Credit card usage remains robust, registering significant growth amid high inflation. Higher prices of goods and services have led to credit card balances quickly approaching pre-pandemic levels. This is good news for credit card companies like Mastercard (NYSE: MA). Given the favorable long-term secular spending trends combined with increasing revenues and margins as well as attractive free cash flows, I believe Mastercard’s growth potential gives a good reason to buy the stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Credit Card Balances Register Highest Growth in 20 Years

Credit card spending is witnessing a major recovery in contrast to acute declines seen during the pandemic years. A report released by the Federal Reserve Bank of New York earlier this week highlighted that credit card balances marked the biggest increase over the past two decades. Credit card balances in the U.S. increased 15% year-over-year in the third quarter of 2022.

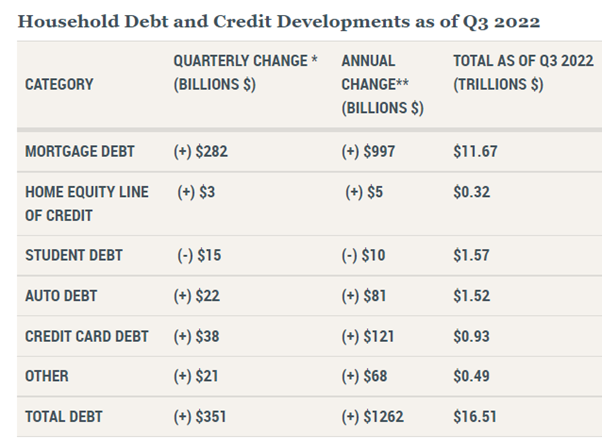

Is it just credit card usage that’s increasing? Let’s look at the overall debt picture in the U.S. During the quarter ended September 30, total household debt posted its highest sequential growth of 2.2% since 2007.

On a year-over-year basis, total household debt grew 8.3% to a record $16.5 trillion. Notably, this marks a more than 16% increase compared to the pre-pandemic levels at the end of 2019. Topping the growth numbers was a strong 15% growth rate in credit card balances, followed by a 9% increase in mortgage balances and a 5.5% increase in auto loan balances. In contrast, there was a slight decline seen in student loan balances.

Important to note here, despite higher loan balances, new loan originations declined for mortgages as well as auto loans during the third quarter due to rising interest rates. Nevertheless, credit card spending remained robust, with aggregate limits on credit card accounts increasing by $82 billion.

One of the concerns that arise from higher credit card usage is potentially higher delinquency rates which means late monthly payments. It is worth noting that delinquency rates have hovered around historically-low levels during the pandemic years. The saving grace is that though delinquency rates are rising, they still remain much lower than their historical highs.

During Q3, the delinquency rate for credit cards in the U.S. increased by about half a percentage point to 3.69% compared to 3.24% in the prior-year quarter.

Mastercard Emerges as a Clear Winner

Stronger demand for credit cards amid rising prices bodes well for Mastercard as customers continue to seek new credit products and offers that come along with them. It is not surprising that during Q3, the total number of Mastercard and Maestro-branded cards posted growth of 5.4% year-over-year to 3.05 billion.

On October 27, MasterCard reported upbeat Q3 results driven by robust consumer spending aided by a recovery in cross-border travel. Adjusted earnings of $2.68 per share handily beat analysts’ estimates of $2.58. Also, the figure was 13.1% higher than last year’s figure of $2.37 per share.

Further, revenues saw a jump of 15.5% year-over-year to $5.76 billion. Driving the revenues was 11% year-over-year growth in gross dollar volume to $2.1 trillion, strong cross-border volume growth of 44%, and 9% growth in switched transactions.

What was more impressive was its profit margin. MA delivered a Q3 adjusted operating margin that grew 100bps to 57.7% compared to 56.7% in the prior-year period.

Mastercard CEO Michael Miebach stated, “We will continue to monitor impacts related to elevated inflation and other macroeconomic and geopolitical risks. Our diversified business model and ability to modulate expenses position us well to navigate through periods of uncertainty while maintaining focus on our strategic objectives.”

Regarding Black Friday next week, U.S. retail sales, excluding automotive, are expected to grow more than 15% year-over-year, according to Mastercard SpendingPulse. The forecast takes into account all in-store as well as online retail sales across all forms of payment.

In terms of valuation, Mastercard is trading at a discount to its own five-year historical P/E averages. At present, Mastercard is trading at a P/E ratio of 34.2x, reflecting a 17% discount from its five-year average of 41x.

Is Mastercard a Buy or Sell, According to Analysts?

The Wall Street community is clearly optimistic about Mastercard stock. Overall, the stock commands a Strong Buy consensus rating based on 18 unanimous Buys. Mastercard’s average price target of $395.94 implies 15.2% upside potential from current levels.

Takeaway: Consider Buying Mastercard Stock

Bitten hard by rising inflation, more and more U.S. consumers are resorting to higher credit card usage. In the current scenario, Mastercard is expected to perform well if the world enters a recession, similar to its high growth witnessed in previous recessionary periods.

Despite headwinds from the Russia-Ukraine War and currency fluctuations, the company has been able to deliver impressive Q3 results. Further, increased revenues converted into a higher margin, which is commendable given higher costs in the current inflationary environment.

Given robust spending trends leading to higher revenues and profitability as well as long-term growth potential, I am bullish on the stock.