The cryptocurrency market went big in 2021, nearly tripling in value and closing the year at more than $2.2 trillion. Coinbase Global (COIN), a prime crypto brokerage, took advantage of the bull market and decided to go public in April last year.

However, the company’s shares have shed more than 85% since. The primary reasons behind the fall are less crypto-trading activity and a fall in cryptocurrency prices, which are beyond Coinbase’s control.

Unfortunately, the consistent decline in the stock price doesn’t present a positive outlook for investors. However, Coinbase might turn up its profitability, given its operating flexibility.

So, whether Coinbase will weather the current downturn and honor investors remains a burning concern, making COIN a touch-and-go stock for now. Hence, we are neutral on COIN stock.

Coinbase’s “Neutral” 5 out 10 Smart Score Rating also agrees with our sentiment. The stock can go either way.

A Shaky Start to the Year: Competition is Heating Up

Coinbase generates most of its revenue from commissions on retail trades, entailing that the stock has a high correlation to the crypto market. This means that any turmoil in the cryptocurrency market will have a dire knock-on effect on COIN.

The problem concerning COIN isn’t internal. The Fed’s decision to hike interest rates to combat inflation has swayed investors away from cryptocurrencies, damping the outlook for Coinbase, but this doesn’t mean Coinbase is doomed. Instead, it just seems like right now is not a good time for crypto.

Back in 2021, when the crypto market was booming, Coinbase reported an annual profit of more than $3.6 billion on $7.8 billion in revenue. Both these figures outnumbered the top-line and bottom-line figures of the prior year. However, in the first quarter of 2022, Coinbase’s revenue fell more than 35%.

The company missed analysts’ revenue estimates as it earned around $1.17 billion versus the analysts’ expectations of $1.48 billion. Also, monthly transacting users (MTUs) tanked to 9.2 million in the first quarter of 2022, down from 11.4 million in the fourth quarter of 2021.

In addition, the total trading volume reduced from $335 million in the first quarter of 2021 to $309 billion in the most recent quarter. All this resulted in Coinbase reporting a net loss of $430 million, or a loss per share of $1.98.

However, the crypto bear market isn’t the only issue. Coinbase was forced to cut its fee on retail trades due to competition piling up. As a result, the company had to reduce its fees from 4% to 1.5%.

Recently, some of Coinbase’s competitors eliminated fees on crypto trades to attract more customers to their platform. This factor alone has instilled fear in investors as Coinbase might experience a further drop. So, competition is another headwind that Coinbase must fight to reap profits.

Coinbase Has a Long Way to Go

Coinbase’s first-quarter report is unsatisfactory, if not worse. Coinbase wants to evolve into a long-term play in the crypto market.

The company’s letter to shareholders said, “We believe these market conditions are temporary, and we remain focused on our long-term growth.” It also mentioned that Coinbase is focusing on the upcoming generation of crypto opportunities, so the profits are yet to arrive.

Emilie Choi, Coinbase’s CEO, highlighted that the decline in the company’s bottom line is due to increased spending that will reward the company in the long run. Coinbase’s general and administrative expenses amounted to more than 52% of sales, up from 13.1% in the same quarter last year.

According to the company, the purpose behind these expenses is to strengthen customer support, compliance, and business support functions. Hence, the spending will help the company solidify relations with customers and regulators and earn profits in a few years.

Wall Street’s Take on COIN Stock

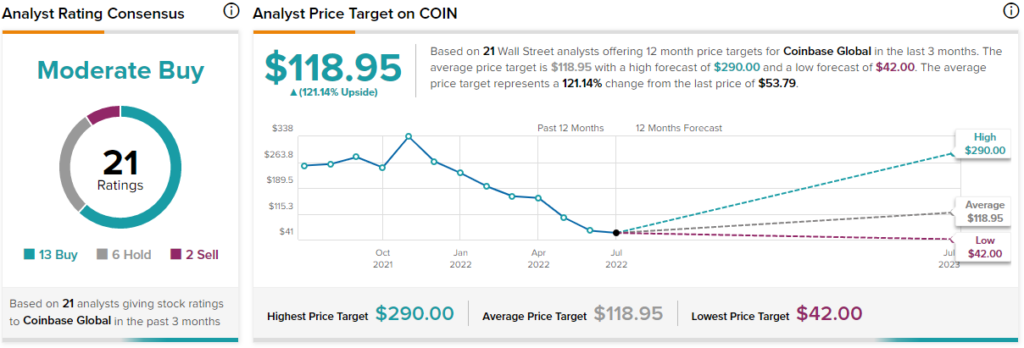

Turning to Wall Street, COIN stock maintains a Moderate Buy consensus rating. Out of 21 total analyst ratings, 13 Buys, six Holds, and two Sells were assigned over the past three months.

The average COIN price target is $118.95, implying 121.1% upside potential. Analyst price targets range from a low of $42 per share to a high of $290 per share.

The Takeaway – Watching from the Sidelines Seems Reasonable

Coinbase’s operating loss suggests that the company is at its lowest. In addition, the reduction in crypto trading and immense competition pose significant threats for Coinbase, forcing it to increase efficiency and flexibility. These headwinds make it hard to convince investors that Coinbase could be a Buy.

However, considering the business size and brand power, the company may find ways to stay relevant and fight back more robustly. Coinbase could become a thriving business in some years, but it’s likely best to wait on the sidelines for now.