The auto industry’s earlier than expected bounce-back provided General Motors (GM) with beats in its latest quarterly statement.

In 4Q20, the auto giant generated revenue of $37.52 billion, coming in ahead of consensus estimates by $1.23 billion and amounting to a 21.7% year-over-year uptick. There was a $0.29 beat on the bottom-line, too, with Non-GAAP EPS hitting $1.93.

The surprising comeback is being blunted by dwindling chip supplies. Electronics makers gobbled up excess chips last year, due to strong pandemic driven demand. Auto makers were more cautious, cutting back on orders during the industry’s Covid slump. Now faced with a global chip shortage, GM said the result could be a $1.5 billion to $2 billion trim to its 2021 earnings.

However, RBC analyst Joseph Spak thinks investors will overlook any temporary headwinds and instead focus on other catalysts on the horizon.

“Cont’d strong execution through challenging times still allows GM to accelerate investment towards future of transportation and allows investors to focus more on opportunities ahead and worry less about some near-term challenges like the chip shortage,” Spak noted. “[The] narrative/investment thesis on GM is moving away from earnings specificity anyways towards what GM can become in the future of transportation.”

What does this entail? More EVs, with 1 million anticipated by 2025, and only TSLA and VW supplying more. More autonomous vehicles (AV), and “new end markets (BrightDrop for last-mile EVs, Hydrotec for fuel cells and CV and we believe eventually data centers).”

Additionally, there could be new revenue and business opportunities such as a subscription model. If all of these are executed correctly, they could “rerate the name higher and further unlock value.”

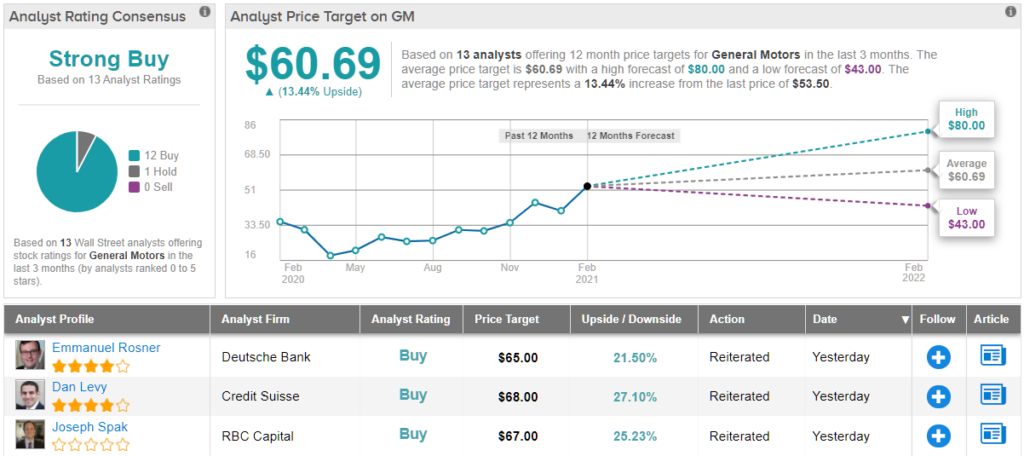

The promise of GM’s future potential merits a price target hike, and Spak increases his from $52 to $67. The implication for investors? Upside of 22%. Needless to say, Spak’s rating stays an Outperform (i.e. Buy). (To watch Spak’s track record, click here)

The rest of the Street is almost unanimously behind GM. Barring one Hold, 12 Buys provide the stock with a Strong Buy consensus rating. Meanwhile, the average price target stands at $60.69, which implies a 13% upside from current level. (See GM stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.