Macro challenges and the growing fears of an impending recession are impacting the IT spending of companies. Nonetheless, spending on cybersecurity solutions is expected to be resilient given the growing number of cyber attacks amid continued digital transition. As per Check Point Research, global cyber attacks grew 28% in the third quarter. Bearing that in mind, we used TipRanks Stock Comparison Tool to pit CrowdStrike (NASDAQ:CRWD), Palo Alto (NASDAQ:PANW), and Fortinet (NASDAQ:FTNT) against each other and pick the cybersecurity stock that could generate the best returns.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

CrowdStrike Holdings (CRWD) Stock

Shares of leading endpoint security provider CrowdStrike plunged after the company reported its fiscal third-quarter results. Revenue grew 53% to $581 million in Q3 FY23 (ended October 31, 2022), while adjusted earnings per share (EPS) surged 135% to $0.40.

Although Q3 revenue and earnings topped estimates, investors were disappointed as the net new annual recurring revenue (ARR) and Q4 guidance lagged estimates. CrowdStrike noted that macro challenges led to elongated sales cycles in the case of smaller customers and made some larger customers opt for multi-phase subscription start dates.

While macro factors might weigh on CrowdStrike’s near-term results, the company’s expanding customer base and increased engagement can’t be ignored. The company’s subscription customer base increased 44% to 21,146 as of Fiscal Q3-end. Also, the proportion of subscription customers who adopted five or more modules was 60% as of the end of Q3 FY23, up from 55% in the prior-year period.

What is the Target Price for CRWD Stock?

Recently, Redburn Partners analyst Nina Marques initiated coverage on CrowdStrike stock with a Buy rating and a price target of $175. Marques called CrowdStrike an innovative cybersecurity leader poised to grab market share from legacy antivirus vendors.

While the near-term expectations for CrowdStrike have been revised to reflect macro pressures, Marques feels that the focus will shift back toward structural tailwinds in the cybersecurity space.

CrowdStrike earns the Street’s Strong Buy consensus rating based on 31 Buys and two Holds. The average CRWD stock price target of $180.26 implies 52.1% upside potential. CRWD stock has plunged nearly 42% so far this year.

Palo Alto Networks (PANW) Stock

Palo Alto recently delivered a beat-and-raise quarter despite adverse macro conditions. The company’s Q1 FY23 (ended October 31, 2022) revenue increased 25% to $1.6 billion, while adjusted EPS surged 51% to $0.83.

The company is experiencing strong demand for its next-generation security (NGS) products, including Cortex, Prisma Cloud, Prisma SASE, and software firewalls. NGS annual recurring revenue (ARR) increased 67% to $2.11 billion in Q1 FY23.

Palo Alto remains optimistic about future growth and continues to win large customers. In Fiscal Q1, the number of customers who spent $1 million or more in bookings value over the last four quarters grew 23% to 1,262.

Is Palo Alto a Buy, Sell, or Hold?

Morgan Stanley analyst Hamza Fodderwala believes that Palo Alto “will be the first $100 billion market cap company in cybersecurity, or nearly double its current share price in two years.” The analyst’s optimism is based on Palo Alto’s platform evolution, leading position in the cloud security market, and improving profitability.

Fodderwala believes that PANW stock is “ready to re-rate” following its strong Q1 results. Fodderwala maintained a Buy rating on PANW stock and a price target of $268.

Wall Street has a Strong Buy consensus rating based on 26 Buys and three Holds. The average Palo Alto stock price target of $219.93 suggests nearly 36% upside potential. PANW stock has declined about 13% year-to-date.

Fortinet (FTNT) Stock

Cybersecurity and networking solutions provider Fortinet’s adjusted EPS grew 65% to $0.33 in the third quarter, fueled by a 33% growth in revenue to $1.15 billion and improved margins. Fortinet’s billings grew 33% to $1.41 billion.

Despite better-than-anticipated top and bottom lines, FTNT stock plunged as the company’s billings guidance fell short of expectations. The company guided for Q4 billings in the range of $1.665 billion to $1.720 billion, against analysts’ consensus estimate of $1.74 billion.

Nonetheless, the company is confident about meeting its medium-term financial targets of $10 billion in billings and $8 billion in revenue in 2025, each reflecting a 22% three-year compound annual growth rate (CAGR) from the midpoint of the 2022 guidance.

Is Fortinet a Good Buy Now?

Following the Q3 print, BTIG analyst Gray Powell reiterated a Buy rating for Fortinet stock, noting that the third quarter results were “solid.” However, Powell slashed his price target for FTNT stock to $62 from $80 as the Q4 billings outlook was “disappointing” and bookings “could have been better.”

Powell remains positive about Fortinet’s potential to gain market share in the network and SD-WAN markets, even though the company is exiting the year with bookings growth in the low 20% range compared to the 42% growth reported in Q2.

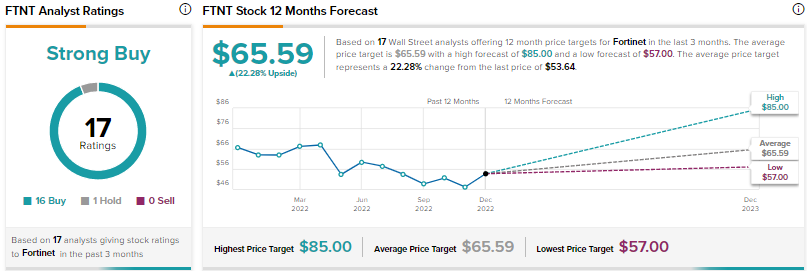

Fortinet’s Strong Buy consensus rating is backed by 16 Buys and one Hold rating. The average FTNT stock price target of $65.59 implies 22.3% upside potential. FTNT stock has declined 22.3% so far this year.

Conclusion

Wall Street is highly bullish about CrowdStrike, Palo Alto, and Fortinet and expects these companies to benefit from the robust demand for cybersecurity solutions amid growing threats and continued digitization.

Analysts see the steep pullback in CrowdStrike as a good opportunity to buy the stock and earn better returns than Palo Alto and Fortinet stocks. CrowdStrike has a strong hold over the endpoint security market and is expected to grow at a faster rate than Palo Alto and Fortinet.