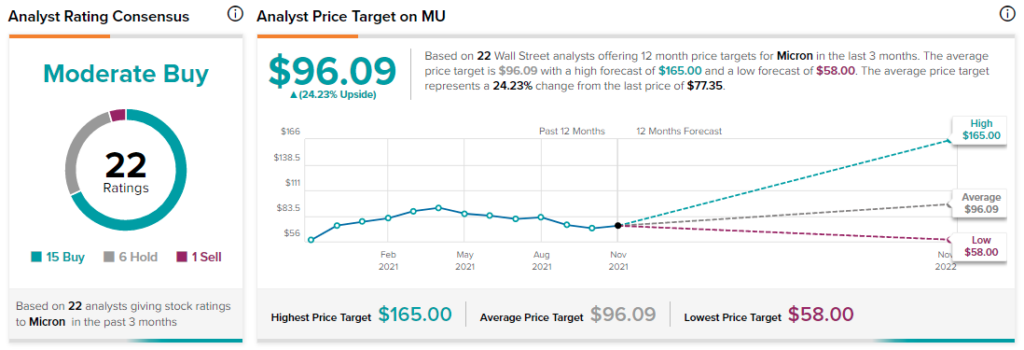

Tipranks’ Stock Forecast Tool indicates 15 out of 22 analysts have given MU a Buy rating, while six analysts have a Hold rating on the stock and just one has a Sell rating on the stock.

The average Micron price target is $96.09, which indicates 24.2% upside potential.

Disclosure: At the time of publication, Hashtag Investing did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.