The Fidelity Enhanced Large-Cap Growth ETF (NYSEARCA:FELG) is a relatively new actively-managed growth ETF from Fidelity Investments. Based on the strength of its highly-rated portfolio and solid long-term track record, I’m bullish on the $2.1 billion ETF. With a reasonable expense ratio of just 0.18% (which is exceptionally cheap for an actively-managed ETF), FELG packs a punch.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What is the FELG ETF’s Strategy?

While FELG is a “new” ETF launched that was launced in November, there’s a twist. Fidelity Investments recently converted six mutual funds into ETFs, including the Fidelity Large Cap Growth Enhanced Index Fund, now FELG. So, while FELG is new to the world of ETFs, it comes with an extensive track record.

Fidelity describes FELG as a “U.S. equity strategy maintaining a large-cap growth profile, leveraging a disciplined approach investing in companies with attractive characteristics.”

FELG’s primary goal is capital appreciation. It will typically invest up to 80% of its assets in equities in the Russell 1000 Growth Index, a market-weighted index of large-cap U.S. growth stocks. Fidelity will then use computer-aided, quantitative analysis to select a diversified group of stocks it believes can outperform the underlying index.

The conversion to an actively-managed ETF enables Fidelity to take advantage of the popularity of ETFs while providing investors a more tax-efficient offering than mutual funds.

Performance Track Record

As discussed above, while FELG is new to the ETF scene, its predecessor fund is no rookie and has produced a strong track record of performance over a long time frame.

As of November 30, FELG’s predecessor fund posted a respectable annualized three-year total return of 9.7%. It generated an even more impressive five-year total return of 15.6%. Over a 10-year timeframe, it generated an annualized return of 13.5%.

FELG’s results were on par with the broad-market S&P 500 (SPX) over the three-year timeframe. It outperformed the S&P 500 over the five- and 10-year time frames, during which the broad-market index generated annualized total returns of 12.5% and 11.8%, respectively.

Taking Stock of FELG’s Portfolio

FELG’s diversified portfolio holds 180 positions. Furthermore, its top 10 holdings comprise just 33.9% of its assets, so there is little concentration risk here. Below is an overview of FELG’s top 10 holdings using TipRanks’ holdings tool.

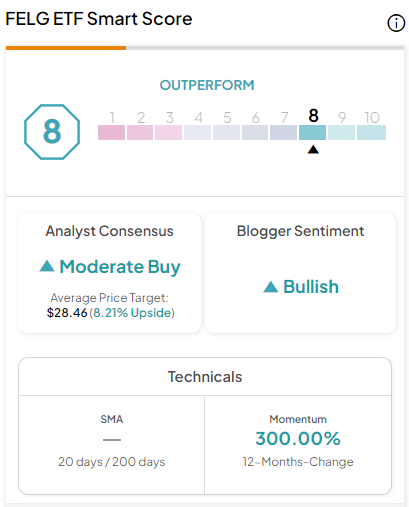

FELG’s top holdings feature a venerable group of Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

An impressive eight of FELG’s top nine holdings feature Outperform-equivalent Smart Scores of 8 or above. Note that the ETF currently has cash as its fourth-largest position, so the Smart Score does not apply there.

FELG’s highly-rated top holdings include the tech sector’s long-term winners like Apple (NASDAQ:AAPL), Nvidia (NASDAQ:NVDA), Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:META), and Alphabet’s Class A shares (NASDAQ:GOOGL).

But FELG is a diversified fund, and it doesn’t limit itself to big tech. UnitedHealth Group (NYSE:UNH) and JPMorgan Chase (NYSE:JPM) round out the top 10 holdings, while other highly-rated non-tech holdings beyond the top 10 include the likes of Home Depot (NYSE:HD), Coca-Cola (NYSE:KO), and Berkshire Hathaway (NYSE:BRK.B).

Overall, FELG gives investors exposure to the dominant tech names that have propelled the market higher in 2023 while still giving plenty of exposure to blue-chip companies from other market sectors, creating a nice mix.

Adding it all up, FELG features an Outperform-equivalent ETF Smart Score of 8.

What is FELG’s Expense Ratio?

FELG charges an expense ratio of just 0.18%, which is reasonable in the grand scheme of things and especially good for an actively-managed ETF.

This expense ratio means that an investor putting $10,000 into FELG will pay just $18 in fees over the course of one year. Assuming that the fund returns 5% per year going forward and maintains this 0.18% expense ratio, this same investor will pay just $230 in fees over the course of 10 years.

This undemanding expense ratio is particularly favorable compared to other popular actively-managed ETFs.

ARK Invest’s flagship fund, the ARK Innovation ETF (NYSEARCA:ARKK), has a much higher expense ratio of 0.75%. An investor putting the same $10,000 into ARKK would pay $75 in fees in year one and $931 in fees over the course of a decade (assuming the same parameters as discussed above).

Even Fidelity’s own Fidelity Blue Chip Growth ETF (BATS:FBCG) charges 0.59%, much more than FELG. An investor putting the same $10,000 into FBCG would pay $59 in fees in year one and $738 in fees over the course of a decade (assuming the same parameters as discussed above).

Another popular actively managed ETF, the T. Rowe Price Blue Chip Growth ETF (NYSEARCA:TCHP), charges 0.57%. An investor allocating $10,000 to TCHP would pay $57 in fees during year one and $714 over a 10-year time horizon.

As you can see, FELG is a cost-effective option in the world of actively-managed ETFs. Below, you’ll find a comparison of FELG, ARKK, FBCG, and TCHP created using TipRanks’ ETF Comparison Tool, which allows investors to compare up to 20 ETFs at a time based on various customizable factors.

Is FELG Stock a Buy, According to Analysts?

Turning to Wall Street, FELG earns a Moderate Buy consensus rating based on 151 Buys, 28 Holds, and one Sell rating assigned in the past three months. The average FELG stock price target of $28.46 implies 8.2% upside potential.

Investor Takeaway

In conclusion, FELG is a solid ETF, no matter what angle you approach it from. When looking at its predecessor fund, it has a respectable track record of long-term performance under its belt.

Additionally, FELG owns a diversified portfolio of highly-rated growth stocks from various market sectors that TipRanks’ proprietary Smart Score rating system views favorably.

Lastly, the fund sports a favorable expense ratio of 0.18%, which is reasonable and particularly attractive compared to the expense ratios of other actively-managed ETFs. For these reasons, I view FELG as an attractive, actively-managed ETF, and I am bullish on the fund.