The year 2022 has been a mixed bag of emotions. With the worst of the pandemic behind us, most of the employment data is picking up, real wages are rising, and pent-up demand is resurging. Meanwhile, the Russia-Ukraine war has resulted in an uptick in commodity prices, which is hurting consumer spending. The inflationary threat particularly to groceries and high gas prices is impeding consumers from spending on discretionary items as much as they would have loved to.

Echoing a similar story, Stifel Nicolaus analyst Chris O`Cull recently released a Restaurants’ industry update under which he has explained the current positives and negatives that are impacting the industry.

According to O`Cull, “The geopolitical environment and rapidly rising prices have presumably been the driving factors behind a recent weakening in forward-looking consumer confidence measures. Moreover, findings from our recently completed survey indicate that consumers, especially low-income cohorts, have started adjusting their buying plans due to inflation.”

Notably, the analyst’s survey showcased those consumers who are much more likely to cut their spending on restaurants if the situation deteriorates further. In such an uncertain consumer spending environment, we decided to take a look at two pizza stocks that could take a hit from the current pullback in discretionary spending.

Moreover, Russia is one of the largest producers of wheat, which is an essential ingredient in pizza dough. The ongoing war has significantly increased the prices of wheat and with several trade restrictions with Russia, the prices are nowhere near their tipping points, further raising the input costs for the pizza makers.

Domino’s Pizza (DPZ)

Founded in 1960, the Domino’s Pizza brand is one of the hot favorites of pizza lovers with its array of everyday value meals and combo deals suiting each individual’s appetite. The pizzeria operates through a mix of company-owned and franchise models both in the U.S. and international markets.

The DPZ stock has lost over 29% year-to-date and gained 3.6% over the past year. The company even pays a regular quarterly dividend of $1.10 per share, reflecting a current yield of 0.99%. To date, the company has approximately $700 million in share repurchases remaining under the current program.

In its recent results for Q4 and the year ending January 2, 2022, Domino’s missed expectations on both revenue and earnings. However, the company did manage to report moderate growth in same-store sales for both Q4 and FY21. At the end of the quarter, Domino’s had a total of 18,848 stores across the globe.

As a tradition, Domino’s provides an outlook for the next two to three years’ time frame, and likewise, the company has projected a Global retail sales growth between 6% and 10% and Global net unit growth of between 6% and 8%. Historically, Domino’s has a compound annual growth rate (CAGR) of global store count growth of 6.6%.

Typically, a restaurant’s business growth is measured by store growth, the higher the number of stores open; the higher the growth, and vice versa.

Interestingly, yesterday, Cowen & Co. analyst Andrew Charles downgraded the DPZ stock to a Hold rating from Buy, and also lowered the price target on the stock to $390 (almost fully valued at current levels) from $480. Following the news, the DPZ stock fell 3.1%, closing at $391.17 on April 5.

According to Charles, Domino’s is expected to open a lesser number of stores in the U.S. as compared to its optimistic outlook. The analyst had a glimpse into Domino’s Franchise Disclosure Document (FDD) given to prospective franchisees. The FDD showcased lower projections of future store openings, which compelled the analyst to lower his forecast for 2022-2024.

Accordingly, Charles now expects Domino’s new stores’ growth to be in line with its CAGR of between 6.2% and 6.5% for 2022 and 2023, at the lower end of the company’s guidance. After Domino’s Q4 earnings miss, several analysts lowered the price target on the stock and a few even downgraded their stance.

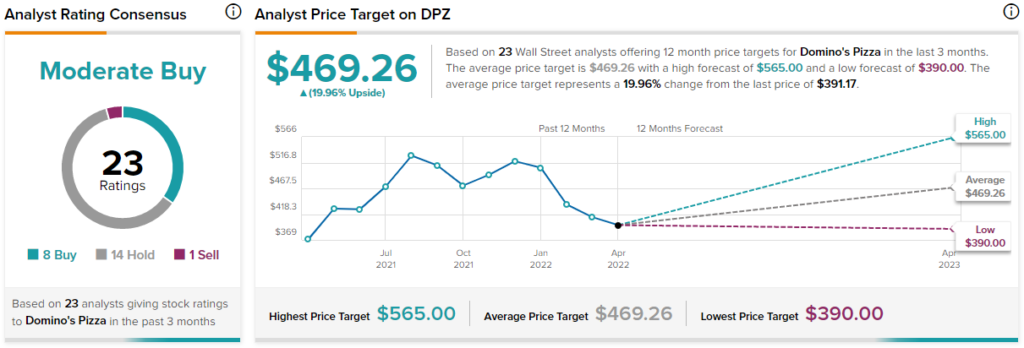

The other analysts on the Street are cautiously optimistic about the stock, with a Moderate Buy consensus rating based on eight Buys, 14 Holds, and one Sell. The average Domino’s price target of $469.26 implies almost 20% upside potential to current levels.

