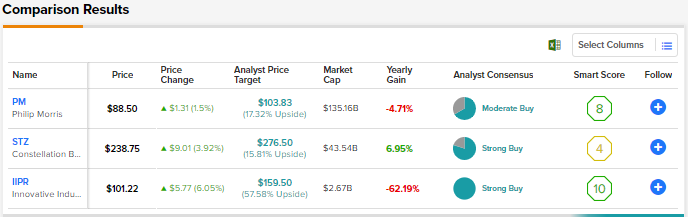

Stubbornly high inflation and rising interest rates are expected to push the economy into a recession. Sin stocks, which are stocks of tobacco, alcohol, cannabis, gambling, and weapon-making companies, are known to be resilient during recessionary conditions due to the nature of these products. We will discuss three sin stocks – Philip Morris (NYSE:PM), Constellation Brands (NYSE:STZ), and Innovative Industrial Properties (NYSE:IIPR) and use TipRanks’ Stock Comparison Tool to pick the most attractive one.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Philip Morris International (PM) Stock

Philip Morris is one of the world’s leading tobacco companies and owns popular brands like Marlboro. It is aggressively working on replacing cigarettes with smoke-free products, keeping in mind evolving consumer needs.

PM expects smoke-free products to account for over 50% of its net revenues by 2025. As part of this goal, the company recently acquired the U.S. commercialization rights to the IQOS system from Altria Group (NYSE:MO), effective April 30, 2024. Furthermore, on Tuesday, it won the European Commission’s conditional approval for the proposed acquisition of Swedish Match, a maker of nicotine pouches and other smoke-free products.

Is Philip Morris Stock a Buy, Sell, or Hold?

Last week, Philip Morris’s Q3 revenue of $8.03 billion and adjusted EPS of $1.53 topped market expectations, even as both the metrics declined year-over-year. Currency headwinds, inflation, and supply chain issues hit Q3 results.

Following the print, Morgan Stanley analyst Pamela Kaufman reiterated a Buy rating on PM stock with a price target of $102. Kaufman highlighted the company’s solid underlying fundamentals and favorable developments related to its U.S. growth plans.

With regard to the $2.7 billion payment to Altria, Kaufman stated, “While the up-front payment appears substantial, we believe this is a compelling value for PM relative to the size of the US cigarette profit pool.”

Overall, the Street has a Moderate Buy consensus rating on Philip Morris stock. The average PM stock price target of $103.83 implies 17.3% upside potential. Shares have declined 6.8% year-to-date. PM has an attractive dividend yield of 5.8%.

Constellation Brands (STZ) Stock

Constellation Brands is one of the leading alcoholic beverage companies. The company’s robust beer portfolio, which includes the popular Modelo and Corona brands, is a vital growth driver. Also, Constellation continues to revamp its wine and spirits portfolio to focus on premium brands.

Equity losses related to Constellation’s investment in cannabis company Canopy Growth (CGC) have been a major concern for investors. On Tuesday, STZ announced that it intends to convert its existing common shares in Canopy into new exchangeable shares to protect shareholder value while retaining its interest in Canopy through non-voting and non-participating shares.

Is STZ a Good Stock to Buy?

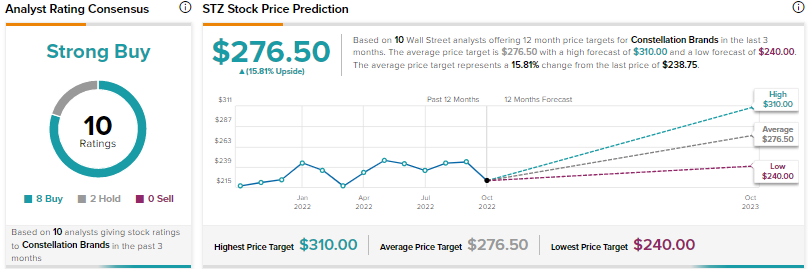

Wedbush analyst Gerald Pascarelli recently named Constellation Brands as his “top pick” in the alcoholic beverage space and initiated coverage on the stock with a price target of $275. The analyst highlighted “accelerating levels of sales growth” of the company’s beer portfolio and solid market share gains as reasons for his bullish stance.

Constellation Brands stock scores the Street’s Strong Buy consensus rating based on eight Buys and two Holds. At $276.50, the average STZ stock price prediction suggests 15.8% upside potential. Shares are down 4.8% so far this year. Constellation’s dividend yield stands at 1.4%.

Innovative Industrial Properties (IIPR) Stock

Innovative Industrial offers a unique investment opportunity for those interested in the cannabis space. IIPR is a real estate investment trust (REIT) that acquires land from state-licensed cannabis operators and leases it back to them.

As a REIT, IIPR must distribute at least 90% of its taxable income to stockholders through dividends, thus making it attractive for dividend-seeking investors. IIPR has an impressive dividend yield of 7.2%.

However, the company faces the risk of tenants defaulting on their payments. For instance, the news in July that one of the company’s key tenants, California-based Kings Garden, defaulted on its rent payments spooked IIPR investors. However, the two parties reached a settlement in September.

What is the Target Price for IIPR?

Compass Point analyst Merrill H. Ross recently upgraded Innovative Industrial stock from a Hold to Buy and increased the price target to $175 from $100.

Ross cited two reasons for the rating upgrade. First, a conditional, confidential settlement with its California tenant, and second, IIPR hiked its dividend by 2.9% to $1.80. The analyst believes that the dividend increase reflects the management’s confidence in collecting lease payments from its tenants. Furthermore, Ross assumes that like the California tenant lease, other leases in the company’s portfolio “will prove enforceable.”

Innovative Industrial stock earns a Strong Buy consensus rating with four unanimous Buys. The average IIPR stock price target of $159.50 implies 57.6% upside potential. IIPR stock has plunged nearly 65% year-to-date due to concerns about the delay in cannabis legalization at the federal level in the U.S. and broader macro challenges.

Conclusion

Wall Street analysts are highly bullish on Innovative Industrial and see the significant pullback in the stock as a great opportunity to build a position. Overall, strong earnings growth, an impressive rent collection rate (99% in the first six months of 2022), a solid dividend yield, and long-term prospects in the cannabis market make IIPR stock an attractive pick.

Furthermore, analysts see higher upside potential in Innovative Industrial stock than in Phillip Morris and Constellation Brands.