In order to tame blisteringly high inflation stemming from pandemic-fueled policies, the Federal Reserve’s aggressively hawkish monetary policy delivered a compelling narrative for soft-drink giant Coca-Cola (NYSE:KO). Subsequently, the Fed saw encouraging disinflation data, leading to speculation about interest rate cuts and thus renewed demand for risk-on assets. However, a recent inflation surprise arguably pushes Coca-Cola back into the spotlight. I am bullish on KO stock for its implied resilience.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Monetary Policy Twists and Turns May Benefit KO Stock

It was only a few months ago that Fed Chair Jerome Powell emphasized the need for vigilance regarding the central bank’s fight against inflation. However, as time went on, policymakers saw disinflationary trends move in the right direction. As a result, Wall Street anticipated a return to a lower interest-rate environment, thereby lifting several risk-on asset classes.

However, a wrinkle materialized. Last week, a report came out, which showed that consumer prices increased by 0.3% in December. That culminated in a 3.4% rise over the year, which exceeded Wall Street’s consensus view of 3.2%. In addition, it jumped conspicuously above the Fed’s 2% inflation target. Therefore, the news signaled to the market that interest rate cuts weren’t a given.

To be fair, more economic data will be on the way. As well, conservative investors may want to wait for a clearer picture before diving aggressively into any one idea. Nevertheless, for those who are pensive about the monetary policy drama, KO stock presents an intriguing proposition.

Of course, if the Fed keeps interest rates the same or even elevates them, the move won’t be a holistic catalyst for KO stock. After all, U.S. government debt is just about the safest form of debt to hold. Therefore, the current high yield competes against something like Coca-Cola. Yes, the company offers a 3.05% dividend yield, but publicly traded securities also face capital market risks.

However, KO stock also benefits from everyday relevancies. As consumer pressures build, Coca-Cola would likely see increased demand from the trade-down effect; that is, consumers seeking cheaper alternatives for frequently bought items or services. As it relates to America’s caffeine consumption, going to the grocery store for Coca-Cola products, compared to an expensive coffee shop, represents an acceptable alternative.

Coca-Cola Could Still Rise on Rate Cuts

Should future economic reports indicate that encouraging disinflationary trends have returned, a temptation to dive into risk-on assets will likely materialize. By itself, that wouldn’t seem particularly helpful for KO stock, which seems boring. However, even with interest rate cuts, Coca-Cola could rise.

For one thing, should the Fed go dovish in its monetary policy, passive-income-providing companies would be more attractive. Further, KO stock offers the possibility of capital gains in addition to its yield, which segues into the second point: the company’s relevance to the underlying beverage market.

According to Mordor Intelligence, the global beverage sector reached a valuation of $3.56 trillion last year. Further, experts project that the segment will expand at a compound annual growth rate of 4.26% through 2028. If so, the forecast would translate to a market size of $4.39 trillion.

That’s great news for KO stock because the underlying enterprise carries a 42% market share of the global non-alcoholic beverage industry. So, with the ecosystem projected to rise, Coca-Cola should benefit from increased demand. What’s more, even if the Fed is successful in engineering a soft landing for the economy, the beverage maker should still offer relevance.

Based on the noticeable rise in the personal saving rate last year, it’s clear that consumers can’t just absorb body blows without lingering effects. While the American consumer overall has been resilient, major retailers warned about reduced spending projections. Therefore, it’s reasonable to expect that the consumer economy will need time to work its way back to full health.

In the meantime, Coca-Cola provides pick-me-ups at significantly cheaper prices (in the grocery aisle) than at retail beverage outlets. No matter what happens with monetary policy, then, KO stock should be relatively insulated.

Financials Focus on the Predictability Aspect

Currently, KO stock trades at a trailing-year earnings multiple of 24.45x. That compares favorably to the beverage (non-alcoholic) sector’s multiple of 27x. However, the real star of the show isn’t the discounted valuation, though it’s a nice bonus. Rather, it comes down to predictability.

Primarily, Coca-Cola is consistently profitable. The company has raised its dividend for over 60 consecutive years. That should provide investors with much-needed confidence. Also, during the third quarter, the company’s return on invested capital increased to 36.78% from 32.81% in the year-ago quarter. Put another way, Coca-Cola continues to make wise decisions with its capital, adding another source of confidence for market participants.

Is KO Stock a Buy, According to Analysts?

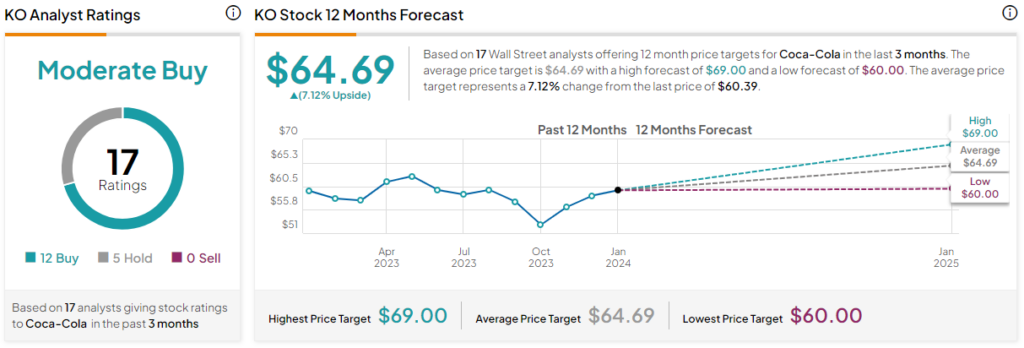

Turning to Wall Street, KO stock has a Moderate Buy consensus rating based on 12 Buys, five Holds, and zero Sell ratings. The average KO stock price target is $64.69, implying 7.1% upside potential.

The Takeaway

While Wall Street eagerly awaited interest rate cuts this year, a recent report suggested that a dovish monetary policy was not 100% guaranteed. That adds some ambiguity to the equities space, which may ultimately benefit KO stock. No matter which way the Fed goes, Coca-Cola offers broad relevancies. For confidence-starved investors, the beverage maker represents a compelling safety net.