Easily one of the hardest-hit companies during the post-pandemic new normal, movie theater operator Cinemark (NYSE:CNK) became a victim of circumstances. With the COVID-19 outbreak initially forcing a shutdown of non-essential businesses, Cinemark, for a time, couldn’t make money. Following the reduction of restrictions, myriad changes in the consumer economy weren’t always so helpful for Hollywood. Nevertheless, a risky but bullish case exists for CNK stock.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

To be clear, anyone participating on the long side of the Cinemark plotline does so against great odds. As I noted earlier, much of the recent volatility in CNK stock centers on the disappointing weekend debut performance of Avatar: The Way of Water. At the domestic box office, the much-awaited sequel to the original Avatar generated $134 million on its debut. Unfortunately, with the high production costs involved, Hollywood analysts expected more.

On the international front, the movie posted a $301 million performance. Though this impressed some onlookers, China’s debut performance of $57.1 million fell below forecasts of around $100 million.

Fundamentally, many investors exited CNK stock due to anticipated pressures on the consumer economy. For one thing, the Federal Reserve remains committed to raising the benchmark interest rate to kill inflation. Another factor centers on job losses. More than a few high-profile companies announced layoffs, which equates to fewer people having well-paying jobs. In turn, this dynamic kills sentiment for discretionary purchases.

Nevertheless, some patience can go a long way with a market idea like CNK stock.

Why Contrarians Stay the Course with CNK Stock

It’s no secret that cinema pundits hoped for more magic during the final month of 2022. However, it’s also unfair to penalize CNK stock excessively for circumstances largely out of its control. In other words, the bears might be missing the forest for the trees.

Regarding the comparatively lackluster domestic box office debut, the American consumer just suffered a stratospheric rise in inflation. Not only did housing prices skyrocket, but so too did virtually everything else. Heading into the final days of the year, consumers tacked on a record amount of credit card debt. Simply put, folks lacked the capacity to spend on discretionary goods and services.

Also, it’s way too early to call the demise of the Avatar sequel. According to a CNN report, the original blockbuster film eventually generated $3 billion in sales, becoming the highest-grossing film of all time. However, you wouldn’t know it from its 2009 debut weekend, earning only $77 million. So, just with the domestic tally alone, the new Avatar is off to a better start.

Just as significantly, both films debuted during or in the immediate aftermath of severe economic cycles. In the original film’s release schedule, moviegoers were busy recovering from the Great Recession. Regarding the current debut, folks are starting to put back the pieces that COVID-19 ripped apart. These things take time.

As well, the success of the original Avatar following the Great Recession should provide hope for CNK stock. Fundamentally, this narrative confirms the escapism angle that bolsters the broader Hollywood industry. As people go through difficult times, entertainment – especially cheap entertainment – offers valuable psychological sustenance and reassurance.

Is CNK Stock a Buy, According to Analysts?

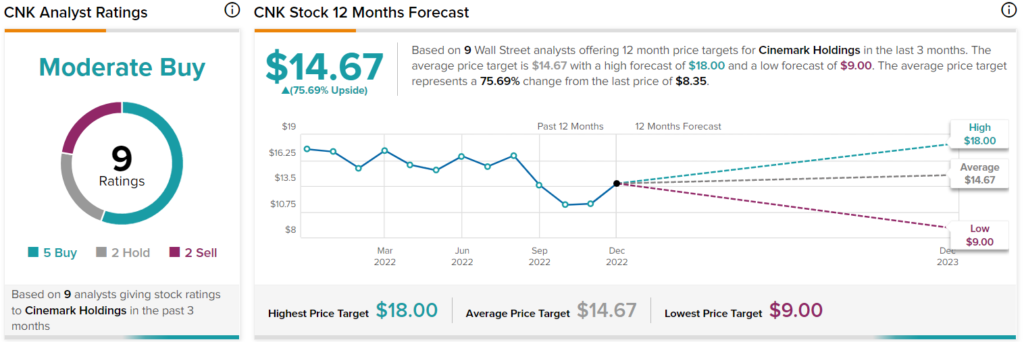

Turning to Wall Street, CNK stock has a Moderate Buy consensus rating based on five Buys, two Holds, and two Sell ratings. The average CNK price target is $14.67, implying 75.7% upside potential.

The Smart Money Moves into Cinemark

During the third quarter of this year, hedge funds piled into CNK stock relative to their Q2-2022 position. At writing, TipRanks indicates that its hedge fund confidence signal pings as very positive. For those reading between the lines, this is a substantive indicator for Cinemark.

Unlike a typical analyst assigning a rating on a stock, hedge funds must put their money where their mouth is. That’s really how they make their living. Therefore, if the institutional investors employing the brightest experts utilizing the best resources believe that CNK stock is worth a shot, it’s at least worth investigating.

In the spirit of full transparency, the current financials for Cinemark don’t inspire confidence. For instance, its three-year revenue growth rate sits at -22.5%. Its net margin sank into negative territory. As a result, so too did its return on equity.

However, these stats represent a recovery phase for CNK stock. Over time, Hollywood producers will likely recognize that they must focus on big blockbusters like Top Gun: Maverick to stay relevant. So long as they follow this tried-and-true formula, Cinemark at least has a chance to boost its financials.

It’s a speculative wager, to be sure, but one that just might pan out.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.