Tech stocks have been staying hot. Generative and predictive AI have been causing a frenzy of sorts, but they’re not the only potential needle movers in the Nasdaq 100 (NDX). Apart from overheated semiconductor stocks, the tech-heavy Nasdaq doesn’t seem to be overly expensive. In fact, JPMorgan (NYSE:JPM) recently noted that the Magnificent Seven (the largest contributors to the Nasdaq 100) look undervalued, at least relative to everything else.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

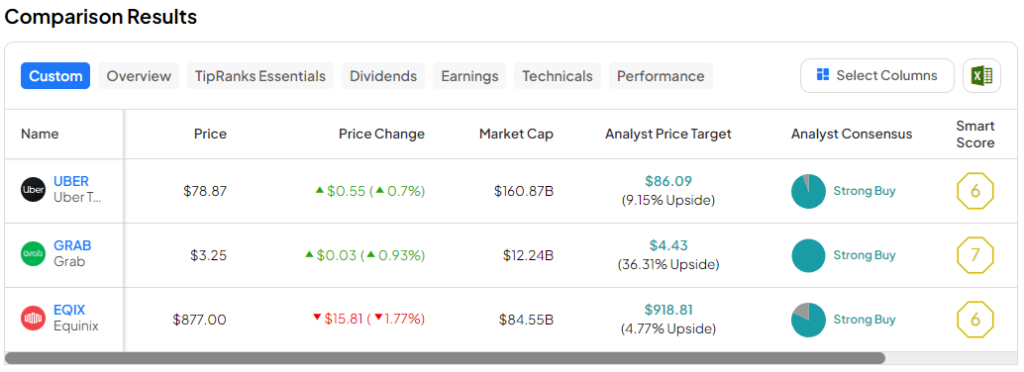

Therefore, in this piece, we’ll check out three intriguing and relatively affordable ways — UBER, GRAB, EQIX — to ride the tech wave higher. Let’s check in with TipRanks’ Comparison Tool to stack up the three Strong-Buy-rated tech plays to see which is worth adding to your watchlist today.

Uber (NASDAQ:UBER)

Uber stock has been one of the market’s breakout performers over the past year and change, with shares now up over 260% from their July 2022 low. Undoubtedly, when the leading ride-hailing (or should I say transportation-as-a-service) play was hovering around all-time lows just under two years ago, there were a number of uncertainties as to whether the firm would be successful in pushing toward profitability.

A vast majority of Wall Street analysts stayed bullish (with Buy ratings) on Uber stock as it sunk to its darkest depths, and they were proven spot-on in the years that followed. Even after Uber stock’s latest parabolic move, analysts are in no rush to downgrade their recommendations. In fact, the stock continues to hang onto its “Strong Buy” rating in the analyst community. I share Wall Street’s sense of bullishness.

Top analysts loved the name when it was trading for around $23 per share, and they’re continuing to love it at more than $79 per share. It’s not hard to see why as the firm continues firing on all cylinders. The company is making good on cost management without having such efforts eat into its ability to grow. For the fourth quarter, mobility sales shot up 34% year-over-year as Uber clocked in its first annual profit.

Looking ahead, look for the Uber One subscription service to help the firm gain further ground over rivals. At some point further down the road (think five to 10 years or so), the rise of autonomous vehicles could act as Uber’s largest margin driver to date as it’s among the best-equipped to shift gears into the era of self-driving robotaxis. All things considered, there are numerous reasons to stay aboard Uber as it continues driving higher for investors.

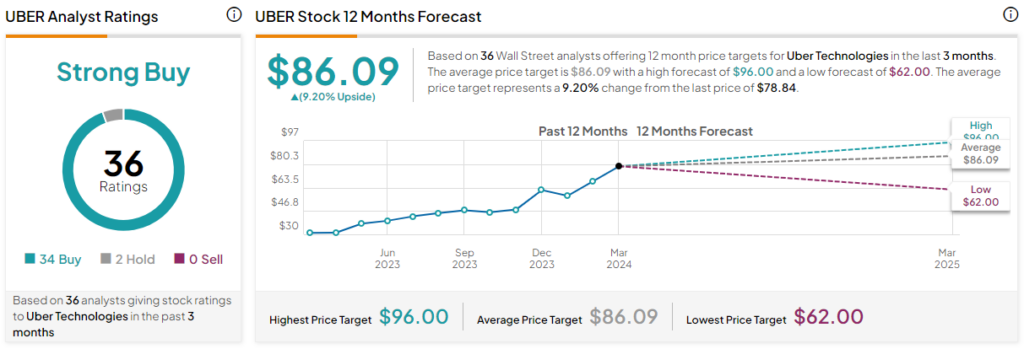

What Is the Price Target for UBER Stock?

Uber stock is a Strong Buy, according to analysts, with 34 Buys and two Holds assigned in the past three months. The average UBER stock price target of $86.09 implies 9.2% upside potential.

Grab (NASDAQ:GRAB)

If Uber stock’s scorching multi-year rally has you feeling like you missed the boat, perhaps Grab stock is worth a grab. After crashing from the high teens to just $3 and change per share, the southeast-Asian-focused ride-hailer may appear to be a cheaper play for those who have a strong stomach for volatility.

However, it’s more expensive, at least on a price-to-sales (P/S) basis. At writing, GRAB stock trades at 5.1 times price-to-sales (P/S), slightly above the 4.4 times P/S of Uber. Despite the uglier stock chart and slightly higher P/S, I remain bullish on GRAB, as recent quarterly takeaways were quite encouraging.