Papa John’s International (PZZA)

Founded in 1984, Papa John’s operates on a similar business model to Domino’s, with operations both in the U.S. and abroad. Papa John’s focus on always using fresh ingredients instead of frozen has propelled consumers’ favor towards the pizzeria’s offerings.

PZZA stock has lost 19.6% year-to-date amid the broader market sell-off compared to a 18.3% gain over the past year.

Papa John’s also pays regular quarterly dividends to the tune of $0.35 per share to shareholders with a current dividend yield of 1.19%. The company also has approximately $411.5 million remaining under its current share repurchase program as of February 17, 2022.

In its Q4 and full-year fiscal 2021 results ending December 26, 2021, Papa John’s beat both revenue and earnings estimates despite supply chain, labor, and Omicron-related challenges. Moreover, the company even reported a solid jump in both its comparable sales growth and global system-wide restaurant sales growth figures.

Notably, Papa John’s ended the fiscal with 5,650 stores worldwide, with 250-unit additions in the year. The story doesn’t end here! Post its earnings, PZZA has announced a historic strategic deal with FountainVest Partners to open over 1,350 new stores in South China by 2040, which is one of the world’s fastest-growing pizza delivery markets.

Similarly, on March 31, Papa John’s also announced a major strategic refranchising agreement with long-term partner Sun Holdings to accelerate domestic development. The latter is also committed to opening 100 new stores across high-growth markets, including Texas, by 2029.

Earlier in March, analyst O`Cull revisited the impact of rising wheat prices on Papa John’s performance due to the ongoing war. The analyst noted that PZZA uses hard red spring (HRS) wheat in its pizza dough, which is mostly sourced domestically as opposted to the winter varietals produced in Russia.

Nevertheless, the analyst stated, “Prices remained elevated YoY in early 2022, however, the recent conflict has exacerbated the rise in wheat prices. In the short term, we do not believe the company has significant exposure to rising wheat prices given its forward buying strategy; however, if recent market prices persist, we estimate it could pressure restaurant margin by roughly 50 bps 2H22.”

Analyst O`Cull has the most conviction towards PZZA under his restaurant coverage. He has a Buy rating on the stock with a price target of $155, which implies 45.2% upside potential from current levels.

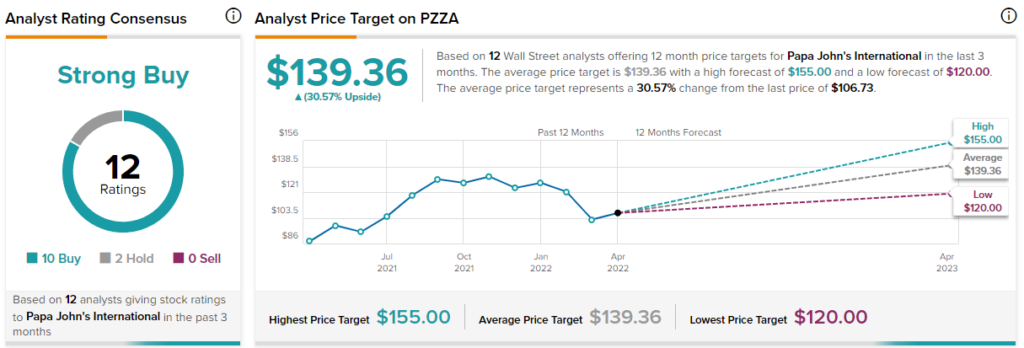

The other analysts on the Street are highly optimistic about the stock, with a Strong Buy consensus rating based on 10 Buys and two Holds. The average Papa John’s price target of $139.36 implies 30.6% upside potential to current levels.

Key Take-Aways

On the valuation front, DPZ currently trades at a 3.45x sales multiple, and PZZA trades at 1.81x sales. While both trade above the industry average of 0.98x sales, the PZZA stock is relatively cheaper compared to DPZ.

Besides, both companies have limited exposure to rising wheat prices since they hedge their purchases in advance. Moreover, considering the factors discussed above and the Street’s inclination towards the PZZA stock, it would be worth investing in Papa John’s story, which has more ambitious plans to widen its footprint and enhance performance.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure