Investors looking for significant returns can opt for growth stocks. These stocks represent companies that are expected to outperform the market by showcasing substantial revenue or earnings growth. These firms often reinvest earnings for further expansion rather than distributing dividends, contributing to their exponential growth. However, growth stocks come with higher risk and volatility compared to other stocks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

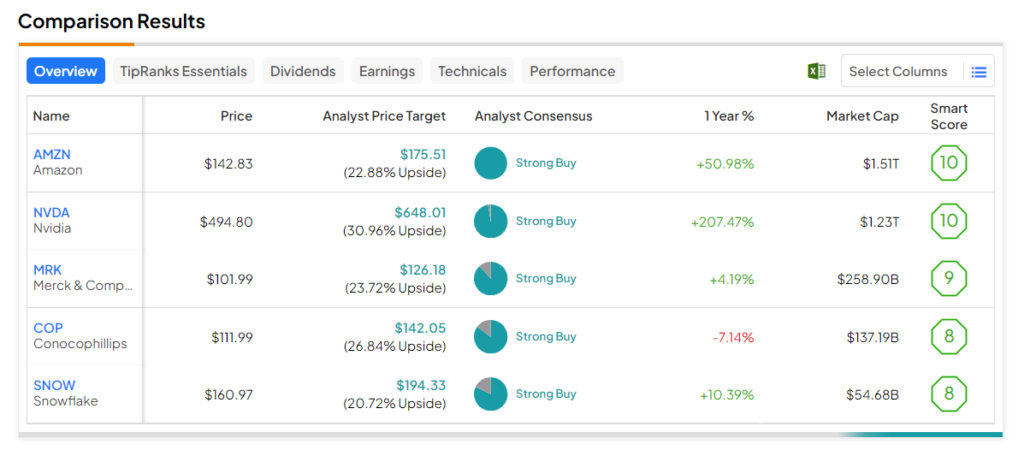

Using the TipRanks stock screener tool, we have shortlisted five growth stocks that have received Strong Buy ratings from analysts and whose price targets reflect an upside potential of more than 20%. These stocks also carry Outperform Smart Scores (i.e., 8, 9, or 10) on TipRanks. Lastly, these companies’ revenues have witnessed a compound annual growth rate of over 10% in the past five years.

Here are the five stocks that investors can consider.

- Nvidia (NASDAQ:NVDA) – The chip giant’s price forecast of $648.01 implies a 31% upside potential. NVDA’s revenues have witnessed a 17.4% three-year CAGR. Seven analysts rated the stock a Buy in the past four days, and NVDA stock has a “Perfect 10” Smart Score.

- Amazon (NASDAQ:AMZN) – The e-commerce giant’s price forecast of $175.51 implies a 22.9% upside potential from the current levels. The company’s revenue has grown at a CAGR of over 10%. Amazon stock carries a Smart Score of 10.

- Merck & Company (NYSE:MRK) – Merck is a global pharmaceutical company focused on healthcare, innovative drugs, and vaccines. The stock’s average price target implies an upside potential of 23.7%. Its revenues increased at a CAGR of 12.6% in the past three years. Also, MRK has a Smart Score of nine.

- ConocoPhillips (NYSE:COP) – The company engages in oil and natural gas exploration, production, refining, and marketing. Analysts currently see an upside potential of 26.8% in the stock. Also, it has a Smart Score of eight, and its topline has grown at a CAGR of 61.1%. Importantly, seven Buy ratings have been assigned to COP stock following the release of third-quarter earnings on November 2.

- Snowflake (NYSE:SNOW) – The company’s platform enables customers to consolidate data into a single source. SNOW stock’s average price target implies a consensus upside of 21.3%. Its revenues increased at a CAGR of 51.8% and has a Smart Score of eight. In the past four days, four analysts have rated the stock a Buy.