Whitehaven Coal Limited’s (WHC) shares surged more than 6% to sit around AU$10.3 in afternoon trading, as the Energy sector was bolstered by global oil production cuts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Energy sector was up around 1.7% on the ASX after midday Thursday, after WTI crude oil closed 1.43% higher to $87.76, when OPEC+ agreed to reduce oil production by about 2 million barrels a day. That’s the biggest production cut since April 2020.

As coal prices are impacted by the supply and demand shocks of the oil market, Australian coal producers have been beneficiaries.

Is WHC a good investment?

Whitehaven Coal shares have seen a stellar rise this year on the back of energy supply issues in the wake of the Ukraine conflict.

The company’s shares have risen more than 280% since the beginning of the year, and surged around 120% in the last three months.

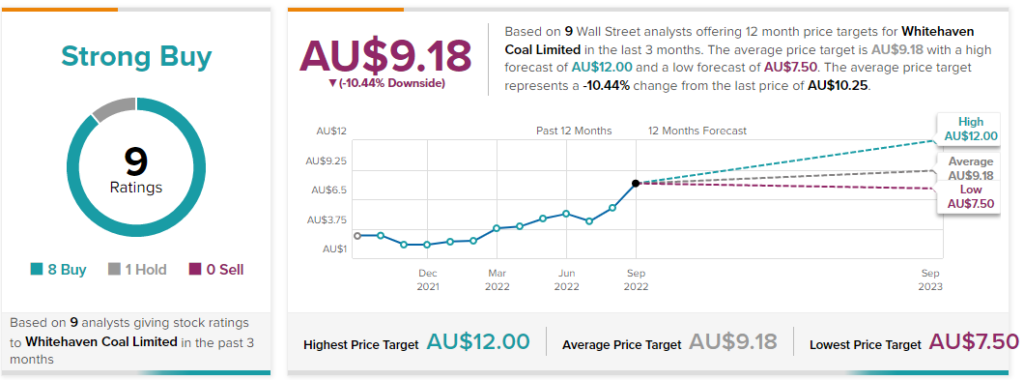

Whitehaven Coal is a Strong Buy according to TipRanks insights, with eight Buy ratings and one Hold rating.

With an Average Price Target of $AU9.18, and having already run so strong this year, the miner has a potential downside of around 10%.

Closing thoughts

While Whitehaven Coal shares have seen surging growth this year, the longer term business model may come under pressure as the switch to renewable energy continues to gain momentum.