Are you ready to sign on the dotted line? DocuSign (NASDAQ:DOCU) stock was on the move today, and there could be more upside coming soon. I am bullish on DOCU stock, as DocuSign’s still-fresh results exceeded expectations, and the company is preparing for a revenue-rich year.

DocuSign specializes in e-signature software. This was a red-hot niche market in 2020 and 2021 when the COVID-19 pandemic lockdowns forced some businesses to conduct operations—including document signing—online instead of in person.

The market’s enthusiasm about that catalyst has faded in recent years, however. Consequently, DOCU stock is far below its 2021 peak price. Yet, there’s plenty of overhead room to rally, and across-the-board Street beats could be DocuSign’s signature move.

DocuSign’s Restructuring Plan Irks Investors

Today is a great day for DocuSign’s shareholders, but let’s back up for a moment. The picture didn’t look so bright for DocuSign earlier this year when the company announced a restructuring plan.

Sometimes, the phrase “restructuring plan” means bankruptcy proceedings, but that’s not what’s happening with DocuSign. Rather, the company is seeking to reduce its expenditures. To that end, DocuSign plans to lay off nearly 6% of its staff.

In some instances, stock traders cheer when a company announces layoffs in order to cut costs. However, DOCU stock actually declined by nearly 6% after the company disclosed its restructuring plan. There are, most likely, a couple of reasons for this.

First, DocuSign expects to incur non-recurring restructuring charges of $28 million to $32 million due to the layoffs. Furthermore, the company’s restructuring plan announcement may have dashed some investors’ hopes of a potential buyout deal for DocuSign.

Apparently, there had previously been market chatter hinting at potential takeover interest for DocuSign from private equity firms, such as Bain Capital (NYSE:BCSF) and Hellman & Friedman. Yet, DocuSign’s restructuring plan announcement evidently didn’t hint at a near-term takeover.

Making matters worse, Citigroup (NYSE:C) hit DocuSign with concerning commentary. According to TheFly, Citigroup said that it saw a “mixed set-up” for DocuSign and that the channel checks for DocuSign were “more cautious” and the growth inputs “remain soft.” Citigroup evidently wasn’t ultra-bearish, though, as it still assigned DOCU stock a Buy rating and an optimistic $90 price target.

DocuSign Takes a “Big Step” Forward with Across-the-Board Beats

Even after learning about the aforementioned not-so-positive news about DocuSign, there’s no reason to just give up on the company. DocuSign just released its financial results for the fourth quarter of Fiscal Year 2024, and there are some nice surprises. Indeed, Wedbush analyst Dan Ives declared that DocuSign’s quarterly earnings represent a “big step in the right direction for the DOCU story.”

I agree 100% with Ives’ positive assessment. Incidentally, Ives hiked his price target on DocuSign stock from $56 to $65, so today’s rally might just be the start of a bigger move.

There’s no denying that DocuSign’s Q4-FY2024 results were fairly impressive. The company’s quarterly revenue grew by 8% year-over-year to $712.4 million, beating the consensus estimate of $698 million. This result also came in above DocuSign’s previously published guidance range of $696 million to $700 million.

So far, so good. Moreover, DocuSign had expected to report quarterly billings of $756 million to $768 million, but the actual result was $833.1 million, up 13% year-over-year. Additionally, DocuSign anticipated Q4-FY2024 adjusted gross margin of 81% to 82%; the actual result was 82%, which is at the upper limit of DocuSign’s guidance range.

Before turning to the bottom-line results, it’s worthwhile to take a glance at DocuSign’s free cash flow (FCF) for the quarter. Encouragingly, DocuSign recorded FCF of $248.6 million, versus $113 million in the year-earlier quarter.

Finally, DocuSign earned $0.76 per share during the quarter, thereby adding to the company’s long-standing track record of quarterly EPS beats. Wall Street, meanwhile, had predicted that DocuSign would only earn $0.65 per share in Fiscal Year 2024’s fourth quarter.

Is DocuSign Stock a Buy, According to Analysts?

On TipRanks, DOCU comes in as a Hold based on four Buys, nine Holds, and two Sell ratings assigned by analysts in the past three months. The average DocuSign stock price target is $64.77, implying 15.4% upside potential.

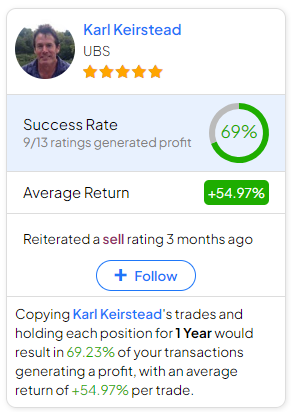

If you’re wondering which analyst you should follow if you want to buy and sell DOCU stock, the most profitable analyst covering the stock (on a one-year timeframe) is Karl Keirstead of UBS (NYSE:UBS), with an average return of 54.97% per rating and a 69% success rate. Click on the image below to learn more.

Conclusion: Should You Consider DocuSign Stock?

Now, it makes sense that Ives sees DocuSign as taking a “big step in the right direction.” Practically everything about DocuSign’s quarterly financial data is, more or less, fairly positive.

Sure, DocuSign’s restructuring plan announcement didn’t please some investors. Frankly, there’s no definitive evidence that DocuSign will be acquired by another company in the near future.

That’s fine, though, as long as DocuSign continues to post Street-beating financial results. Consequently, I’m taking a bullish stance on DOCU stock and am considering it for a long position today.