Chegg’s (NYSE:CHGG) CEO gave investors the brutal truth about generative artificial intelligence’s (AI) impact. I say don’t punish the company for signaling an irreversible tech trend, especially since Chegg’s financial results weren’t as bad as expected. I am bullish on CHGG stock and expect that there could be a sharp share price recovery in the near future.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Based in California, Chegg operates an online direct-to-student learning platform that provides homework and study assistance. I’ve actually had some adverse experience with Chegg, as I previously offered private tutoring services but noticed that I was losing some business because the students decided to just get help through Chegg and similar assistance providers.

Now, the tables have turned as it’s Chegg that’s losing business due to a new, fast-emerging technology. While some companies, like Microsoft (NASDAQ:MSFT), are thriving in 2023, Chegg has lost favor quickly among short-term traders. This might just be a setup for better times ahead, though, so don’t pronounce judgment on CHGG stock until you’ve delved into the data.

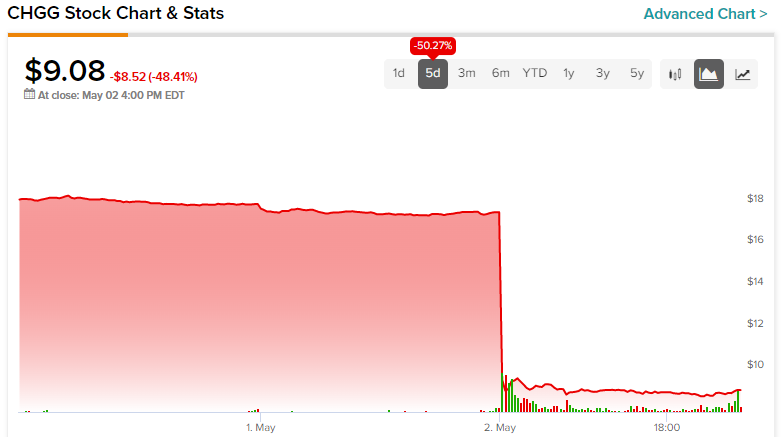

CHGG Stock Drops Nearly 50% in a Day

Today, Craig-Hallum analyst Alex Fuhrman is probably regretting his decision to upgrade CHGG stock from Hold to Buy and raise his price target from $20 to $25. Fuhrman anticipated an “in-line quarter,” and Chegg did even better than that, with top and bottom-line beats. Nevertheless, Chegg stock slumped 48.4% on May 2, the day after the company released its first-quarter 2023 earnings results.

Fuhrman saw “encouraging” signs that higher education enrollment was improving, but this wasn’t the market’s focus as Chegg issued its quarterly data and commentary. Rather, it was the rapid adoption of OpenAI’s ChatGPT generative AI platform and its impact on Chegg’s ability to gain new customers that evidently prompted the stunning sell-off in CHGG stock.

Given the horrendous response to Chegg’s quarterly report, one might assume that the company’s results were terrible. However, a closer look reveals that Chegg — which has an excellent track record of quarterly EPS beats, by the way — delivered Q1-2023 EPS of $0.26, exceeding the analyst consensus estimate by a penny per share. Meanwhile, Chegg’s sales declined 7.2% year-over-year to $187.6 million — not too bad, considering the apparently deep impact of ChatGPT — and besides, this result outpaced analysts’ forecast of $185.17 million in sales.

Chegg’s CEO Offers Harsh Truths but Also Hope

Those figures, by themselves, wouldn’t likely have caused the wholesale dumping of CHGG stock that took place post-earnings-announcement. Instead, it seems that investors were reacting to the commentary provided by Chegg President and CEO Dan Rosensweig. While Rosensweig certainly addressed the potentially challenging effects of generative AI technology on Chegg’s business, he also offered some words of hope, though many traders chose to only see the glass as half-empty.

Certainly, Rosensweig couldn’t deny ChatGPT’s influence on Chegg’s results in 2023’s first quarter. The company’s Subscription Services revenue decreased 3% year-over-year to $168.4 million, while Chegg’s Subscription Services subscriber count declined 5% to 5.1 million. These aren’t drastic drops, but they’re worth paying attention to.

Rosensweig, in a bold but honest move, acknowledged that student interest in ChatGPT increased significantly in March and that this adversely affected Chegg’s new customer growth. This admission may have been enough to cause a snowball effect of selling pressure on CHGG stock. There’s more to the story, though. Rosensweig explained that Chegg isn’t just going to stand by and let generative AI ruin the company’s business.

Rather, Chegg will actually work with generative AI, and even with ChatGPT itself, to turn a perceived foe into a friend of the company. This starts with “the introduction of CheggMate, which we recently announced in cooperation with OpenAI,” Rosensweig stated. CheggMate, the CEO continued, “will harness the power of ChatGPT, paired with our proprietary data and subject matter experts,” to improve the learning experience for Chegg’s students.

Is CHGG Stock a Buy, According to Analysts?

Turning to Wall Street, CHGG stock comes in as a Hold based on one Buy and 12 Hold ratings. The average Chegg stock price target is $15.13, implying 66.6% upside potential.

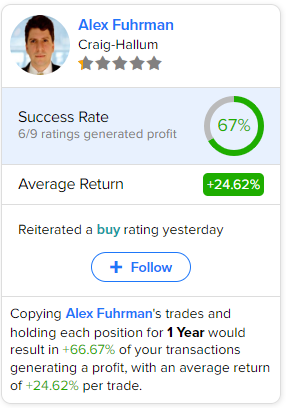

If you’re wondering which analyst you should follow if you want to buy and sell CHGG stock, the most accurate analyst covering CHGG stock (on a one-year timeframe) is the aforementioned Alex Fuhrman of Craig-Hallum, with an average return of 24.62% per rating. See below.

Conclusion: Should You Consider Chegg Stock?

Many short-term traders will probably disagree with me on this, but I feel that the market is misreading Rosensweig’s message. Yes, generative AI presents a challenge for Chegg. However, it’s not as if Chegg is just sitting around, idly waiting for OpenAI to steal Chegg’s customers.

What the bearish traders missed is that Chegg is teaming up with OpenAI and utilizing ChatGPT instead of resisting it. That’s a smart move, and sooner or later, I expect the market to realize this. Therefore, while this is certainly risky, I feel that CHGG stock is worth considering for a long position while the share price is at this unreasonably low level.