If you’ve ever wanted to invest in the same stocks as top hedge fund managers, then the Goldman Sachs Hedge Industry VIP ETF (NYSEARCA:GVIP) may be the fund for you.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With just $176.8 million in assets under management (AUM), GVIP is easy to overlook, but I’m bullish on this small ETF from legendary investment firm Goldman Sachs (NYSE:GS) based on its solid performance. I’m also bullish on GVIP because of its differentiated strategy that takes it well beyond the tried-and-true (but at this point somewhat tired) Magnificent Seven names to give investors exposure to a whole slew of awesome under-the-radar stocks that are quietly generating excellent returns.

GVIP’s Unique Methodology

GVIP is a unique ETF with a differentiated strategy. According to Goldman Sachs, the fund “seeks to track the GS Hedge Fund VIP Index,” which “consists of fundamentally driven hedge fund managers’ ‘Very-Important-Positions,’ which appear most frequently among their top 10 long equity holdings.”

These “fundamentally driven hedge fund managers” are U.S. hedge fund managers that hold between 10 and 200 positions in U.S. equities, according to their most recent 13F filings. The fund excludes managers with less than $10 million in equity assets.

Goldman Sachs explains that the equity positions these remaining hedge funds hold are “then ranked within each individual hedge fund manager’s portfolio by descending market value. The approximately 50 stocks that appear most frequently in the top 10 holdings of this universe then become the Index constituents.”

The constituents are equal-dollar weighted and rebalanced quarterly, which prevents the fund from being dominated by a handful of positions, as we’ll discuss in the next section.

This methodology unearths some real hidden gems and creates an interesting group of holdings that you won’t find in most typical, cookie-cutter ETFs, as we’ll discuss further below.

It’s important to note that the ETF does not invest in the hedge funds themselves, and it doesn’t seek to track the performance of any specific hedge fund.

Portfolio of Hedge Fund Favorites

GVIP owns 47 stocks, and there is very little concentration risk here as its top 10 holdings account for just 23.7% of the fund. Below, you’ll find an overview of GVIP’s top 10 holdings from TipRanks’ holdings tool.

Nvidia (NASDAQ:NVDA) is the second-largest holding here, which is perhaps unsurprising, as the semiconductor juggernaut is beloved by investors of all stripes, whether they are retail investors or seasoned hedge fund managers.

But beyond Nvidia, there are plenty of shrewd investments here in stocks that are less familiar to many investors, myself included.

For example, the top holding is Vertiv (NYSE:VRT), which has ripped a 521.8% gain over the past year and enjoys a ‘Perfect 10’ Smart Score from TipRanks’ Smart Score system. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

Additional top 10 holdings like Tenet Healthcare (NYSE:THC) and AerCap Holdings (NYSE:AER) also boast 10 out of 10 Smart Scores and have returned 86.1% and 66.3%, respectively, over the past year. APi Group (NYSE:APG), another name that is well off the beaten path, enjoys a 9 out of 10 Smart Score and has returned 80.1% over the past year.

Outside of the top 10 positions, GVIP’s holdings, including Energy Transfer (NYSE:ET), Progressive (NYSE:PGR), Taiwan Semiconductor (NYSE:TSM), and Broadcom (NASDAQ:AVGO), all clock in with 10 out of 10 Smart Scores and have generated impressive returns over the past 12 months.

Add it all up, and GVIP looks like a great way to gain exposure to plenty of names from beyond the Magnificent Seven that are performing well and harbor considerable potential, going forward.

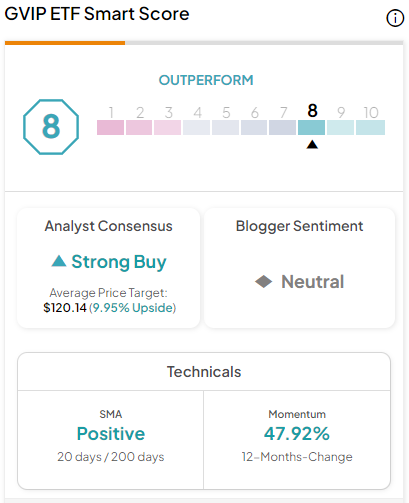

GVIP itself boasts an Outperform-equivalent 8 out of 10 ETF Smart Score.

Another nice thing about GVIP is that it is incredibly diversified by sector and not overly reliant on technology stocks. For investors who have decried the fact that the tech-centric Magnificent Seven has been responsible for much of the broader market’s gain over the past year, GVIP is a welcome antidote, as information technology has just an 18.9% weighting within the fund. For comparison, information technology makes up 29.8% of the S&P 500 (SPX). In fact, the fund’s largest weighting is toward financials (21.2%), followed by industrials (19.7%).

GVIP’s Solid Track Record

GVIP has a solid track record of performance, with a five-year annualized return of 13.9% as of February 29. As of the same date, the fund also returned 14.6% on an annualized basis since its inception in 2016.

What Is GVIP’s Expense Ratio?

GVIP charges an expense ratio of 0.45%. This means that an investor allocating $10,000 into the fund will be charged $45 in fees on an annual basis. While this doesn’t make GVIP one of the cheaper funds out there, it isn’t terrible, and notably, it is still below the average expense ratio for all ETFs, which is currently 0.57%. Assuming that GVIP maintains this fee structure, an investor in the fund will pay $567 in fees in a 10-year period.

Is GVIP Stock a Buy, According to Analysts?

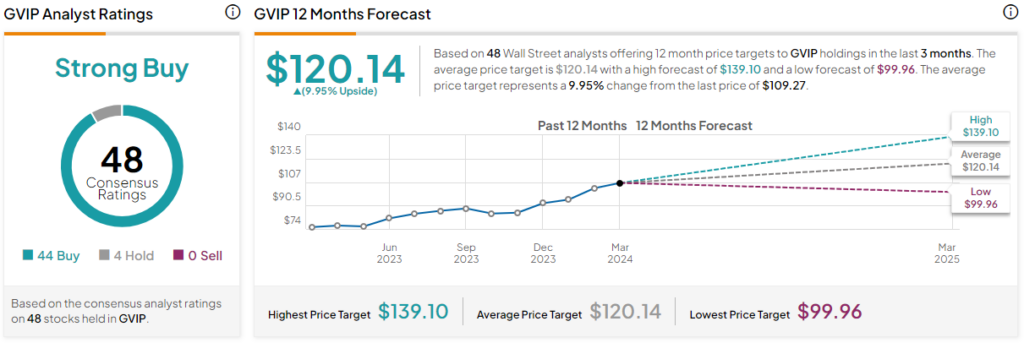

Turning to Wall Street, GVIP earns a Strong Buy consensus rating based on 44 Buys, four Holds, and zero Sell ratings assigned in the past three months. The average GVIP stock price target of $120.14 implies 10% upside potential.

Exposure to the Market’s Hidden Gems

GVIP is an interesting ETF with a differentiated strategy that gives investors exposure to a wide variety of the stock market’s hidden gems, which they won’t find in the many generic ETFs currently flooding the market.

I’m bullish on GVIP based on its solid five-year performance and the fact that it gives investors exposure to overlooked stocks like Tenet Healthcare, Aercap Holdings, and APi Group, which are quietly posting scorching performances. I also like the fact that GVIP invests in many stocks outside of the tech sector that are performing well, giving investors exposure to a different group of the market’s winners.