The uncertain macroeconomic environment and ongoing geopolitical crisis will likely keep the volatility elevated in the stock market. Against this challenging investing environment, investors seeking steady passive income could consider low-beta sin stocks like Altria Group (NYSE:MO). Its forward dividend yield of approximately 8.2% implies investors need to buy 322 MO shares at Tuesday’s closing price of $45.74 to make $100 in monthly passive income.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Here’s Why Altria is a Solid Passive Income Stock

The graph below shows that Altria is a low-beta stock (beta of about 0.50), implying it is less volatile than the broader market. This is well reflected in its stock price performance this year. It’s worth highlighting that Altria stock is up about 2% year-to-date compared to a 20% drop in the S&P 500 Index (SPX).

While this sin stock remains stable amid volatility, it has paid and increased dividends for over five decades.

Altria recently hiked its quarterly dividend by 4.4% to $0.94 a share, translating into an annual dividend of $3.76 per share. Altria has now increased its dividend for the 57th time in the last 53 years, including the recent hike.

What is the Price Target for Altria?

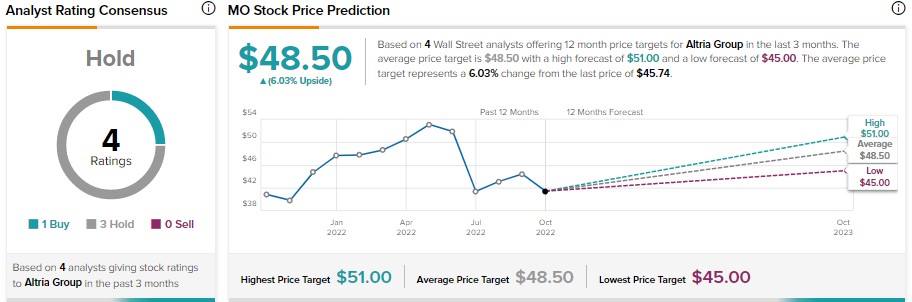

Altria, which is scheduled to announce its Q3 results on October 27, has a Hold recommendation on TipRanks. It has received one Buy and three Hold recommendations. Meanwhile, analysts’ average price target of $48.50 implies 6% upside potential.

Bottom Line

Despite macro challenges, Altria continues to grow its earnings. The company has exceeded analysts’ EPS estimates in the last three consecutive quarters. Meanwhile, for Q3, analysts expect Altria to post earnings of $1.30 a share, implying year-over-year growth of 6.6%. As for the full year, Altria is confident of growing its earnings by 4-7%.

Its growing earnings base, low beta, and consistent dividend growth make Altria a solid stock to generate worry-free income.