Like Uber, Grab has been making huge strides to become profitable in recent months. In its latest quarterly reveal, Grab achieved the feat while also announcing an impressive $500 million share repurchase plan.

Indeed, the two positive developments seem to be more than enough to support the name as it looks to sustain a rally from its recent depths. For now, though, the stock still seems to be stuck in the ditch, with flat performance endured over the past two years. However, moving ahead, Grab is shooting to keep driving sales, free cash flows, and EBITDA higher for 2024 (and likely beyond). And, of course, the rise of self-driving is a compelling wild card that may give Grab stock a much-needed shot in the arm.

Indeed, the Grab story seems to “rhyme” with that of Uber’s. The climate for ride-hailing seems to be looking up. And if Grab can continue on its promising path, I’d not be surprised if the name gains for investors at an above-average rate from here.

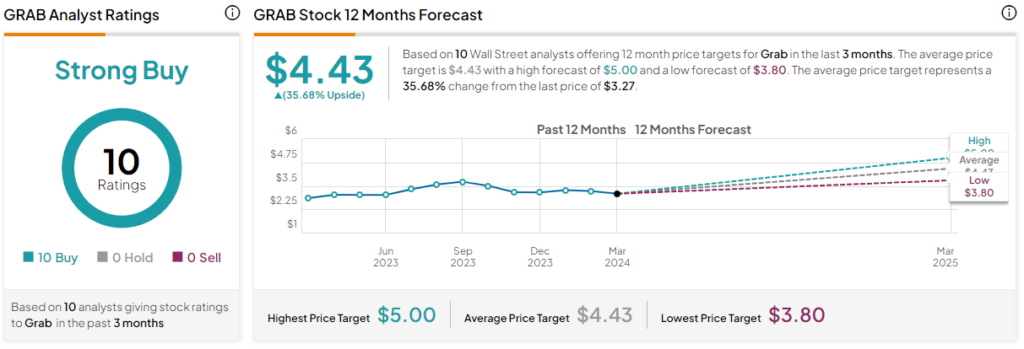

What Is the Price Target for GRAB Stock?

Grab stock is a Strong Buy, according to analysts, with 10 unanimous Buys assigned in the past three months. The average GRAB stock price target of $4.43 implies 35.7% upside potential.

Equinix (NASDAQ:EQIX)

There’s been a ton of buzz surrounding AI-ready data centers, with some of the plays gaining more momentum than the AI chip plays themselves. Though certain high-momentum data center plays may be getting bubbly, Equinix stock (a digital infrastructure real estate investment trust or REIT, with a 1.9% distribution yield) remains modestly priced, perhaps even undervalued, given its growing stake in the AI game.

Thus, I remain bullish and view EQIX stock as more of a “catch-up” play as more emphasis is shifted toward fully loaded private AI infrastructure.

Shares of EQIX are on the cusp of a big breakout, recently rising to a new all-time high, just shy of $900 per share. Though the breakout has been many years in the making, there are reasons to believe that even greater heights could be around the corner as more light is shined on what could be an AI-heavier future.

As a $83 billion titan-sized REIT, Equinix already has an impressive geographical footprint. With top-notch liquid cooling systems, managed services, and the means to house truly impressive AI systems, Equinix stands out to be a huge beneficiary as demand for AI infrastructure stays hot. Looking ahead, the REIT is looking to expand its footprint in Africa, with $390 million set aside to bet on data centers.

Just last week, Bank of America’s (NYSE:BAC) David Barden reiterated his Buy rating to go with a $1,000 price target on the stock (suggesting around 14% upside). He’s not the only analyst who foresees shares hitting the four-digit mark, either.

What Is the Price Target for Equinix Stock?

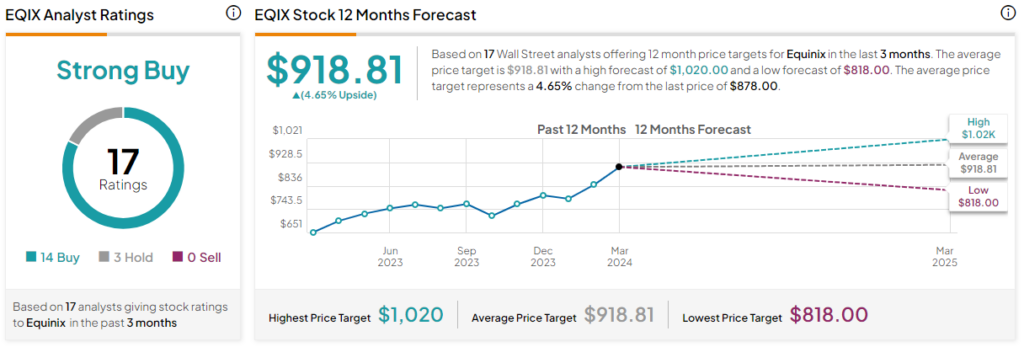

Equinix stock is a Strong Buy, according to analysts, with 14 Buys and three Holds assigned in the past three months. The average EQIX stock price target of $918.81 implies 4.65% upside potential.

Conclusion

The aforementioned ride-hailers (UBER, GRAB) and data center plays (EQIX) have some pretty powerful drivers behind them that could help them sustain a march higher from here. Each driver seems less hyped up than those facing other corners of the tech scene. Of the trio, analysts see the most upside potential from GRAB stock (~36%). I think analysts will be right; the needle could move much higher if Grab does its stock looks to pull off a U-turn.